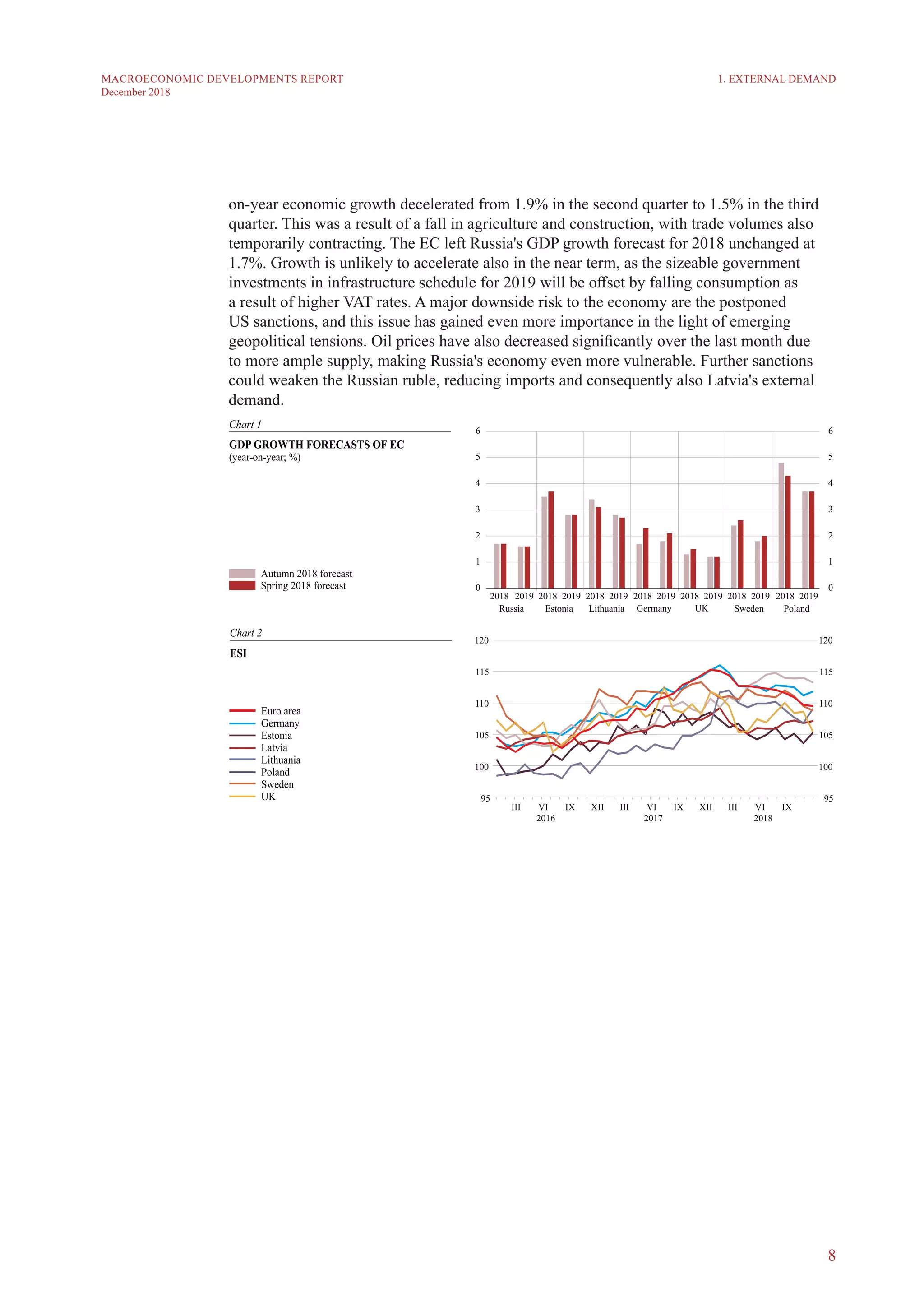

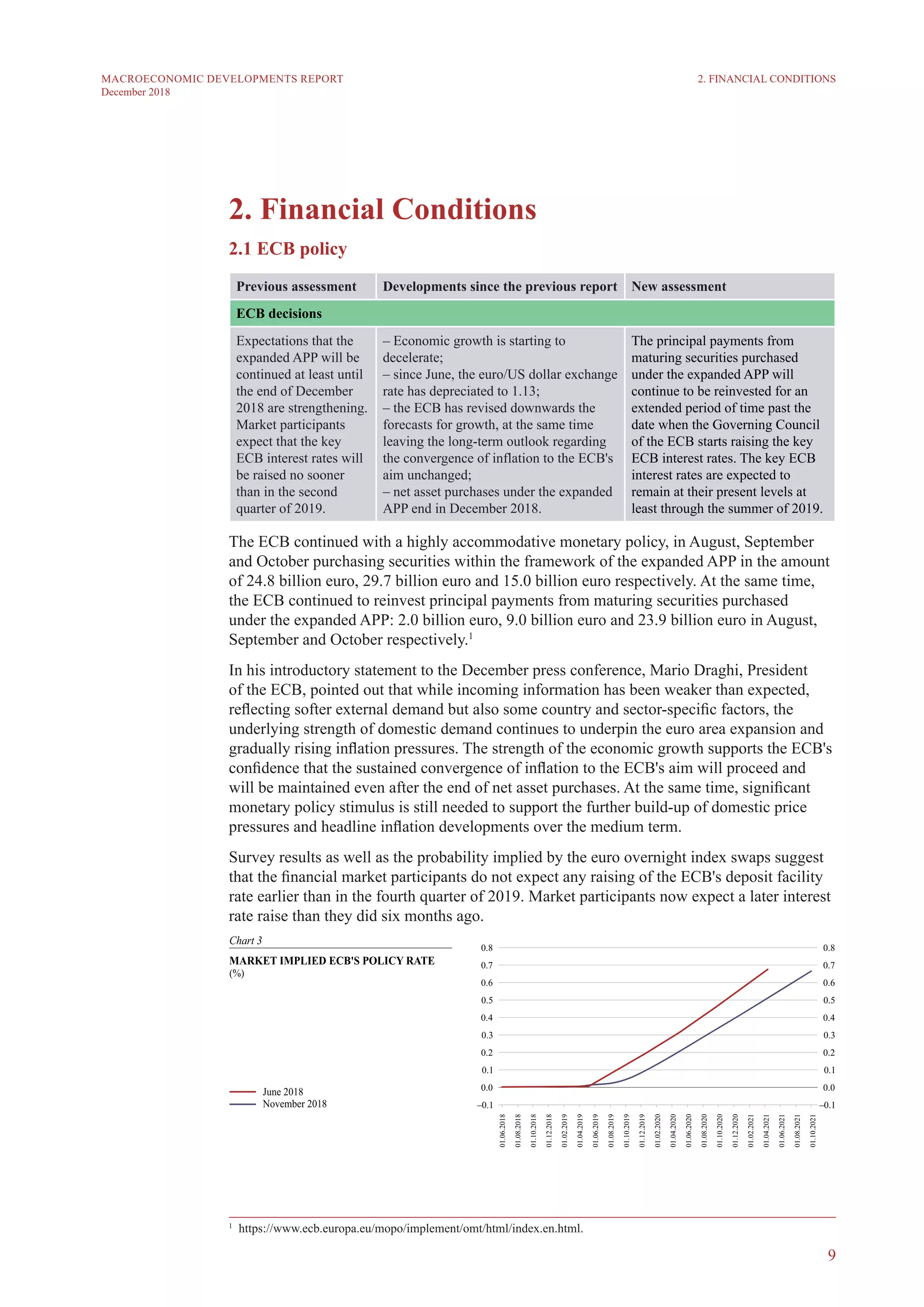

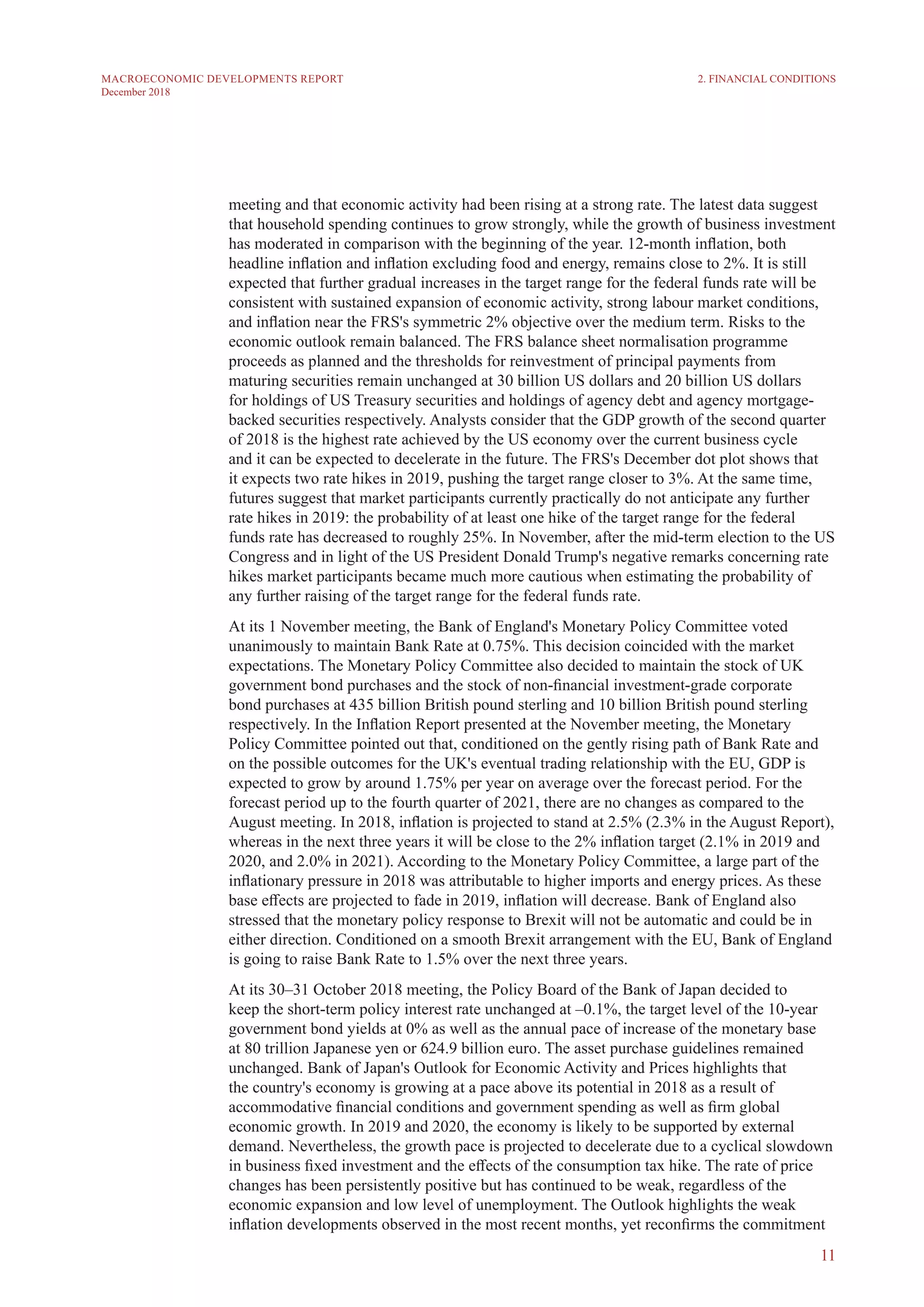

