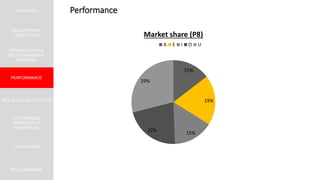

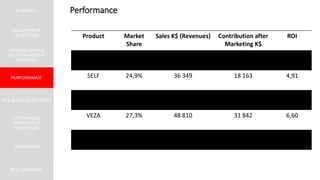

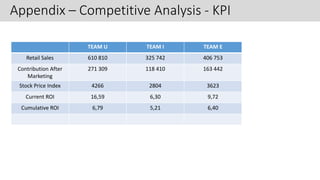

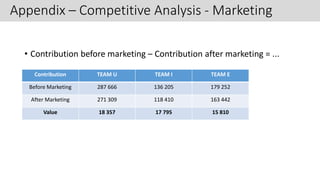

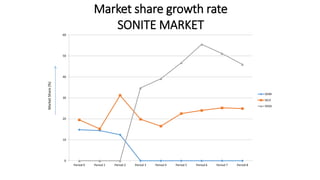

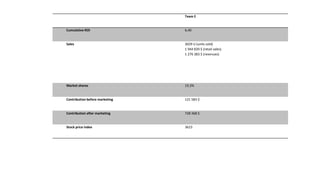

Team E achieved a cumulative ROI of 6.4%, generated $1.276 billion in revenues through sales of 3029 units, and increased their market share to 19.3%, resulting in a $728 thousand contribution after marketing and a stock price index of 3623. Their strong financial performance was driven by growing market share and revenues while maintaining high returns on investment.