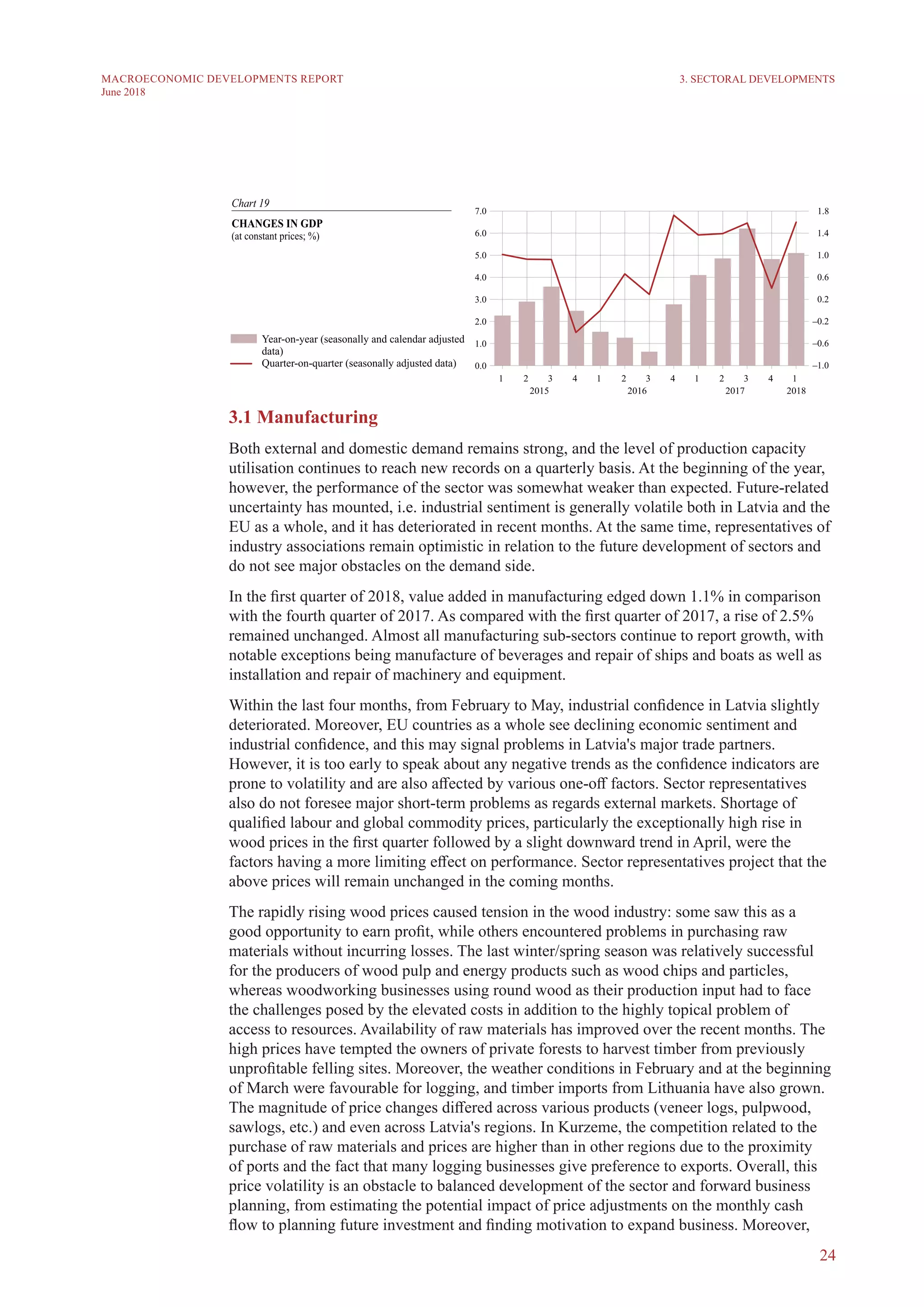

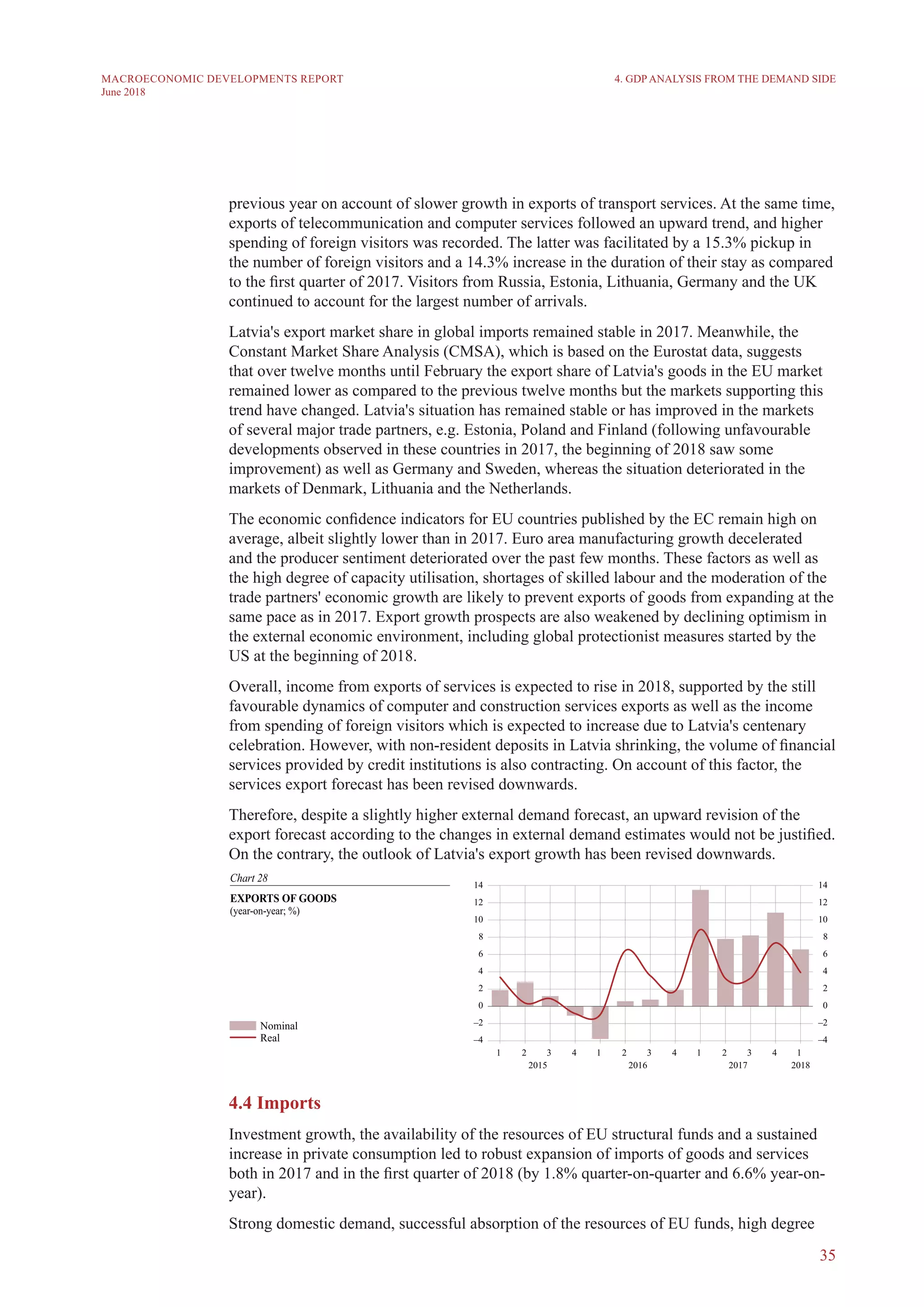

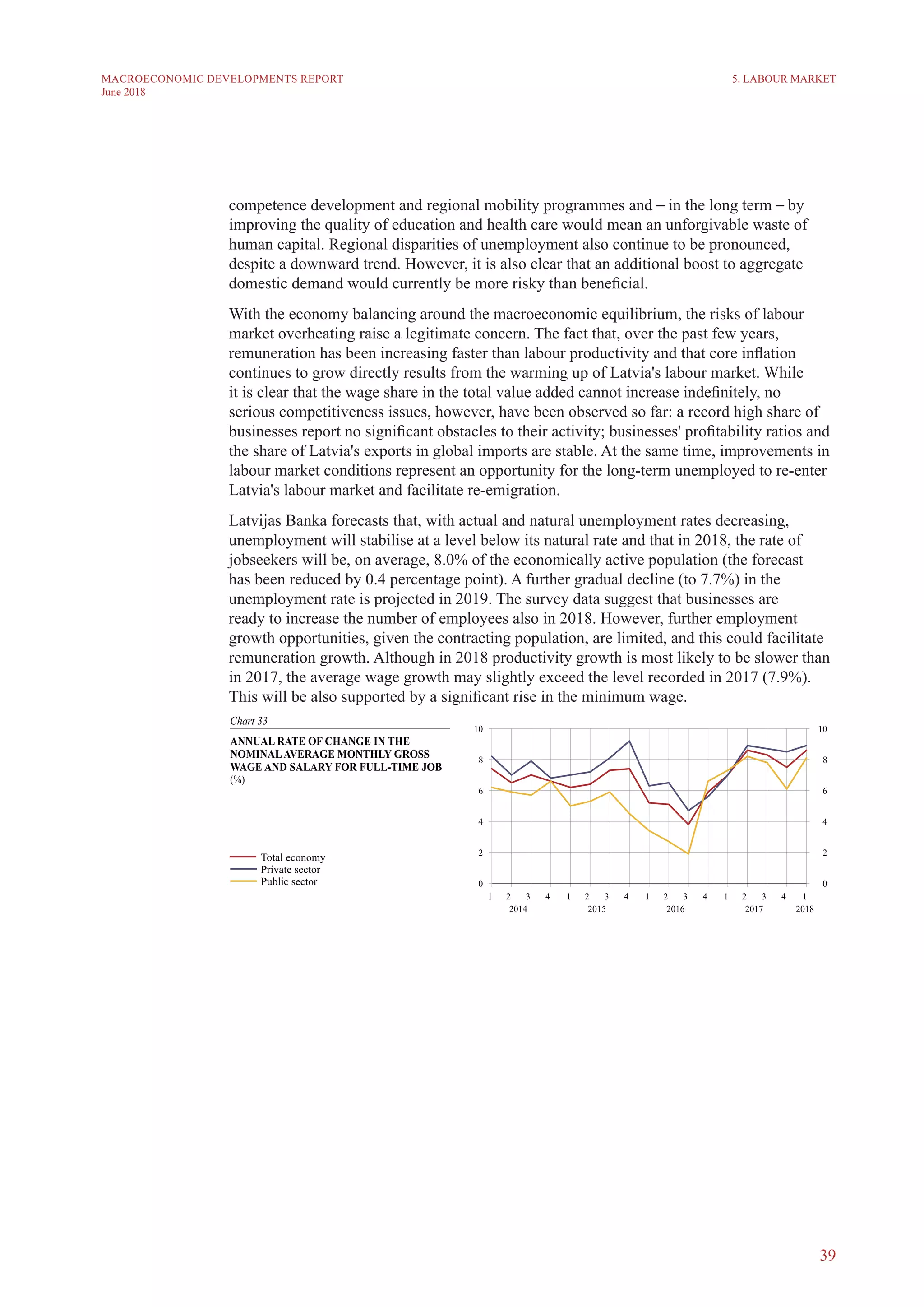