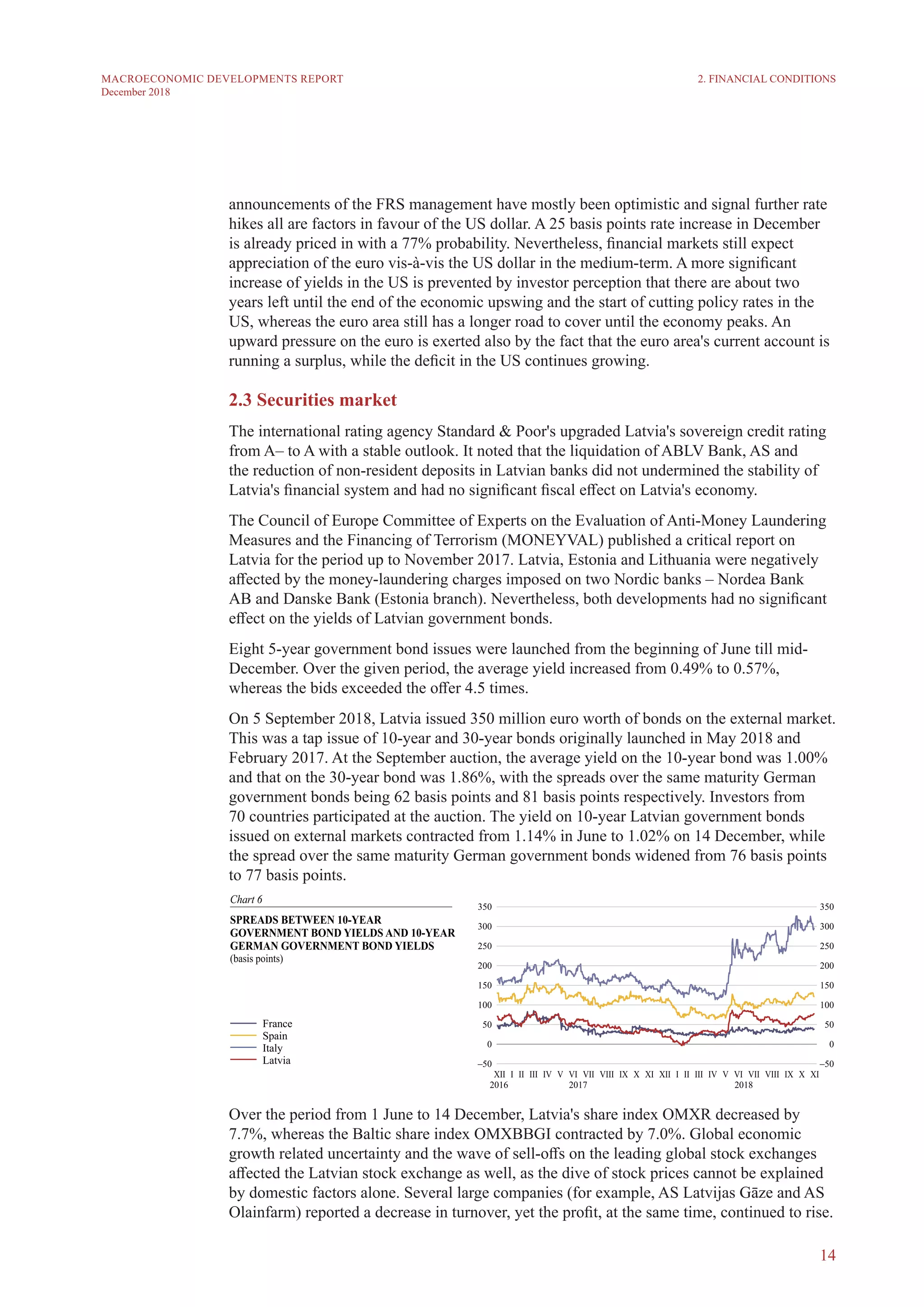

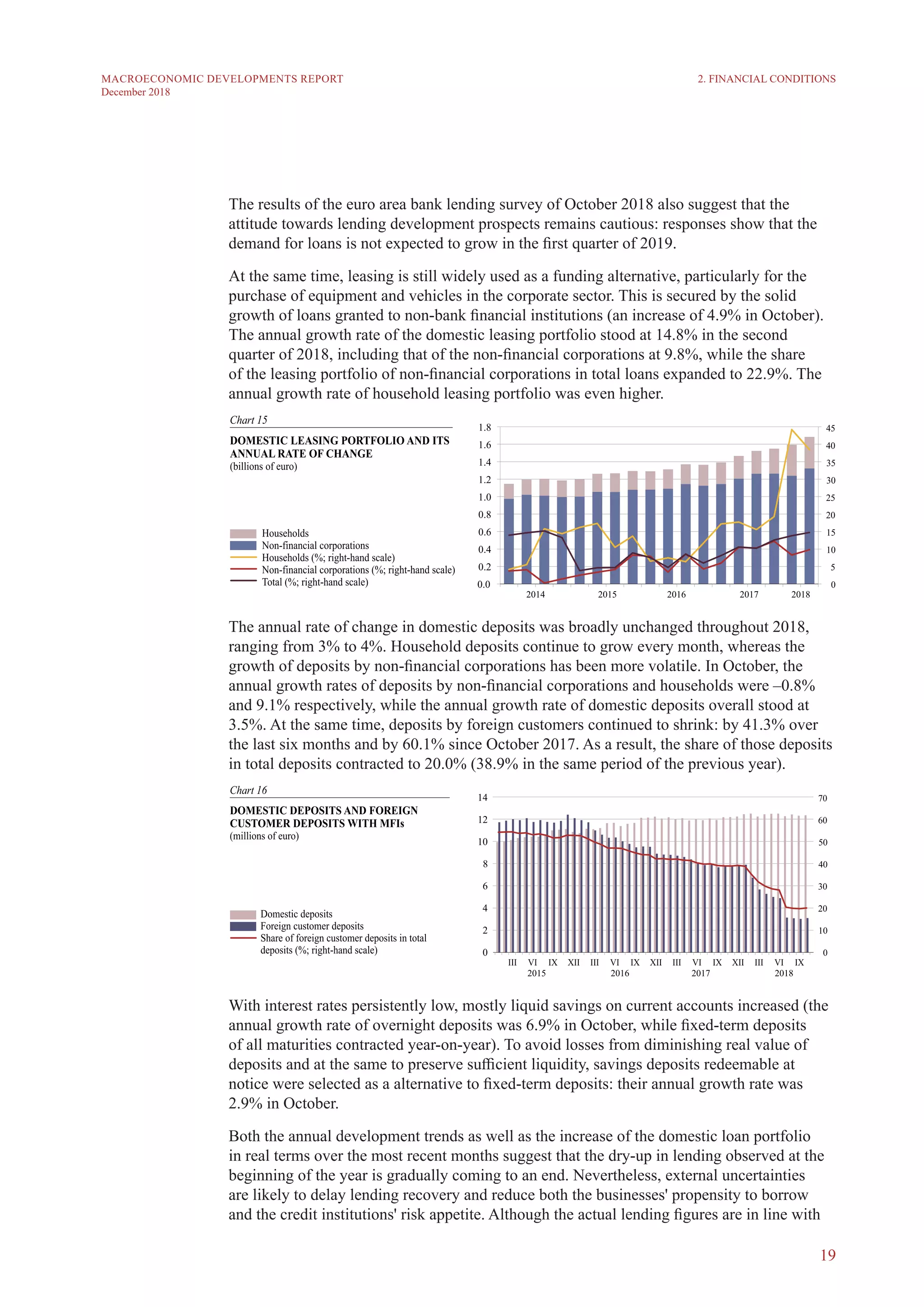

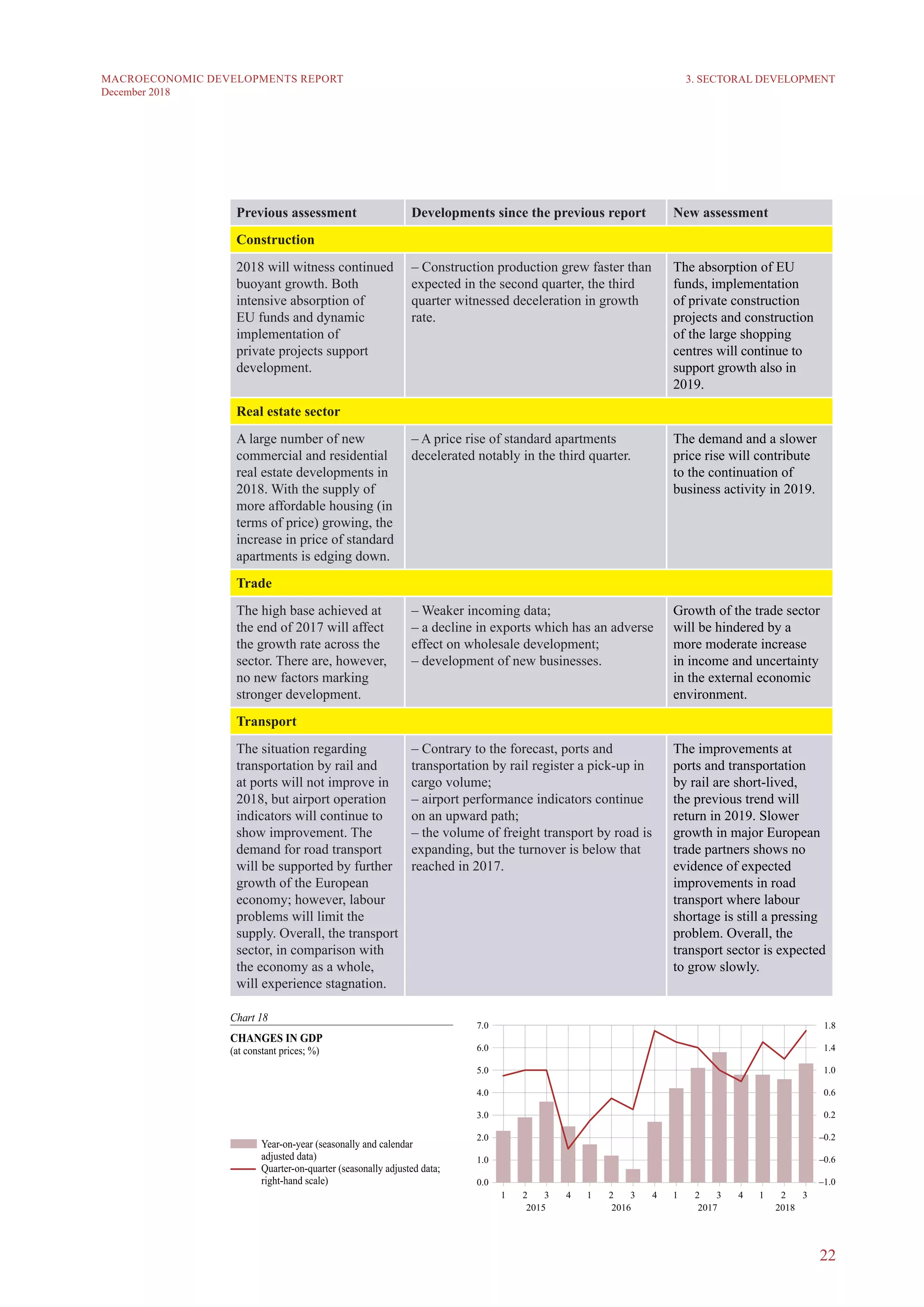

