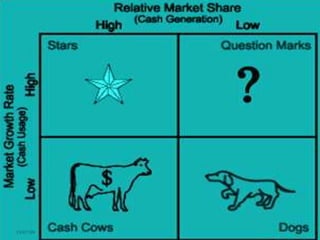

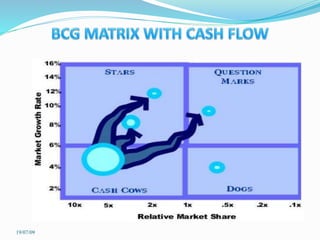

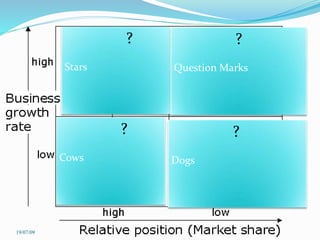

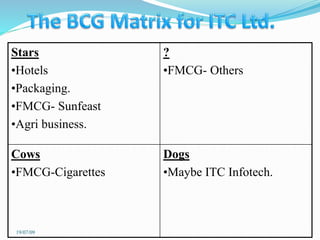

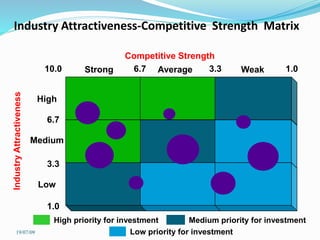

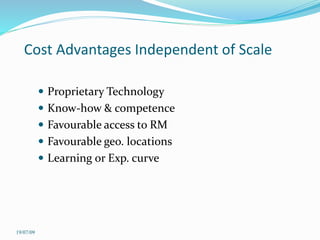

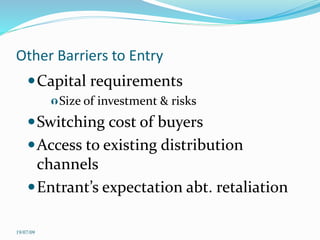

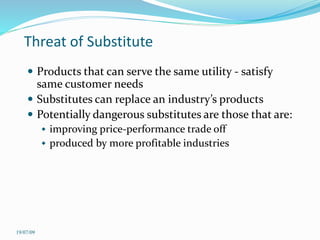

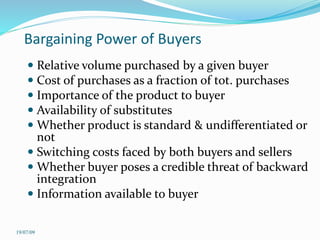

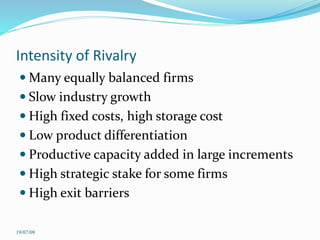

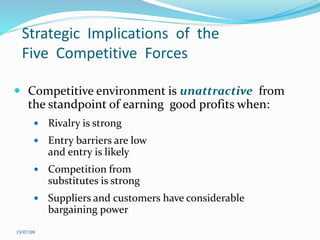

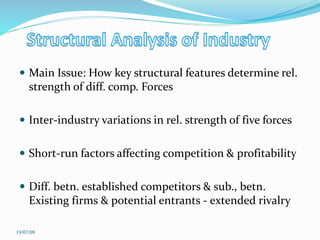

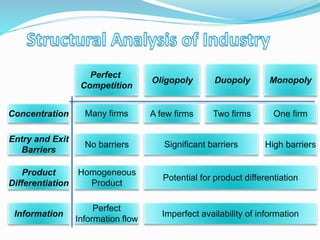

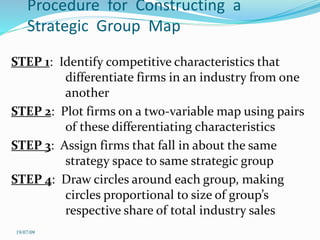

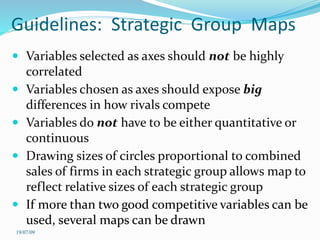

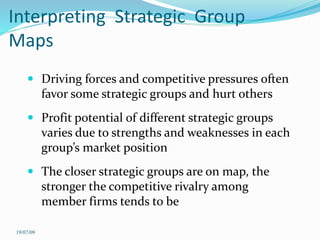

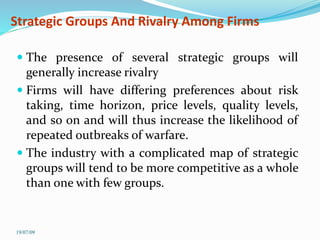

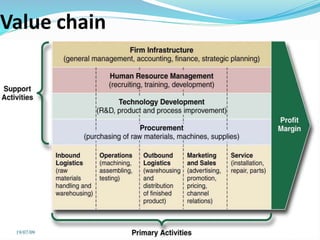

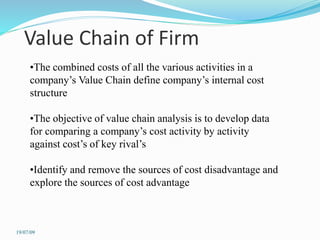

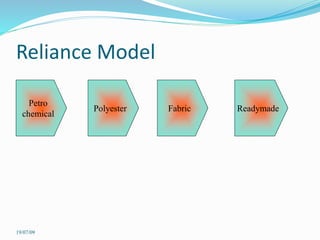

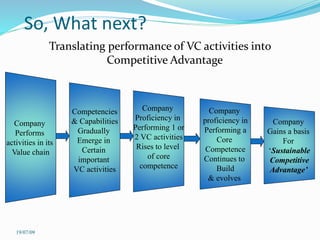

This document provides an overview of various strategic management tools and frameworks including the BCG matrix, GE nine cell matrix, Porter's five forces, strategic groups, SWOT analysis, and value chain analysis. It explains how each tool is used, key aspects to analyze, and how insights can be gained to inform strategic decision making. The BCG matrix classifies products/businesses into four categories based on market growth rate and relative market share. Porter's five forces analyzes competitive rivalry and industry attractiveness. SWOT evaluates internal strengths and weaknesses and external opportunities and threats. Value chain analysis examines activities to create and deliver value.