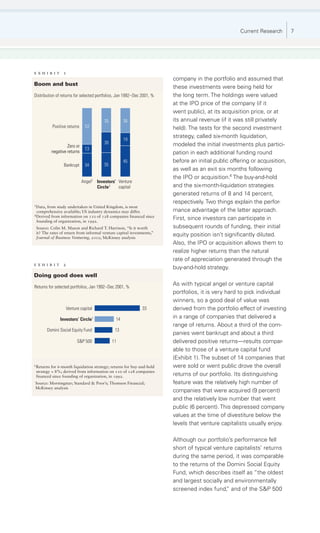

A study analyzed 110 socially responsible companies that received funding from members of Investors' Circle, a network of angel investors, over a 10-year period. A portfolio simulating $72 million invested in these companies generated returns of 8-14% under different holding strategies. This performance was comparable to stock market indexes and outperformed expectations of most investors who accepted lower returns for social/environmental benefits. The results provide evidence that social purpose ventures can achieve financial returns meeting investor expectations.