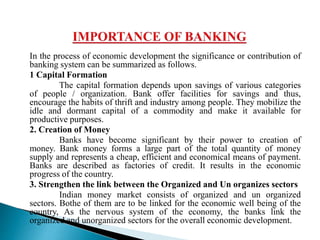

Banks have evolved to serve a broader societal role beyond their traditional functions, contributing significantly to economic growth and capital formation. They accept deposits, provide loans, and create credit, thereby facilitating various sectors of the economy and promoting financial inclusion. The establishment of the Reserve Bank of India marked a pivotal moment in banking history, enabling structured oversight and the development of banking systems to support national economic objectives.