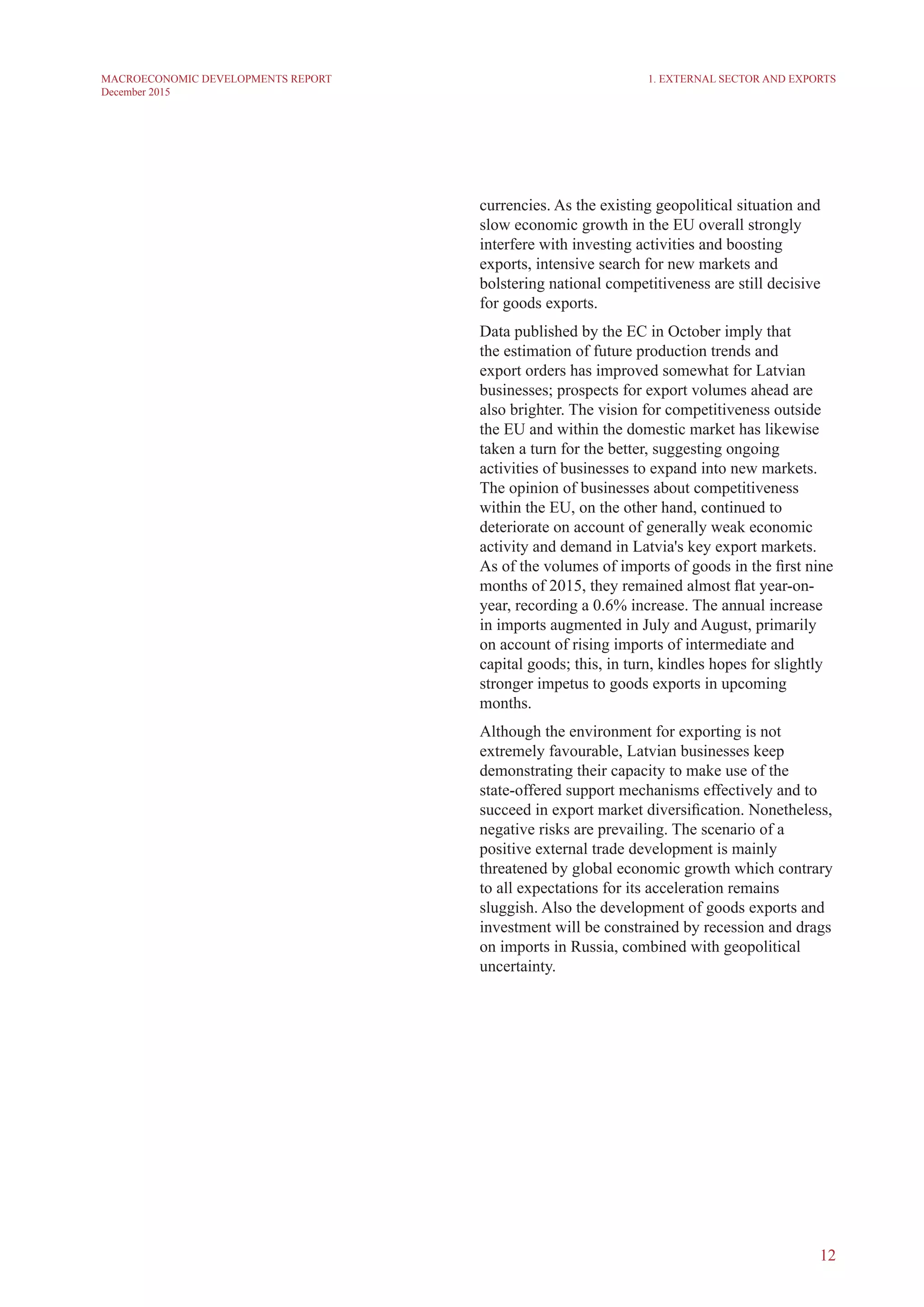

