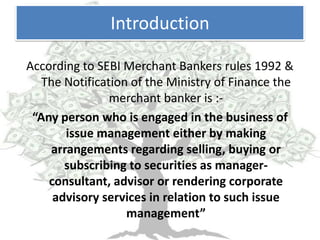

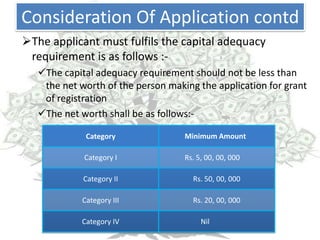

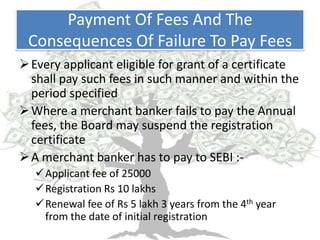

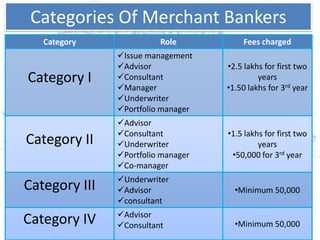

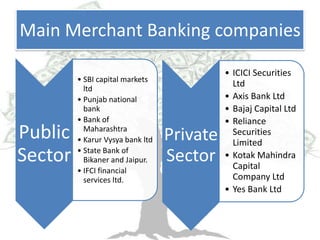

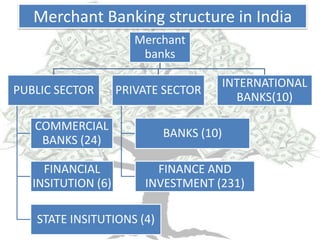

Merchant banking provides various financial services to corporations including corporate counseling, project counseling, loan syndication, managing securities offerings, and portfolio management. To become a merchant banker in India, an entity must register with the Securities and Exchange Board of India and meet certain net worth requirements that vary based on the category of registration. Some of the major merchant banking companies in India include ICICI Securities, SBI Capital Markets, Axis Bank, and Kotak Mahindra Capital Company. Merchant banking first began in India in 1967 and has grown to include both public and private sector banks and financial institutions that help companies raise capital and advise on mergers and acquisitions.

![Merchant Banking

Business

Made by

Mr. Vishal Narvekar

[S.Y.B.F.M .]](https://image.slidesharecdn.com/merchantbankingbusiness-130327022541-phpapp01/85/Merchant-banking-business-1-320.jpg)