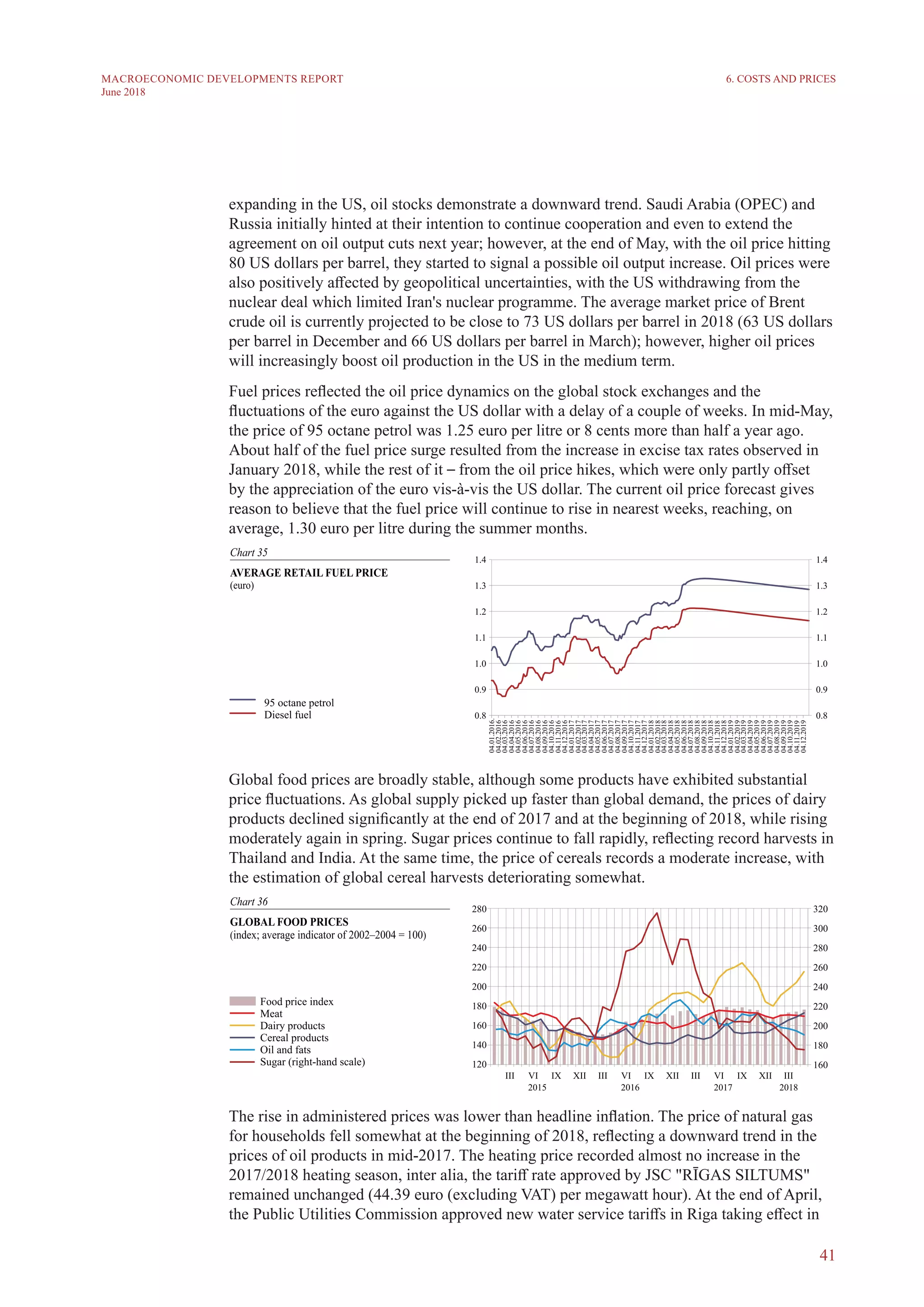

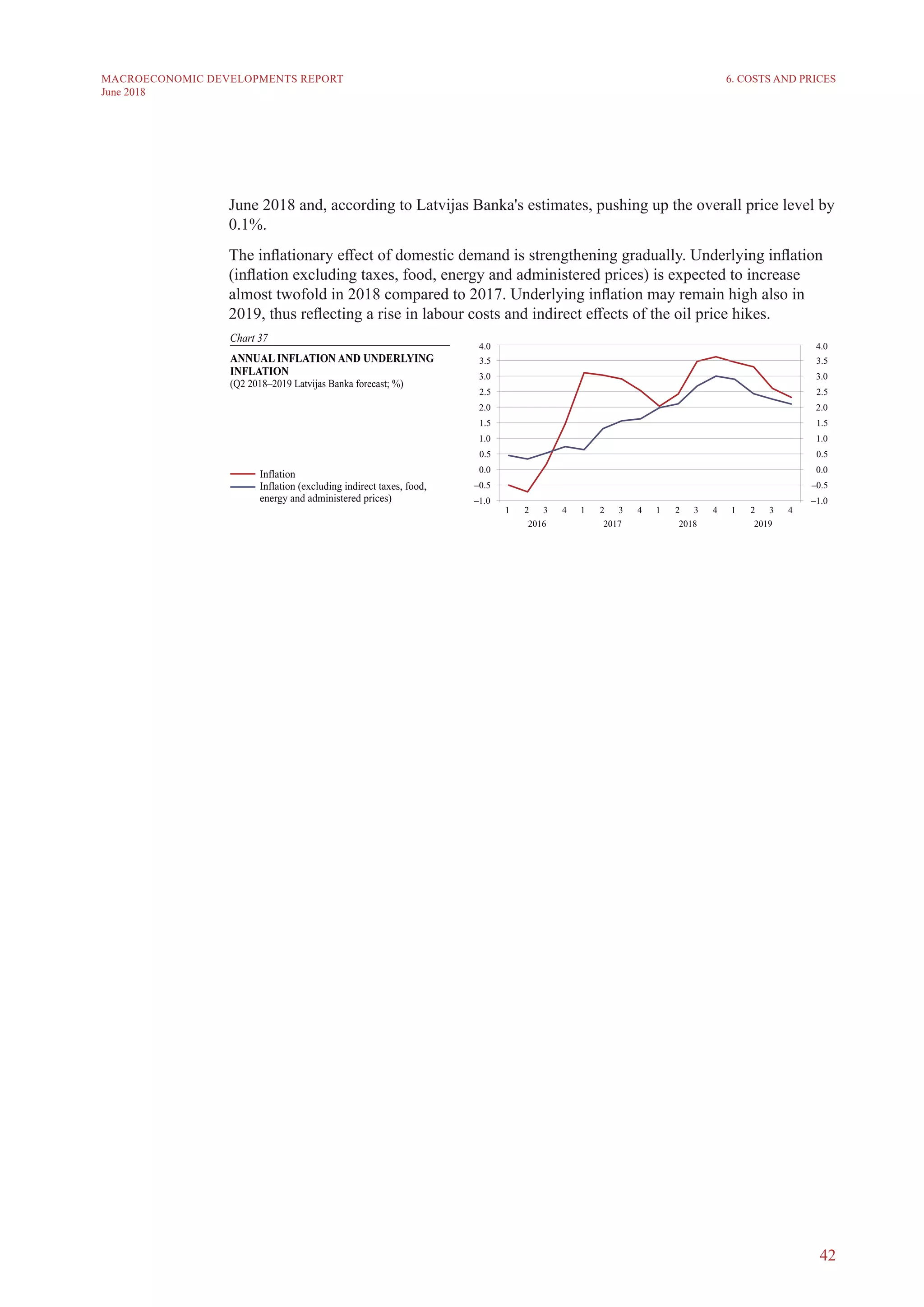

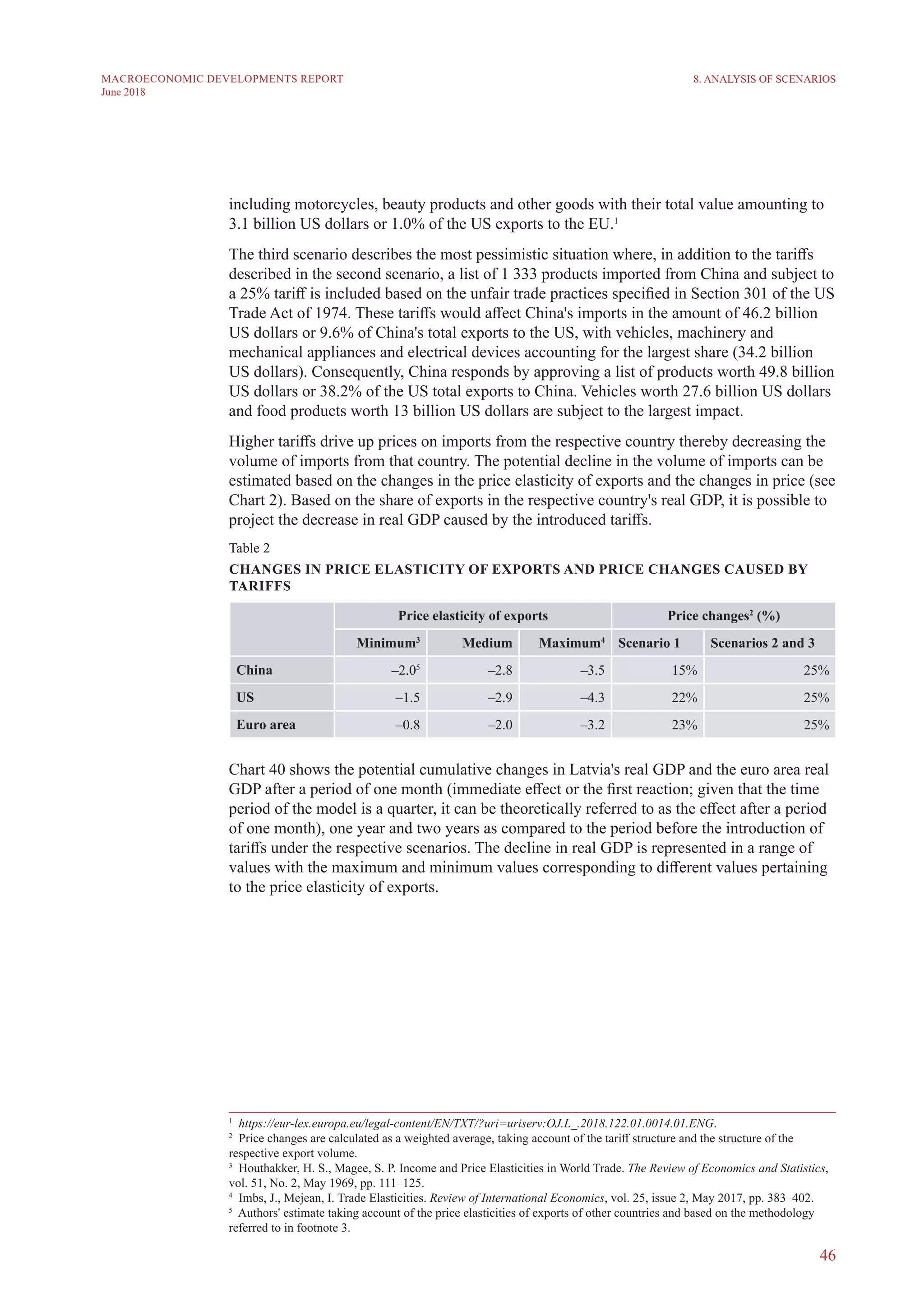

The June 2018 Macroeconomic Developments Report from Latvijas Banka highlights a downward revision of Latvia's GDP forecast, influenced by negative trends in the financial sector and an uncertain external economic environment. Although construction activity is expected to boost growth, risks such as geopolitical tensions, trade wars, and insufficient investment persist. The report notes stable external demand and potential support from rising private consumption and investment despite anticipated challenges.