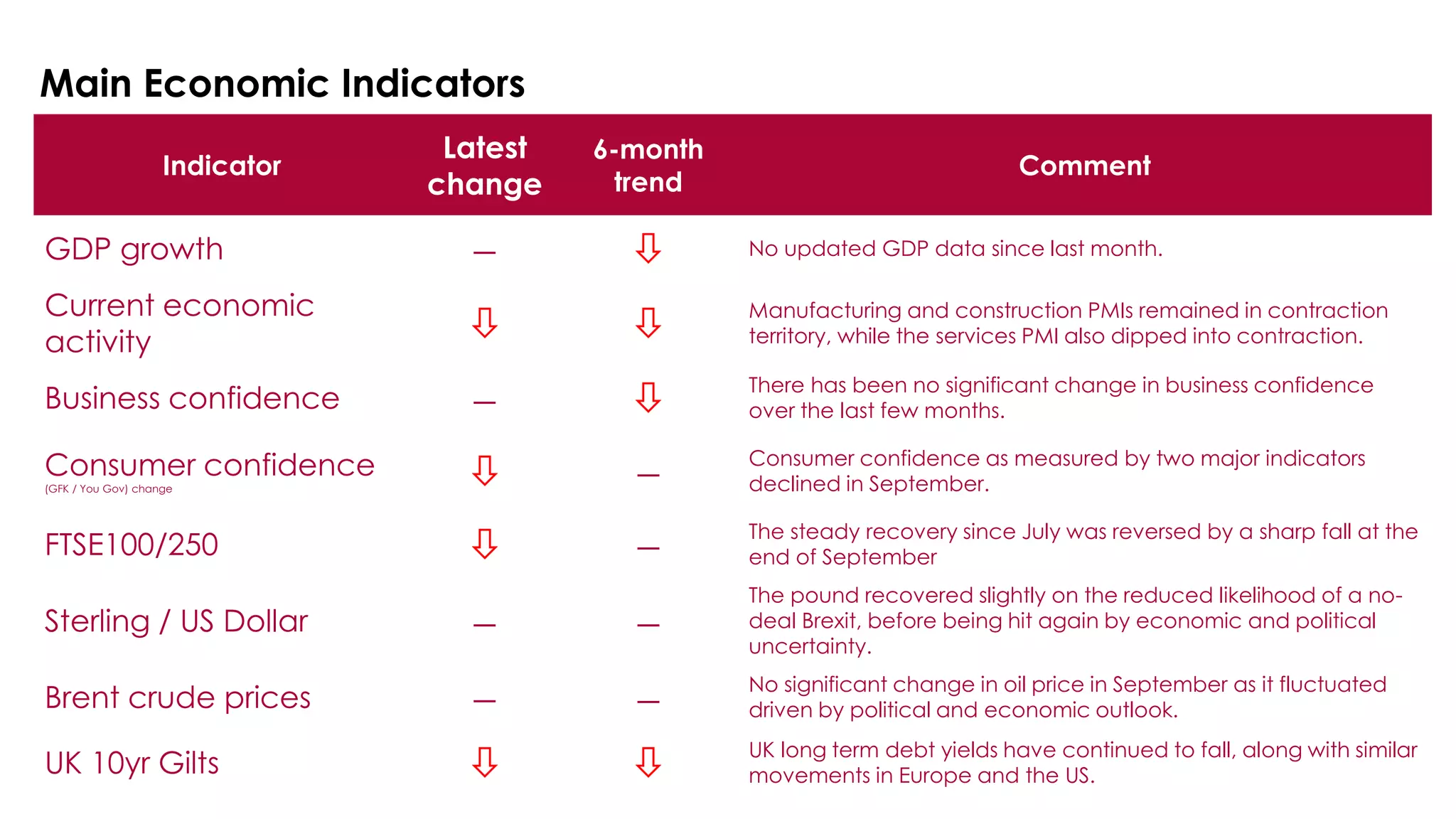

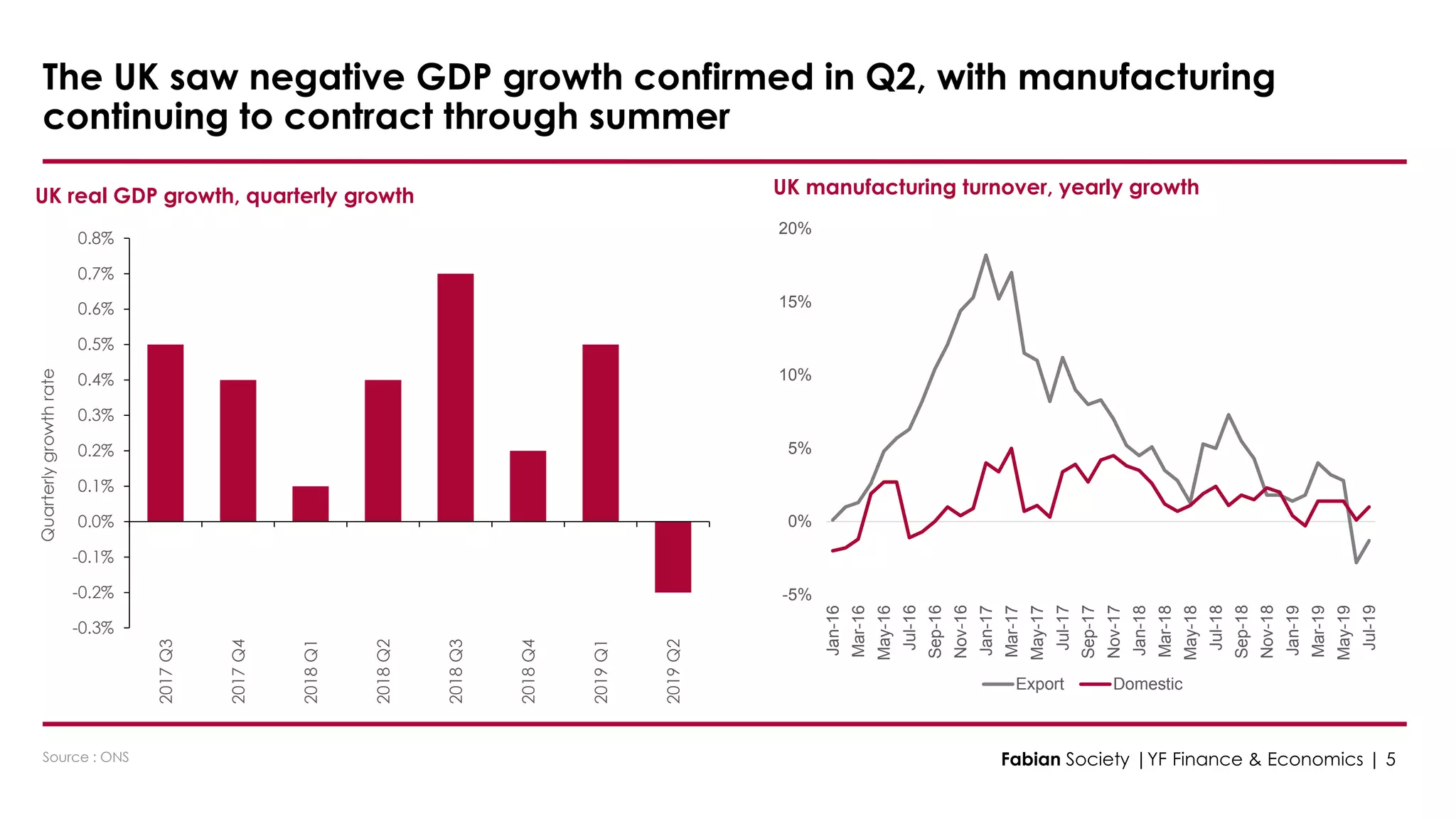

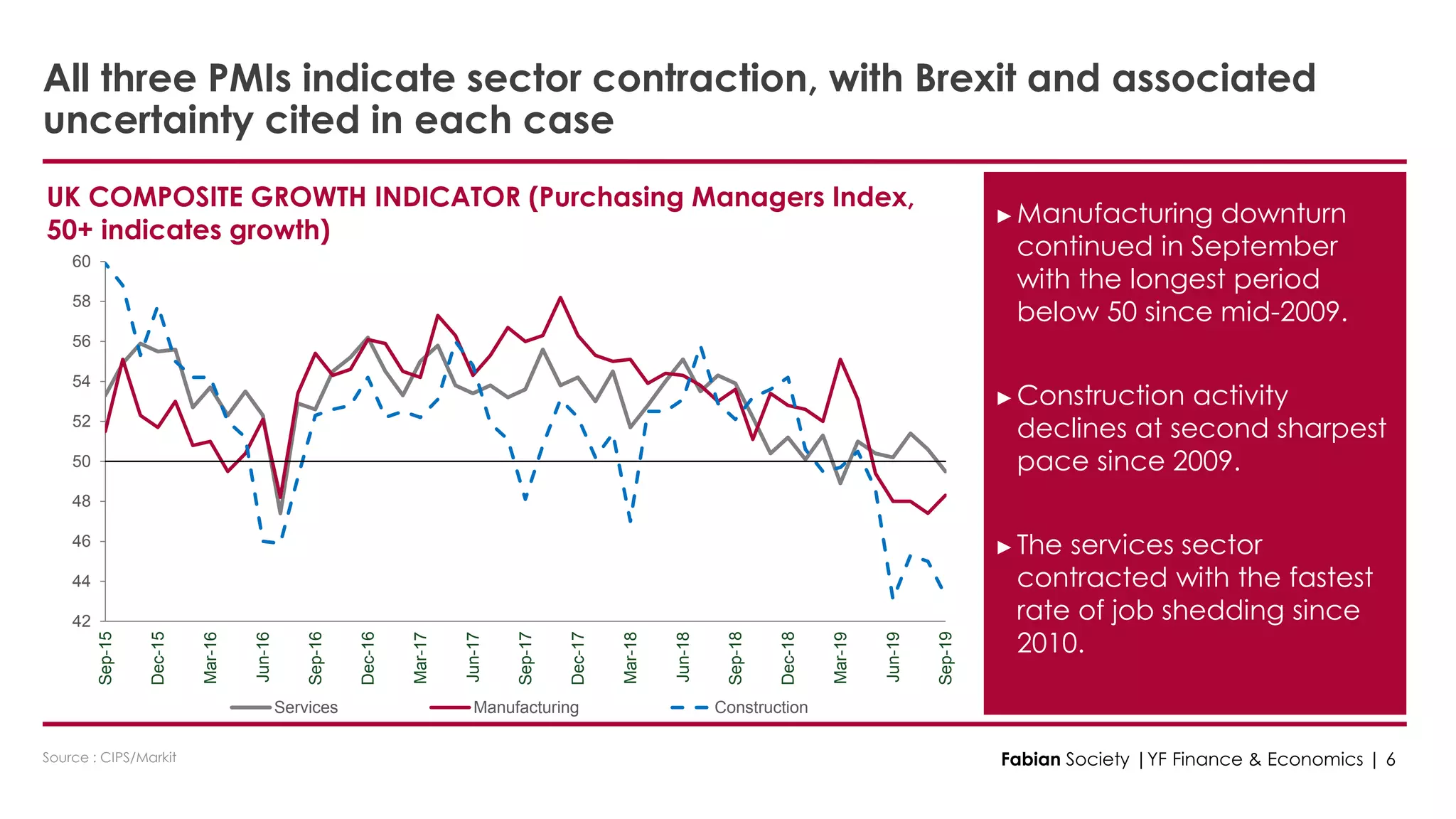