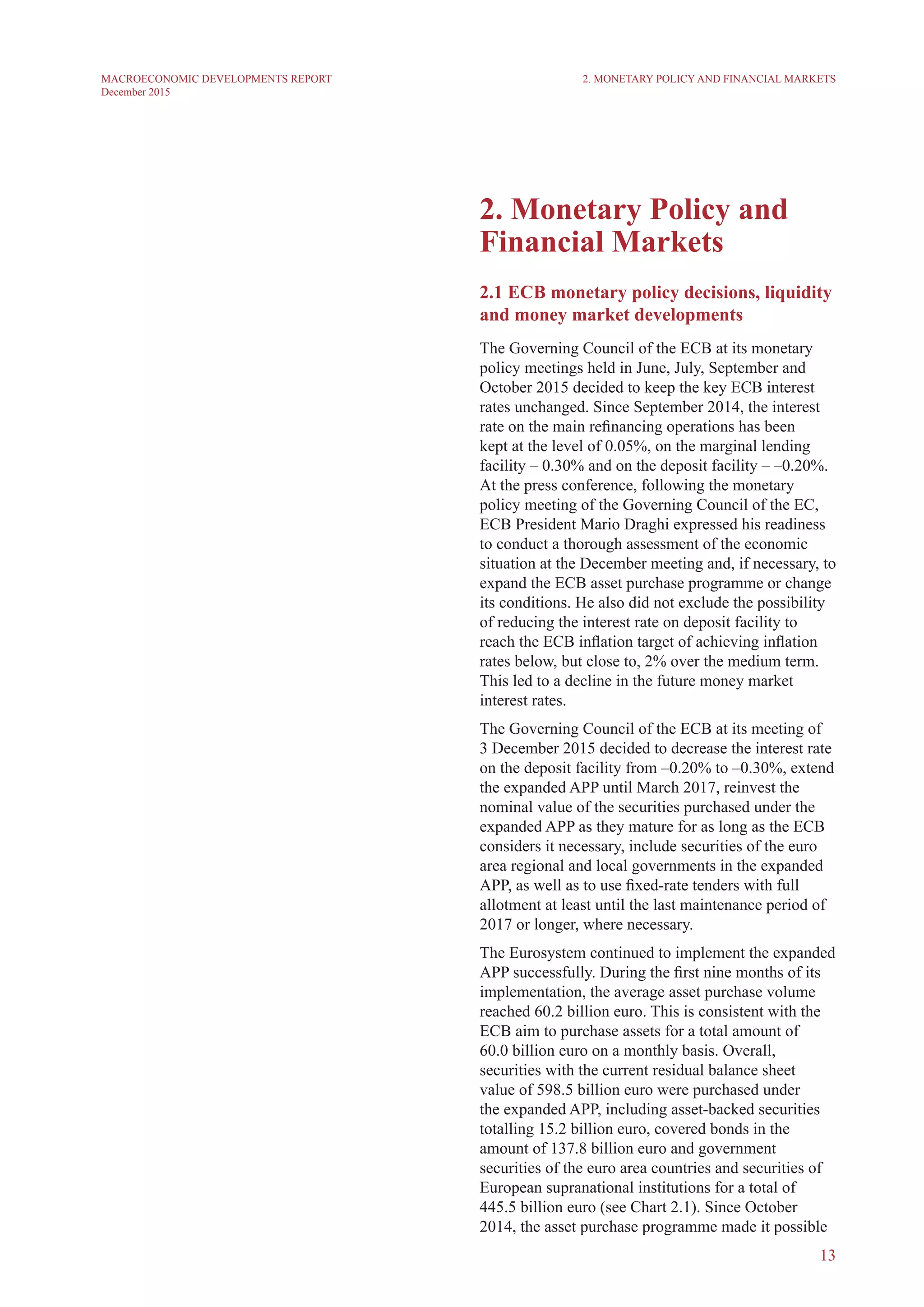

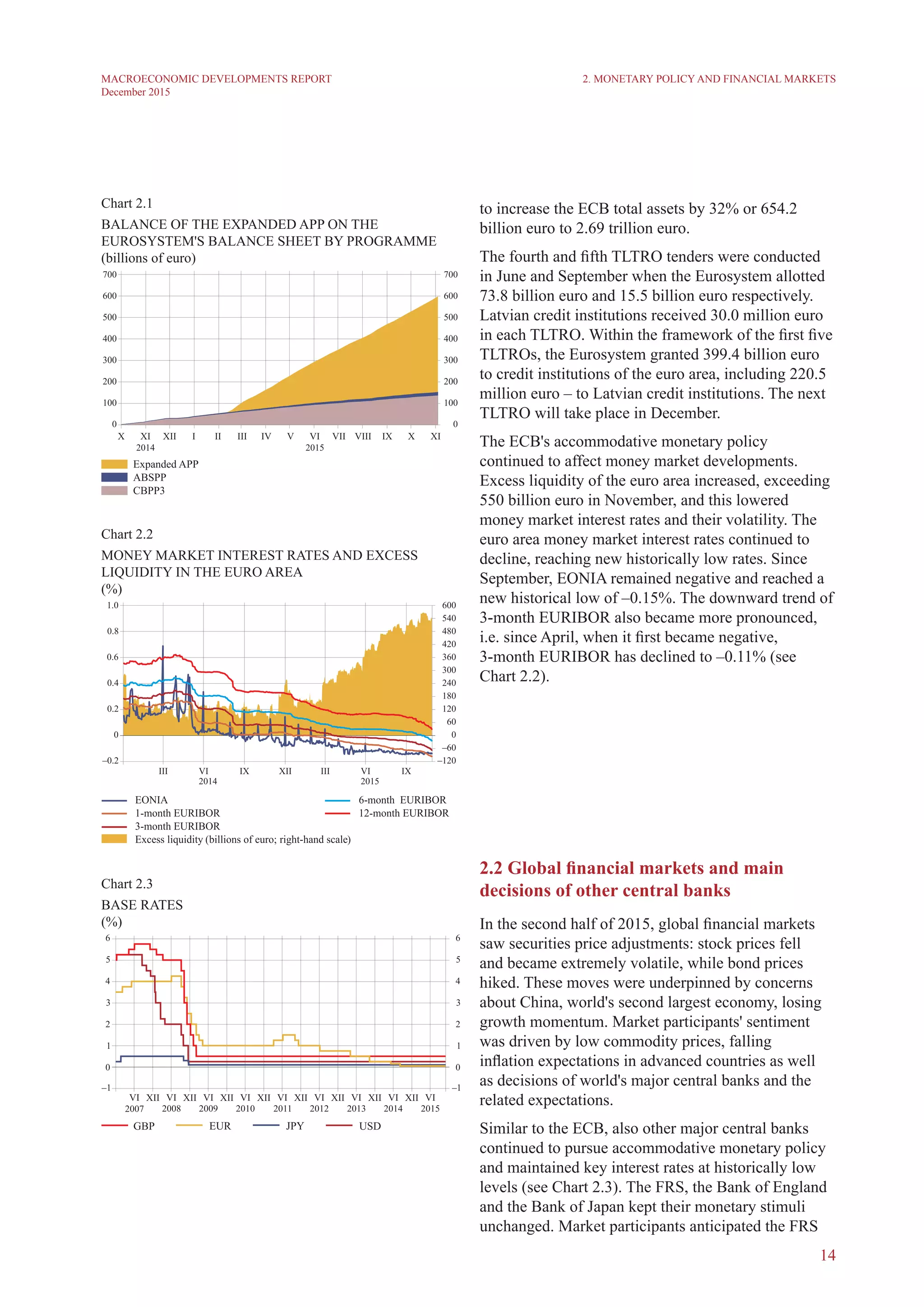

