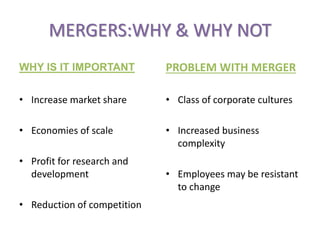

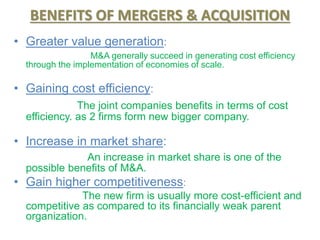

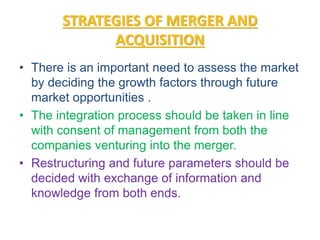

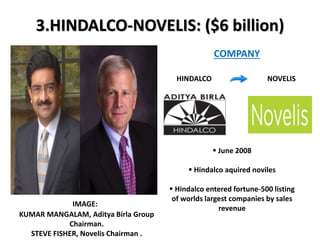

Mergers and acquisitions allow companies to achieve growth objectives like profits, market dominance and survival. The document discusses the definitions, types, strategies and benefits of mergers and acquisitions. It provides examples of major M&A deals including Tata Steel-Corus ($12.2B), Vodafone-Hutchison Essar ($11.1B) and Hindalco-Novelis ($6B) and discusses challenges like integration difficulties and overly diversified operations that can arise from mergers and acquisitions. The conclusion emphasizes learning from others' mistakes, clearly defining objectives, and acquiring expertise to interpret changes.