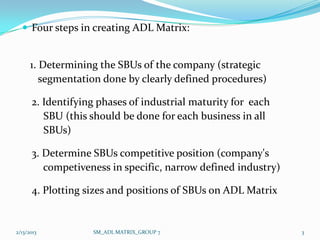

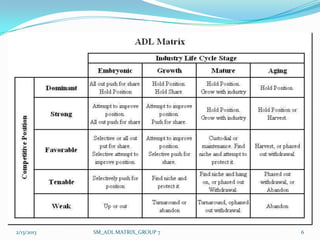

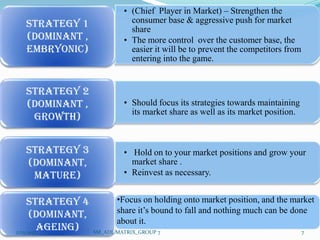

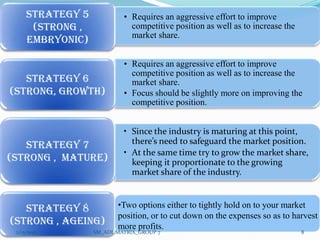

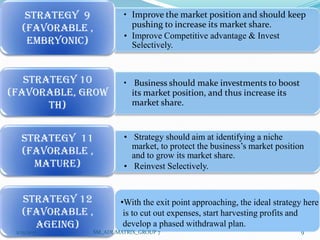

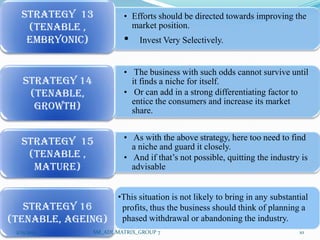

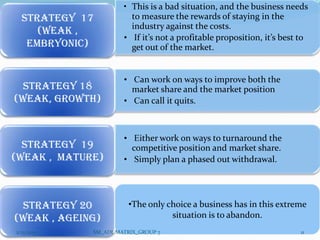

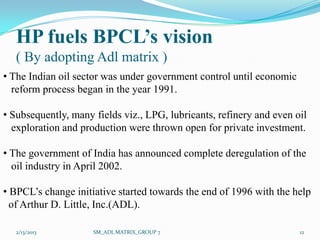

The document discusses the Arthur D. Little (ADL) matrix, a strategic management tool developed in the 1970s. It outlines the four steps to create an ADL matrix: 1) determining strategic business units, 2) identifying industrial maturity phases, 3) determining competitive position, and 4) plotting on the matrix. The matrix analyzes businesses across two dimensions: competitive position (dominant to weak) and industry maturity (embryonic to aging). For each combination, it provides strategic recommendations. The document also discusses how BPCL used the ADL matrix to develop strategies as it transitioned to a deregulated oil market in India.