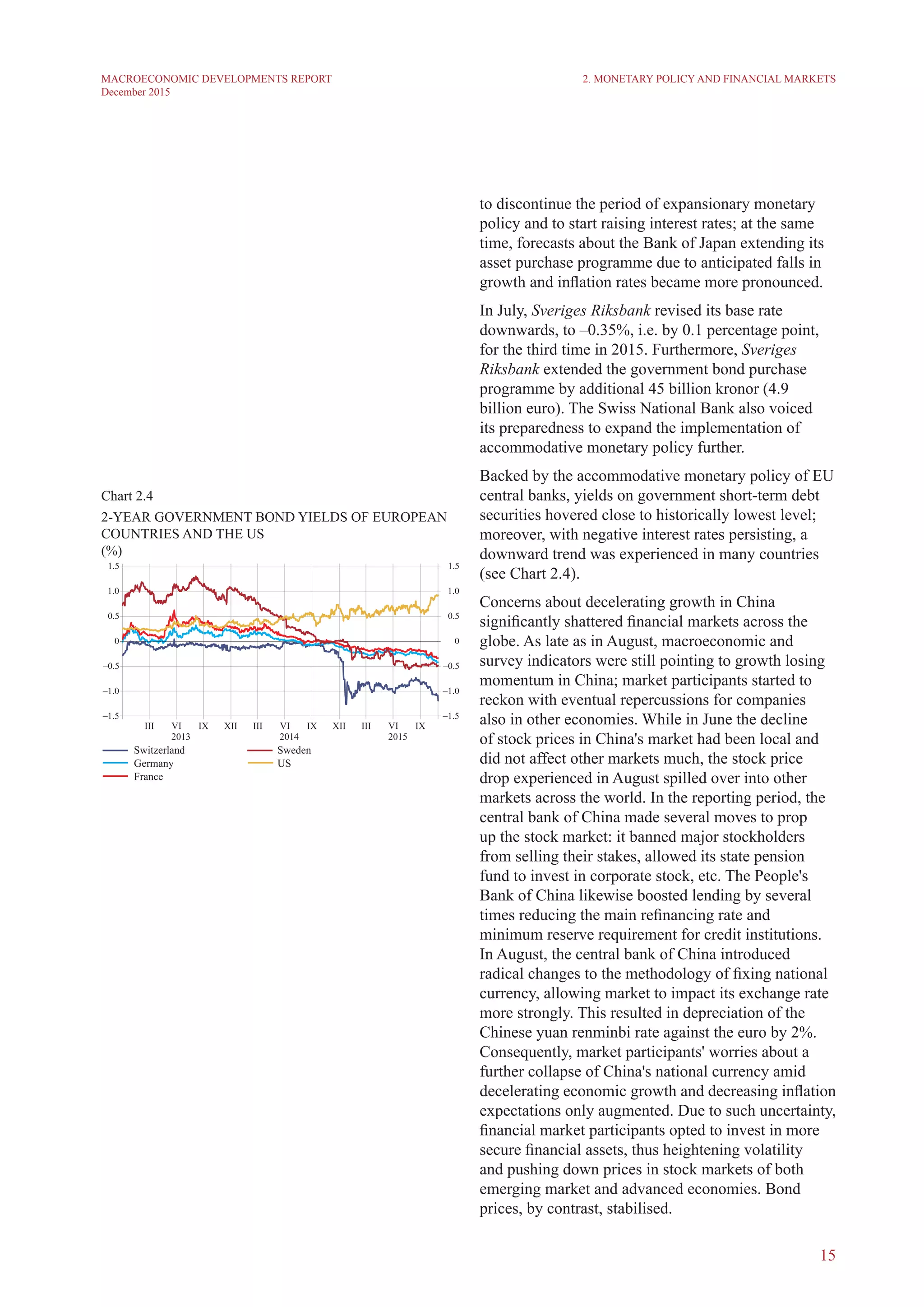