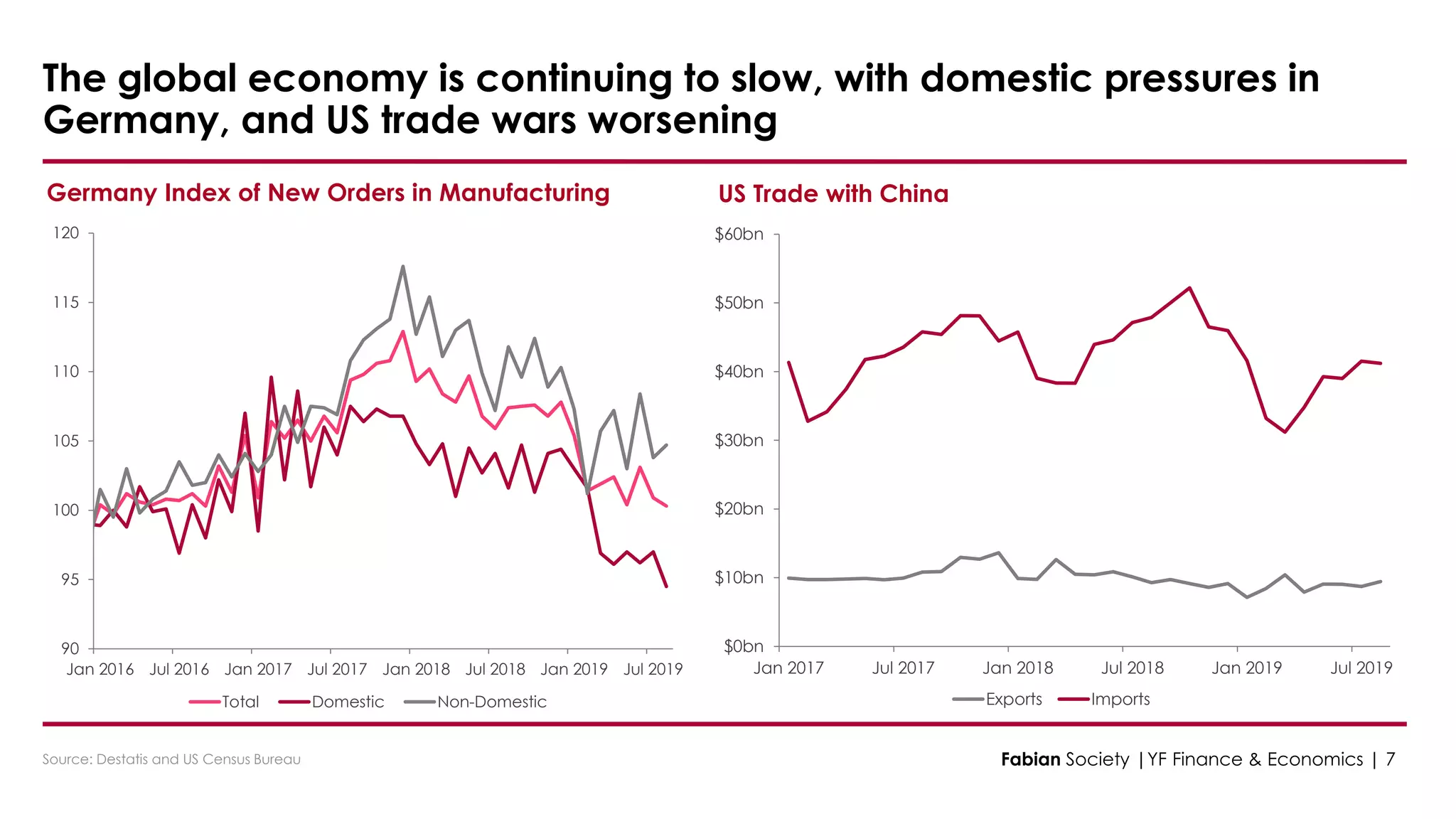

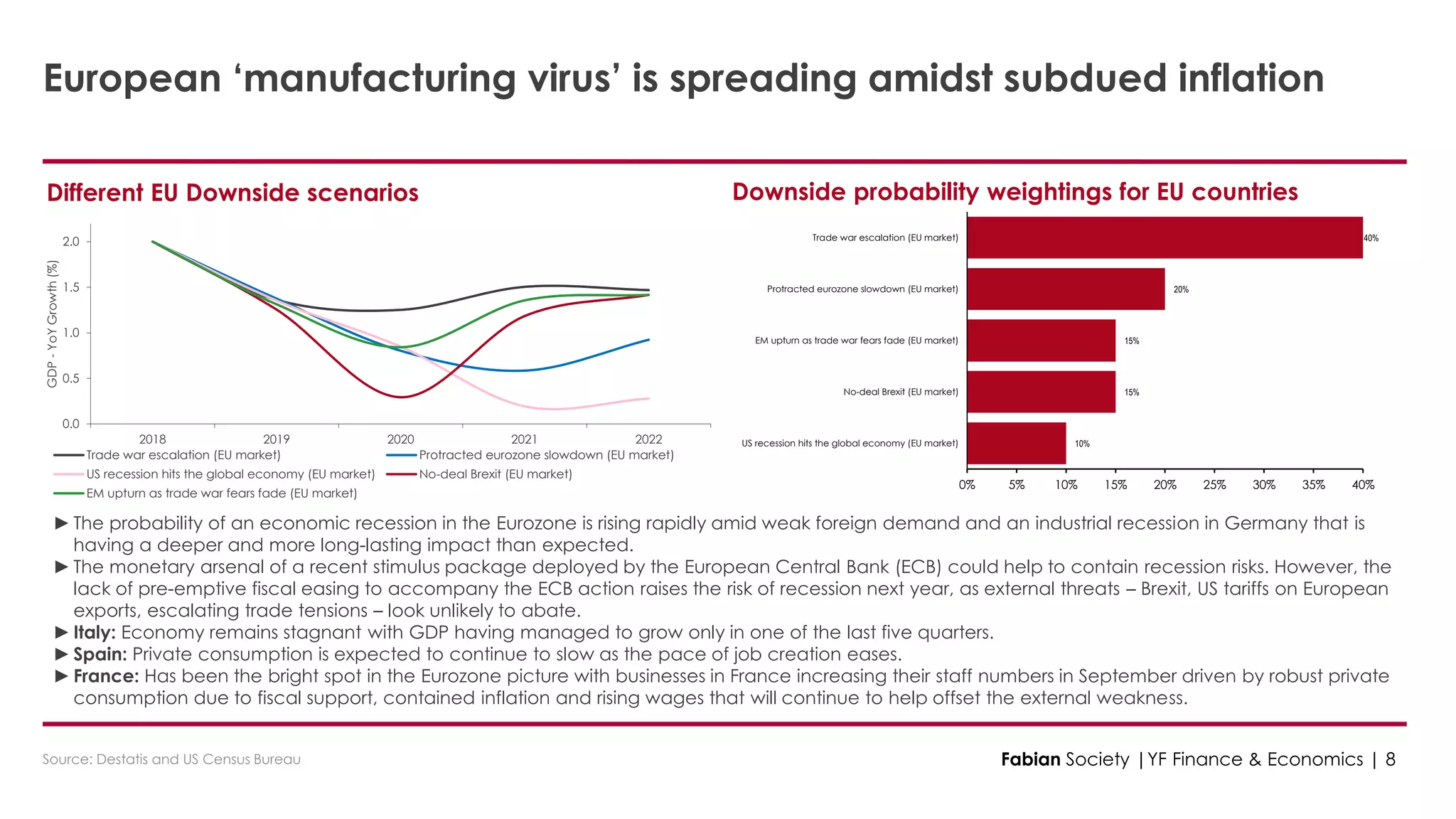