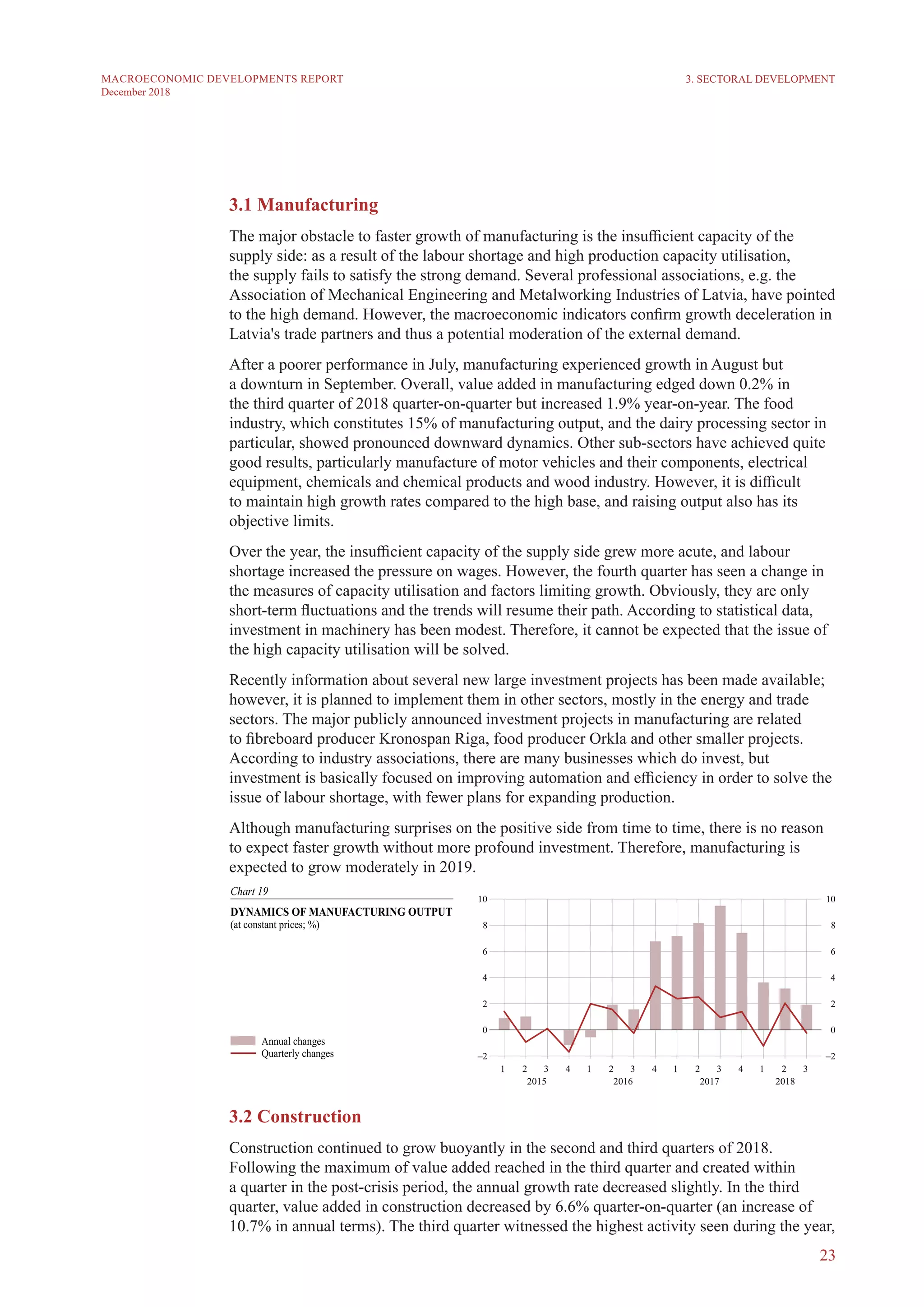

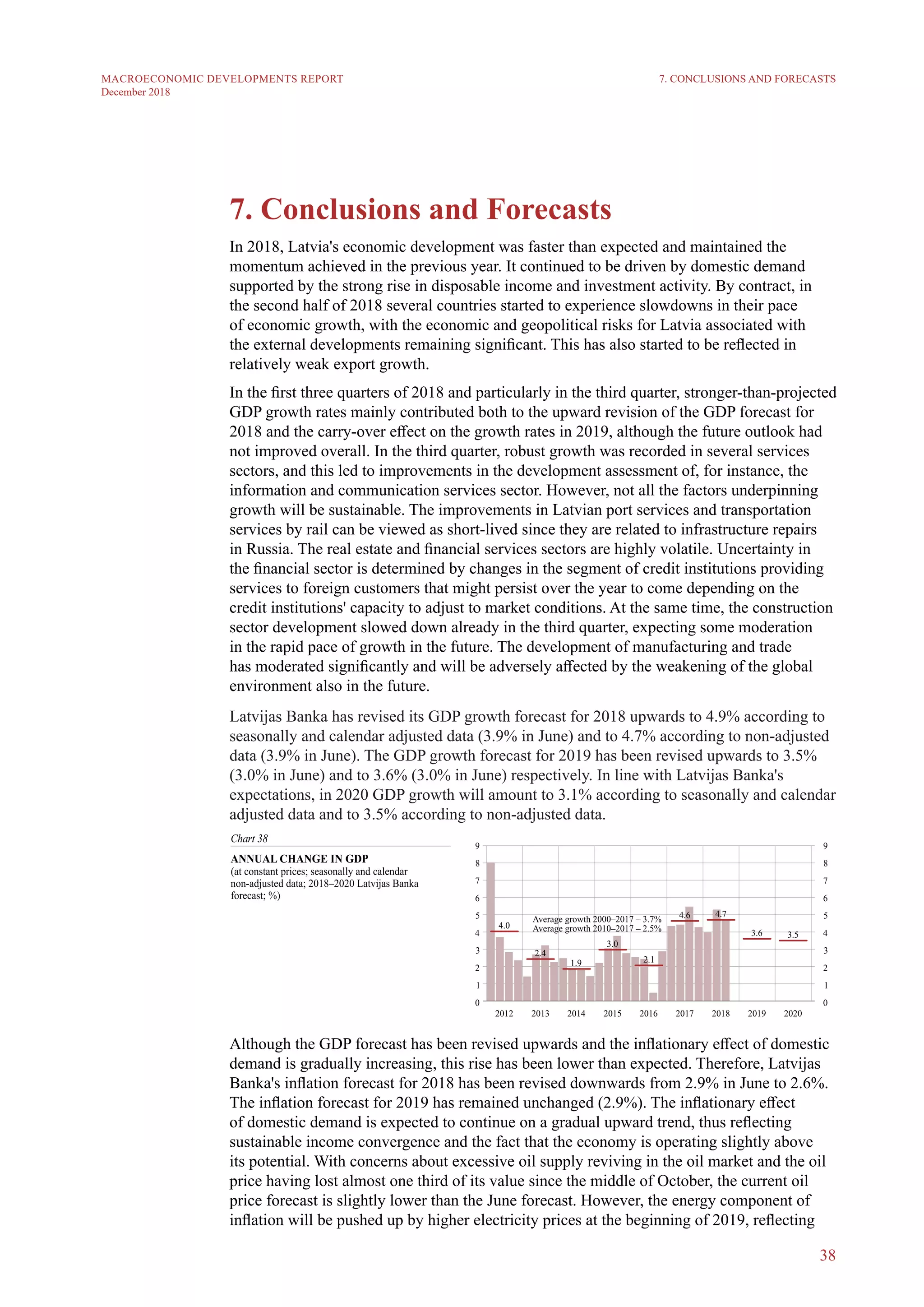

The December 2018 Macroeconomic Developments Report from Latvijas Banka provides an optimistic yet cautious outlook on Latvia's economic growth, noting an upgrading of GDP forecasts for 2018 despite expected gradual slowing in the coming years due to external demand constraints and labor shortages. The report highlights that while domestic demand will increasingly support growth, issues in the construction sector and rising inflation driven by domestic factors remain concerns. Overall, the global economic environment is characterized by uncertainties, particularly due to Brexit and trade tensions, impacting external demand forecasts for Latvia's major trade partners.