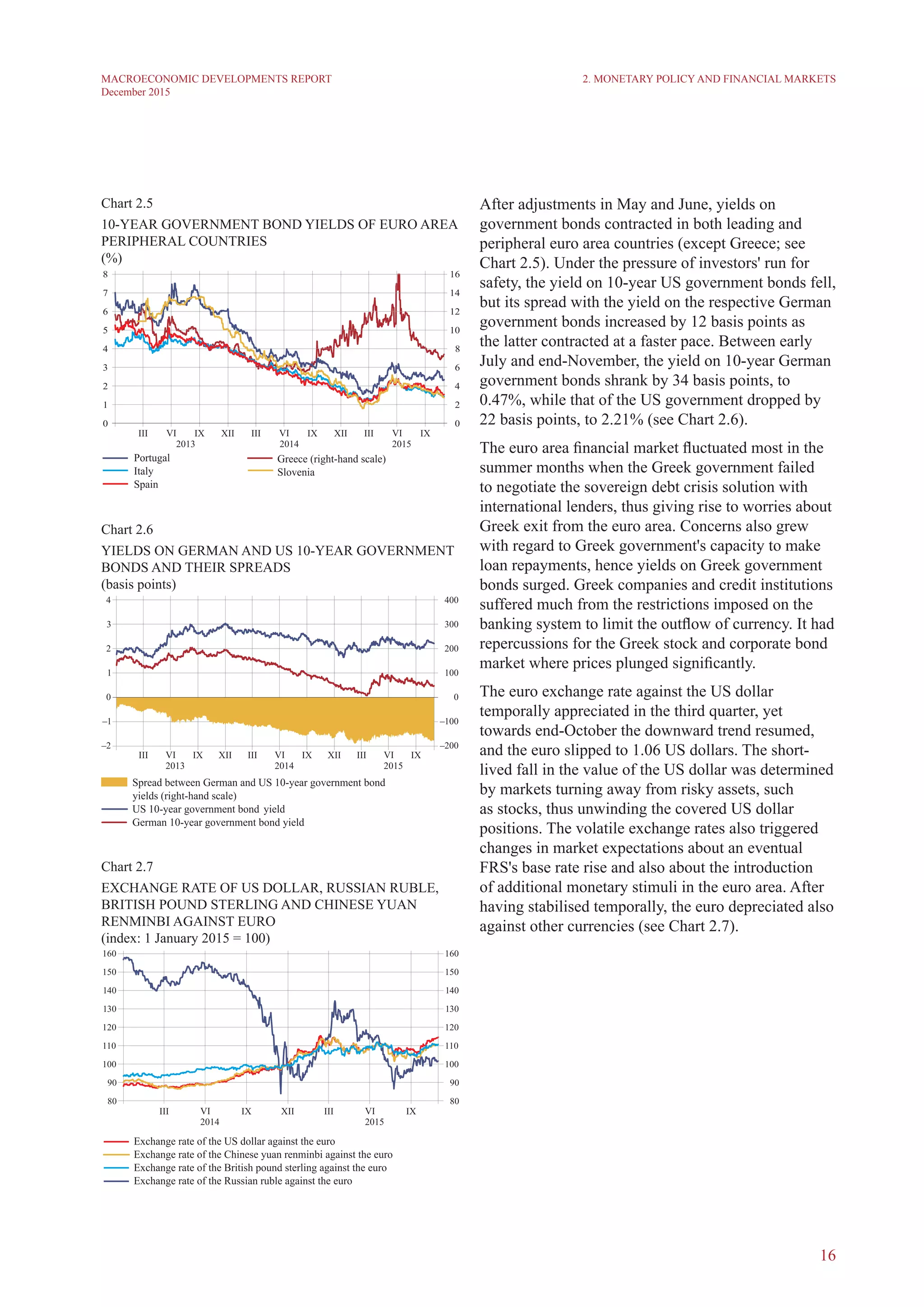

