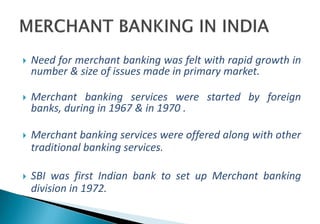

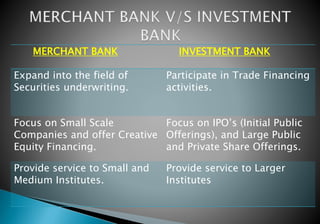

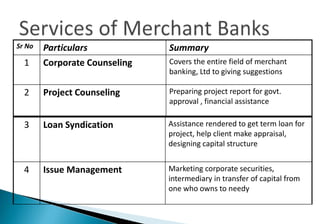

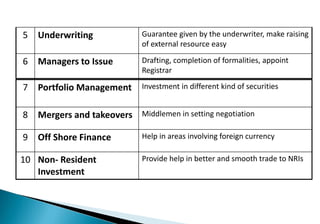

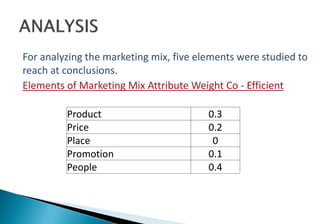

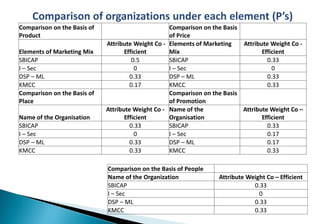

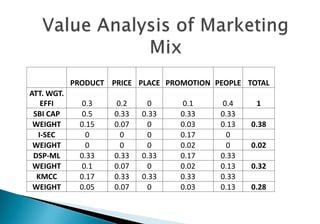

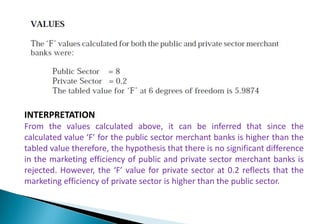

This document analyzes the marketing effectiveness of merchant banking services between public and private sectors in India. It compares two public sector banks, SBI Capital Markets and Industrial Securities and Finance Company, to two private sector banks, DSP Merrill Lynch and Kotak Mahindra Capital, based on their marketing mix strategies. The analysis shows that while the public sector banks have slightly higher overall marketing effectiveness, the private sector banks have a higher marketing efficiency, with people and product being the most important elements of their marketing mix. The study concludes there is relevance to applying marketing mix concepts in merchant banking and competition in the sector has increased with its growth.