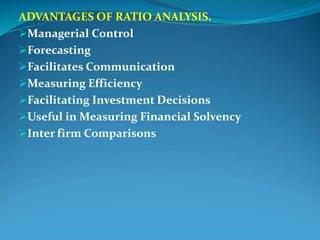

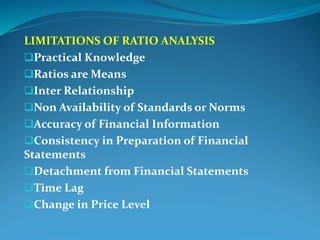

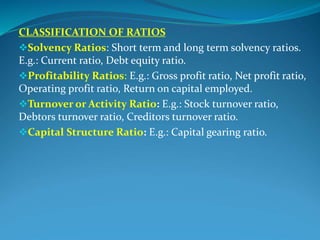

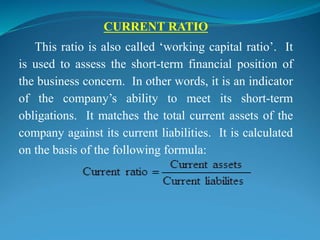

Ratio analysis involves calculating mathematical relationships between financial statement items to assess a company's performance and financial position over time and compare it to industry standards. It involves selecting relevant ratios, comparing calculated ratios to past and industry ratios, and interpreting the results to make recommendations and identify areas needing improvement. Ratios can be expressed as proportions, rates, coefficients, or percentages. Ratio analysis provides advantages like managerial control, forecasting ability, and facilitating investment decisions, but also has limitations such as practical knowledge constraints and inconsistencies in financial reporting.