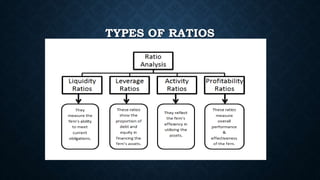

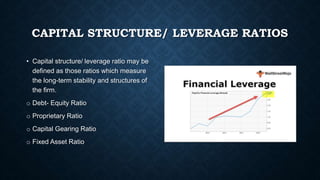

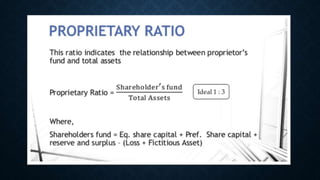

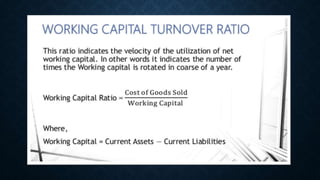

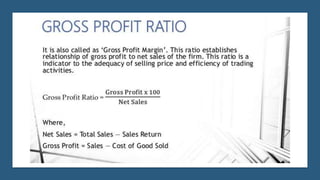

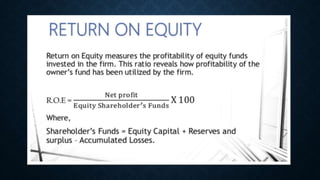

This document discusses ratio analysis as a tool for assessing a firm's financial performance across various dimensions. It outlines the objectives, advantages, and limitations of ratio analysis and details different types of financial ratios, including liquidity, capital structure, activity, and profitability ratios. Ultimately, the goal of ratio analysis is to provide stakeholders with insights into a firm's strengths, weaknesses, and operational efficiency.