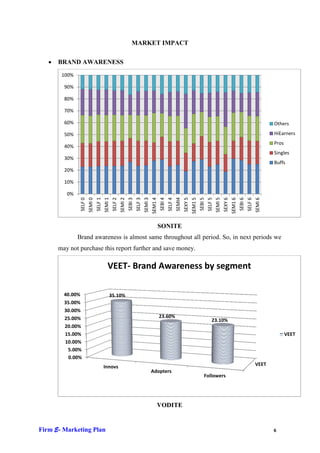

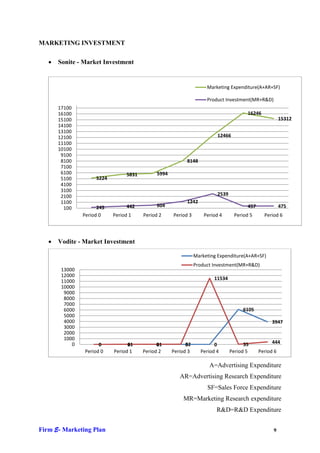

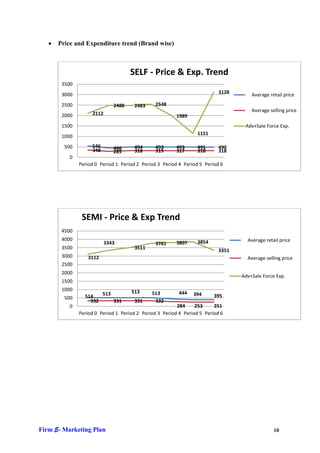

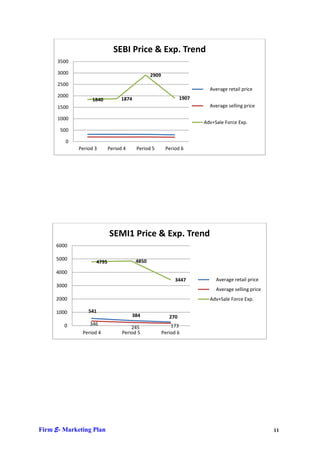

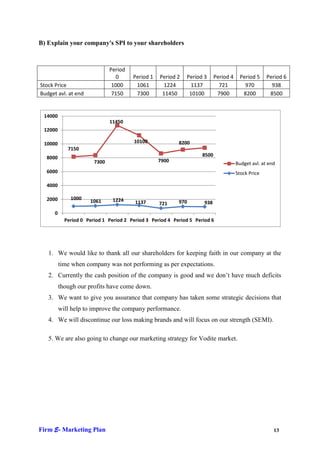

The document analyzes the financial and market performance of a company over 6 periods, including metrics like net contribution, ROI, stock price, market share, and marketing investments. It shows fluctuations in sales revenue, expenses, and profits impacting other KPIs. Different brands are launched and their prices, awareness, and purchase intentions are tracked over time.