Here are the key steps to solve this problem:

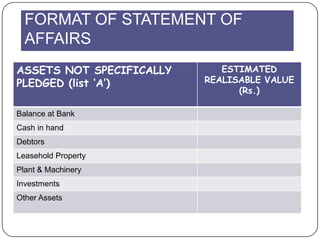

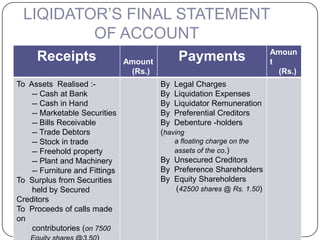

1. Prepare a Statement of Affairs showing the estimated realizable value of assets and liabilities.

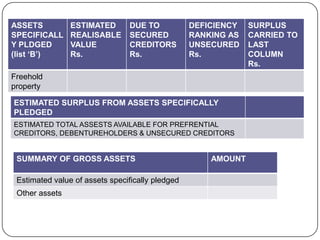

2. Classify assets as specifically pledged or not specifically pledged. Estimate surplus/deficiency from specifically pledged assets.

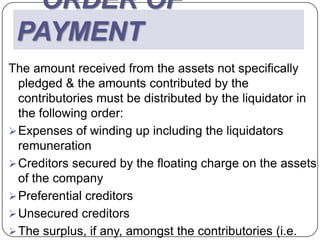

3. Estimate total assets available for preferential creditors, debenture holders, and unsecured creditors.

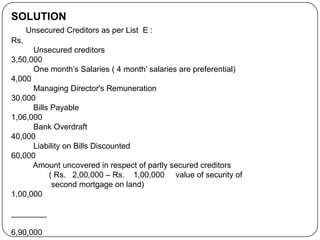

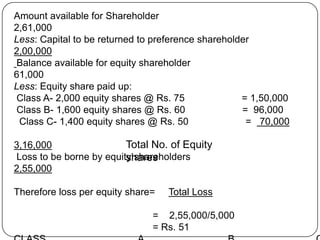

4. List secured, preferential, debenture holder, and unsecured creditors and estimate surplus/deficiency for each class.

5. Distribute estimated surplus in order of priority - secured creditors, preferential creditors, debenture holders, unsecured creditors.

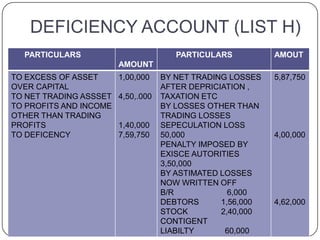

6. Prepare a summary showing distribution of assets and estimated surplus/def

![Section 425 (1) of the companies act

provides that a company can be

liquidated in any of the following three

ways :

COMPULSORY WINDING UP BY THE COURT

VOLUNTARY WINDING UP BY THE MEMBERS

WINDING UP UNDER THE SUPREVISION OF

COURT

Generally the provisions of the Act with respect to

the winding up apply to winding up of a company

whether it be by the court or voluntary or subject

to the supervision of the court [Section 425 (2)]](https://image.slidesharecdn.com/liquidation-121002063302-phpapp01/85/Liquidation-5-320.jpg)