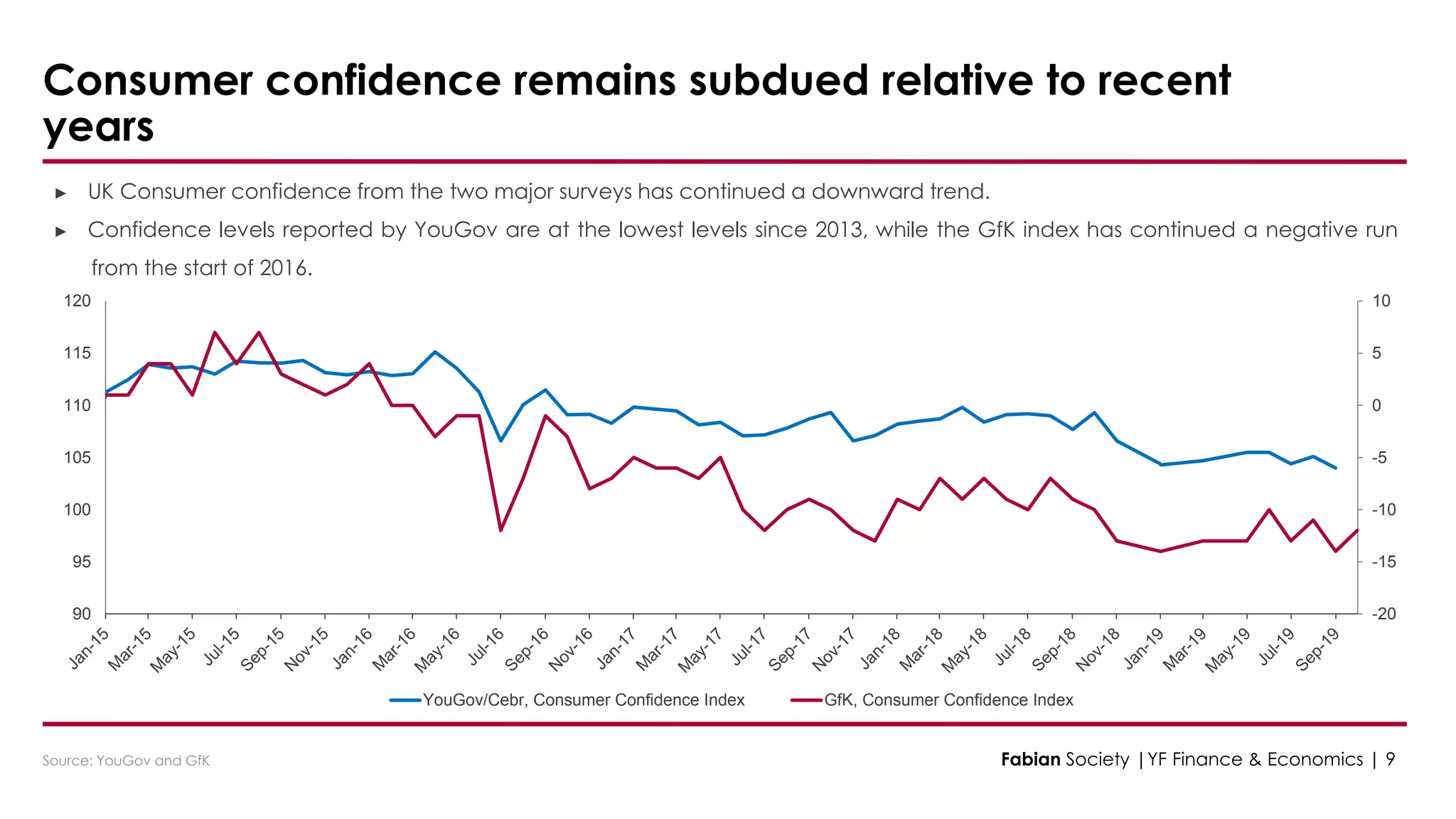

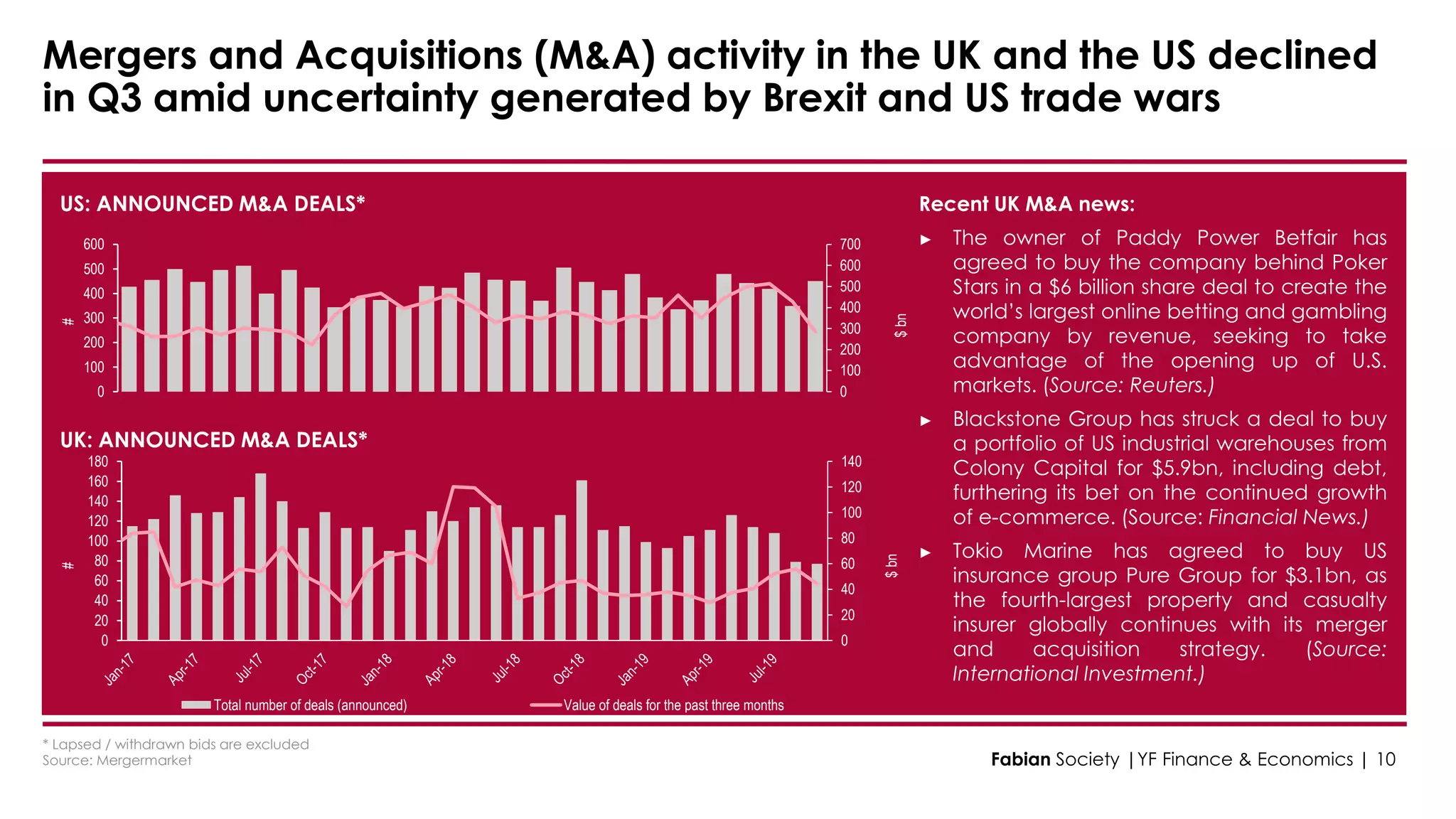

The document summarizes recent economic developments in the UK and globally. It notes that the UK economy saw negative GDP growth in Q2 2019, with manufacturing continuing to decline. PMIs indicate contraction in agriculture, manufacturing and services in September due to Brexit uncertainty. The global economy is also slowing, partly due to pressures in Germany and worsening US trade wars. M&A activity in the UK and US has declined amid ongoing uncertainties from Brexit and trade tensions.