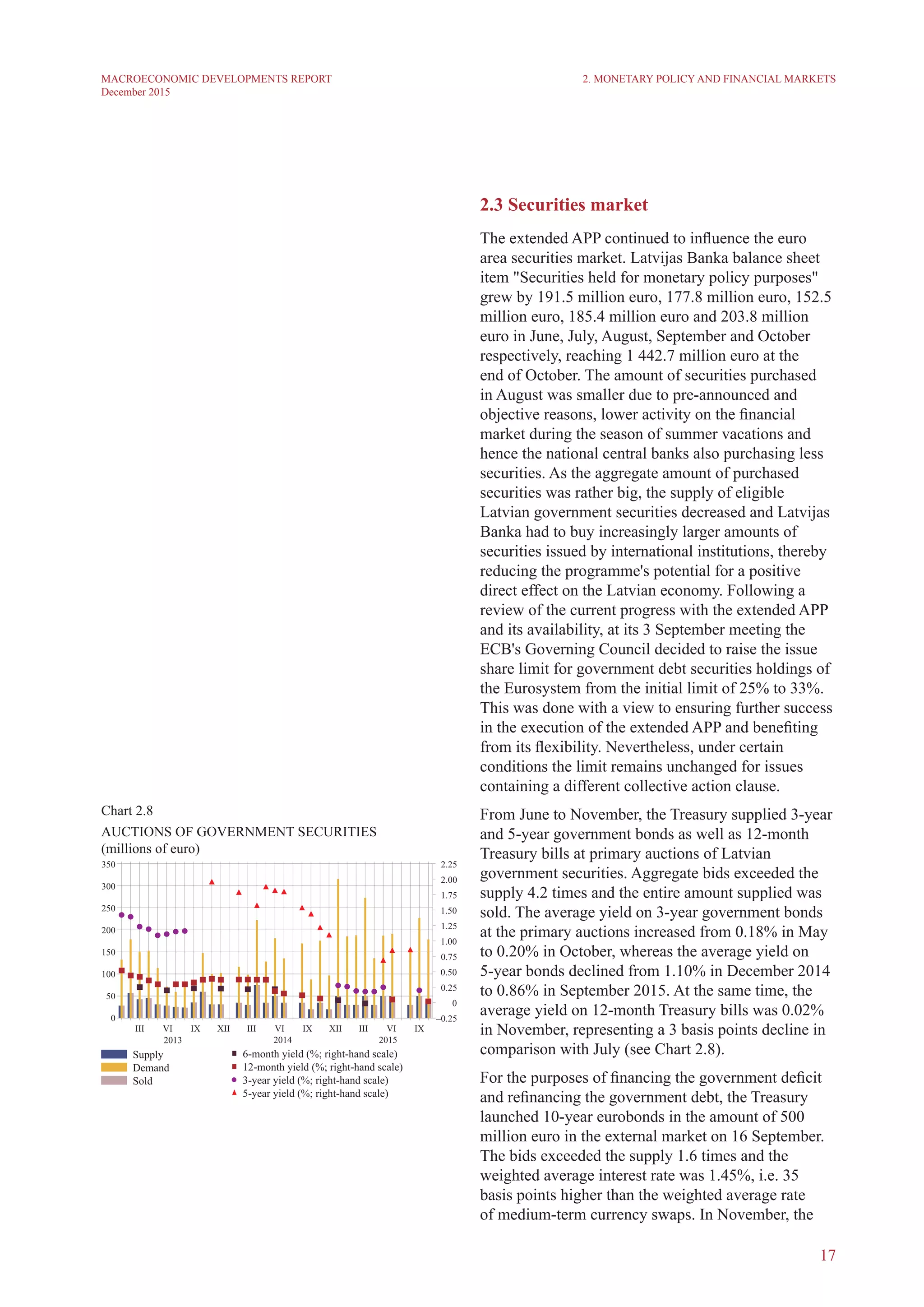

