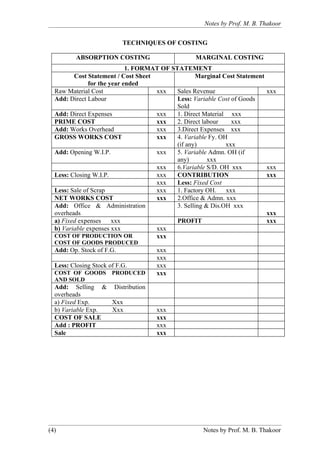

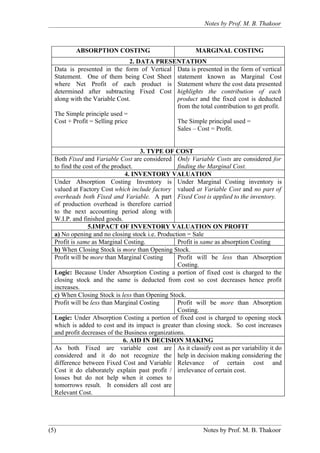

The document provides an overview of marginal costing techniques. It defines key terms like marginal cost, fixed cost, and variable cost. It explains the differences between absorption costing and marginal costing. Absorption costing includes both fixed and variable costs when calculating product costs, while marginal costing only includes variable costs and separates fixed costs. This treatment of costs helps marginal costing better aid in decision making by distinguishing relevant variable costs from irrelevant fixed costs.

![Notes by Prof. M. B. Thakoor

Steps for Problems i.e. Q.1. Q.2. Q.3.

(I) Find the Units sold by the following formula

Quarter I Quarter II Quarter III Quarter IV

(Units) (Units) (Units) (Units)

Opening Stock XXX XXX XXX XXX

Add: Production XXX XXX XXX XXX

XXX XXX XXX XXX

Less: Closing Stock XXX XXX XXX XXX

Units Sold XXX XXX XXX XXX

(II) Under Absorption Costing:

Quarter I Quarter II Quarter III Quarter IV

(Units) (Units) (Units) (Units)

Sales (Units Sold X S.P.) XXX XXX XXX XXX

Less: 1. Variable Cost XXX XXX XXX XXX

(Units Sold x V.C. Per Unit)

2. Fixed Cost XXX XXX XXX XXX

(Units Sold x F.C. Per Unit)

Profit [Sale – (V.C. + F.C.)] XXX XXX XXX XXX

Add: Over absorption XXX XXX

(Actual Prodn. – Normal

Prodn.) X Overhead rate

XXX XXX XXX XXX

Less: Under Absorption XXX XXX

(Normal Prodn. – Actual

Prodn.) X Overhead rate

Final Profit XXX XXX XXX XXX

(III) Under Marginal Costing

Quarter I Quarter II Quarter III Quarter IV

(Units) (Units) (Units) (Units)

Sales (Units Sold X S.P.) XXX XXX XXX XXX

Less: Variable Cost XXX XXX XXX XXX

(Units Sold x V.C. Per Unit)

Contribution XXX XXX XXX XXX

Less: Fixed Cost XXX XXX XXX XXX

(For Normal Prodn. Or

Fixed Amount Given but

not the absorption rate)

Profit XXX XXX XXX XXX

(8) Notes by Prof. M. B. Thakoor](https://image.slidesharecdn.com/marginalcostingsynopsisnotes-120328220113-phpapp02/85/Marginal-costing-synopsis-notes-8-320.jpg)