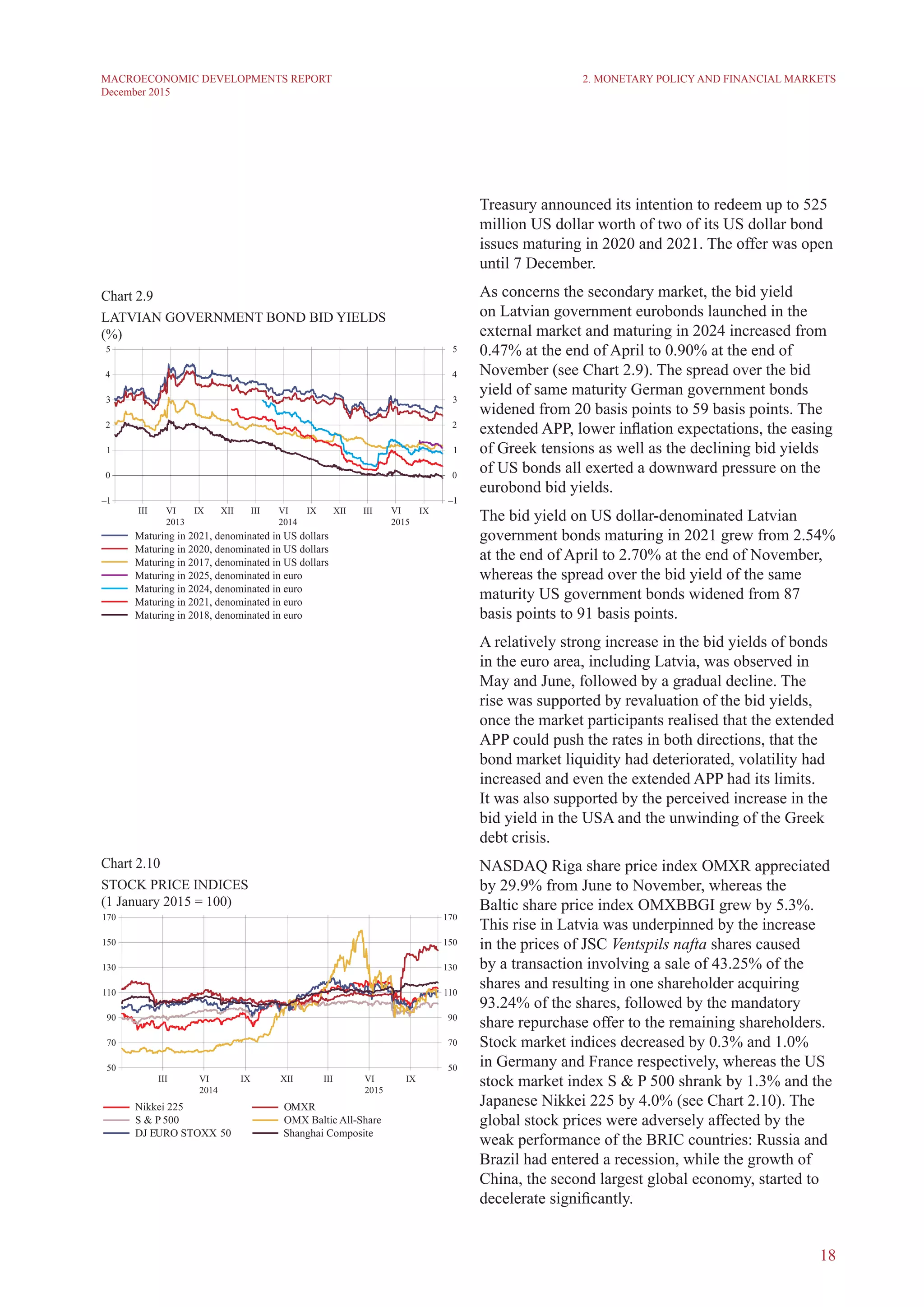

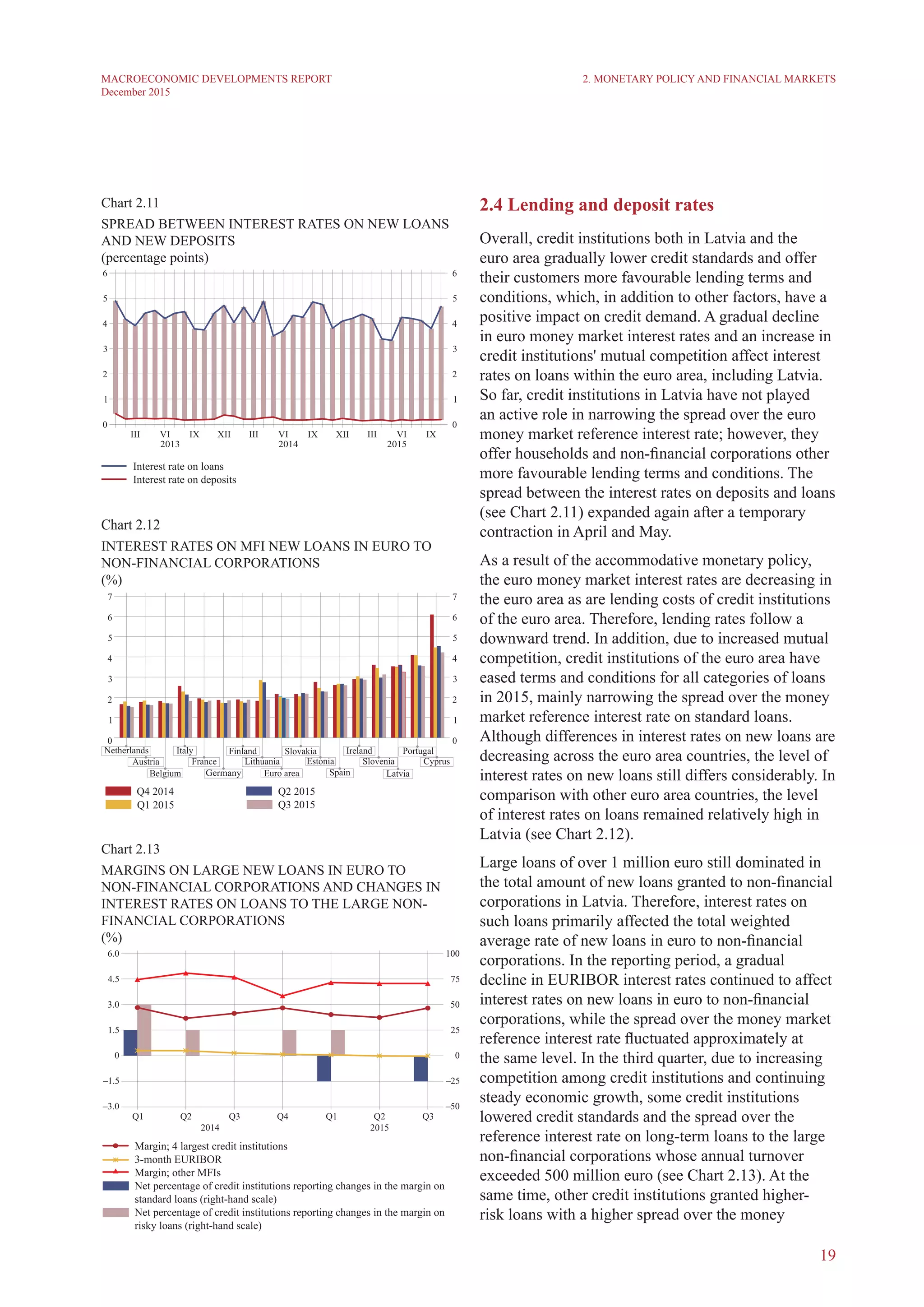

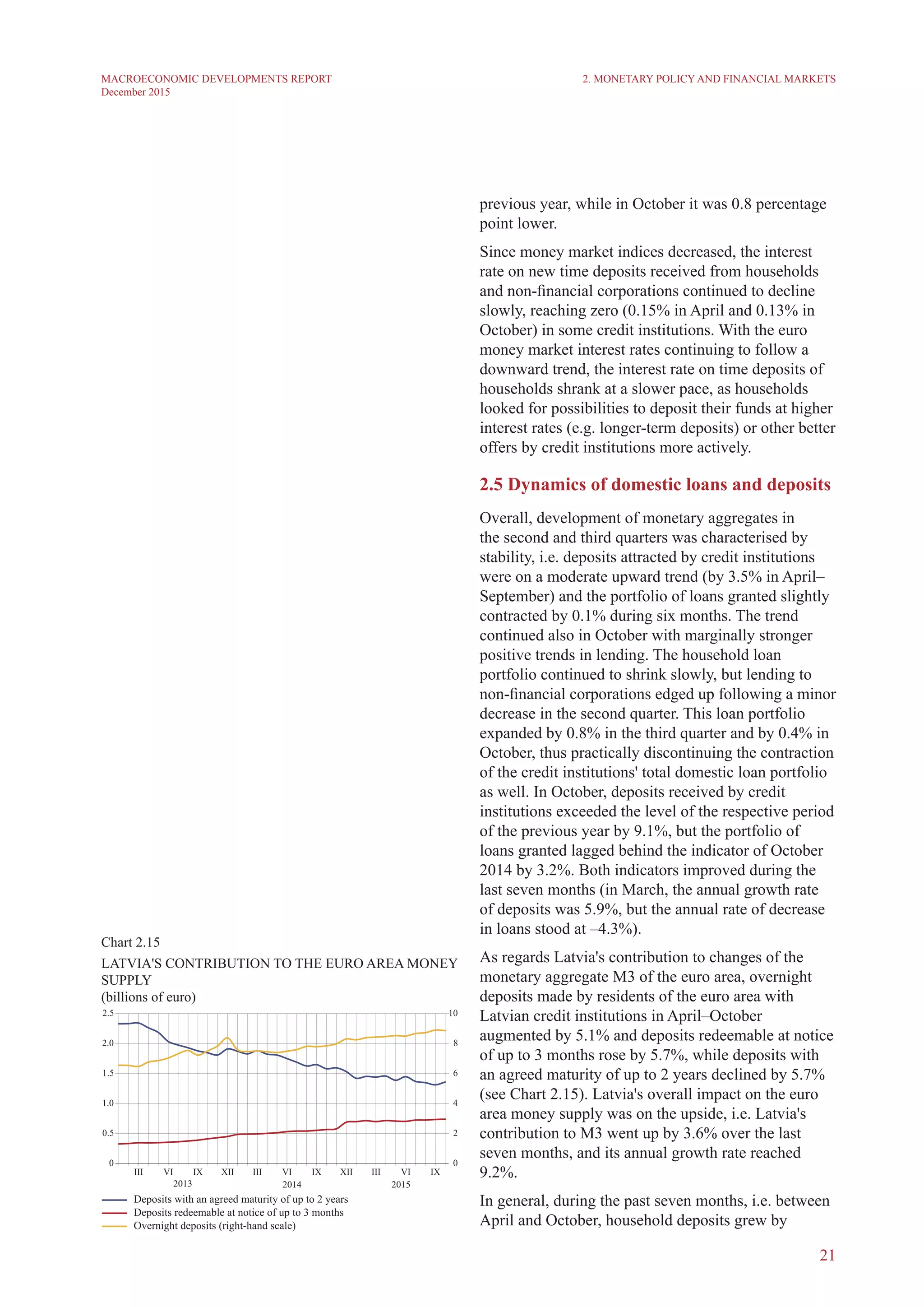

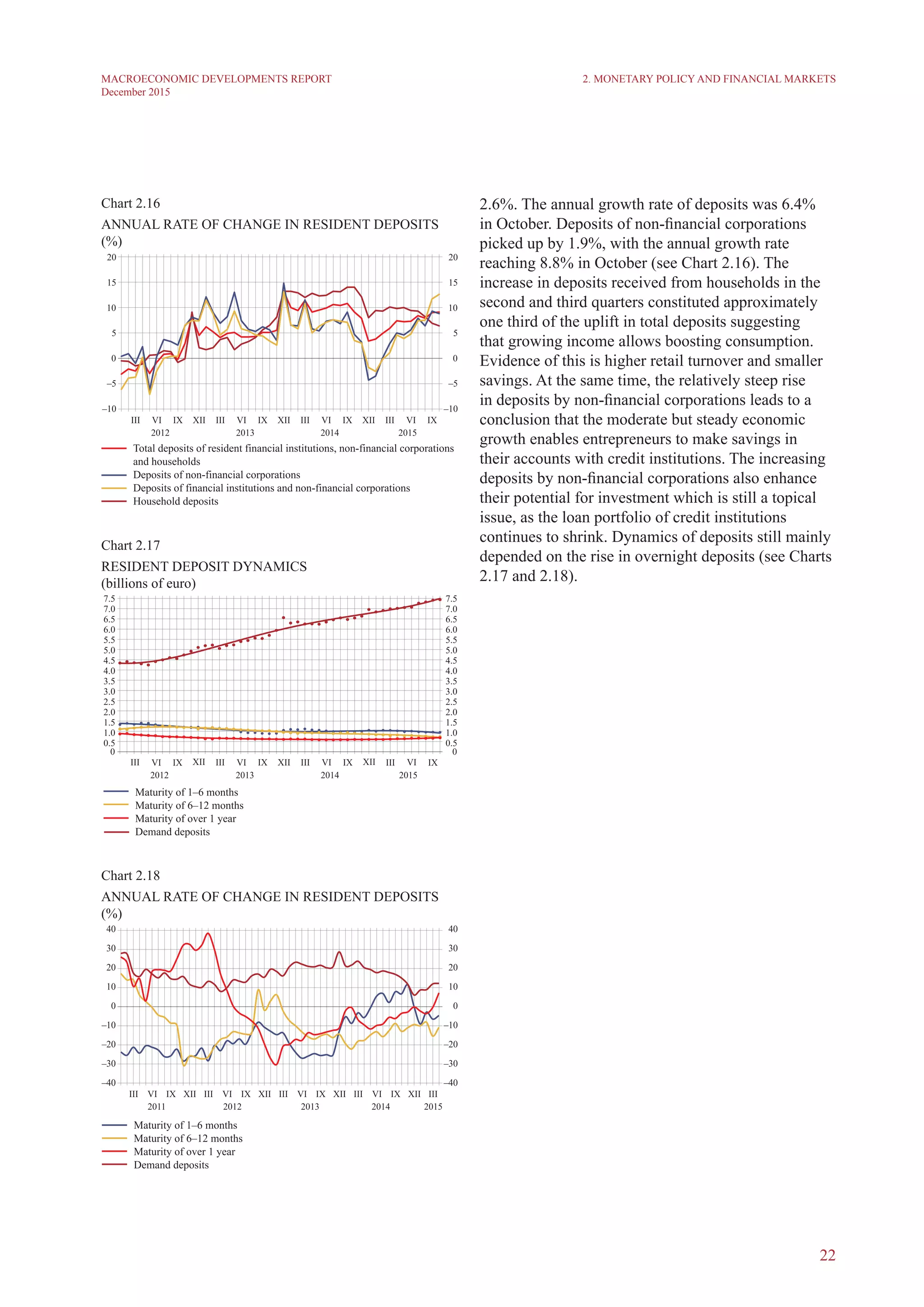

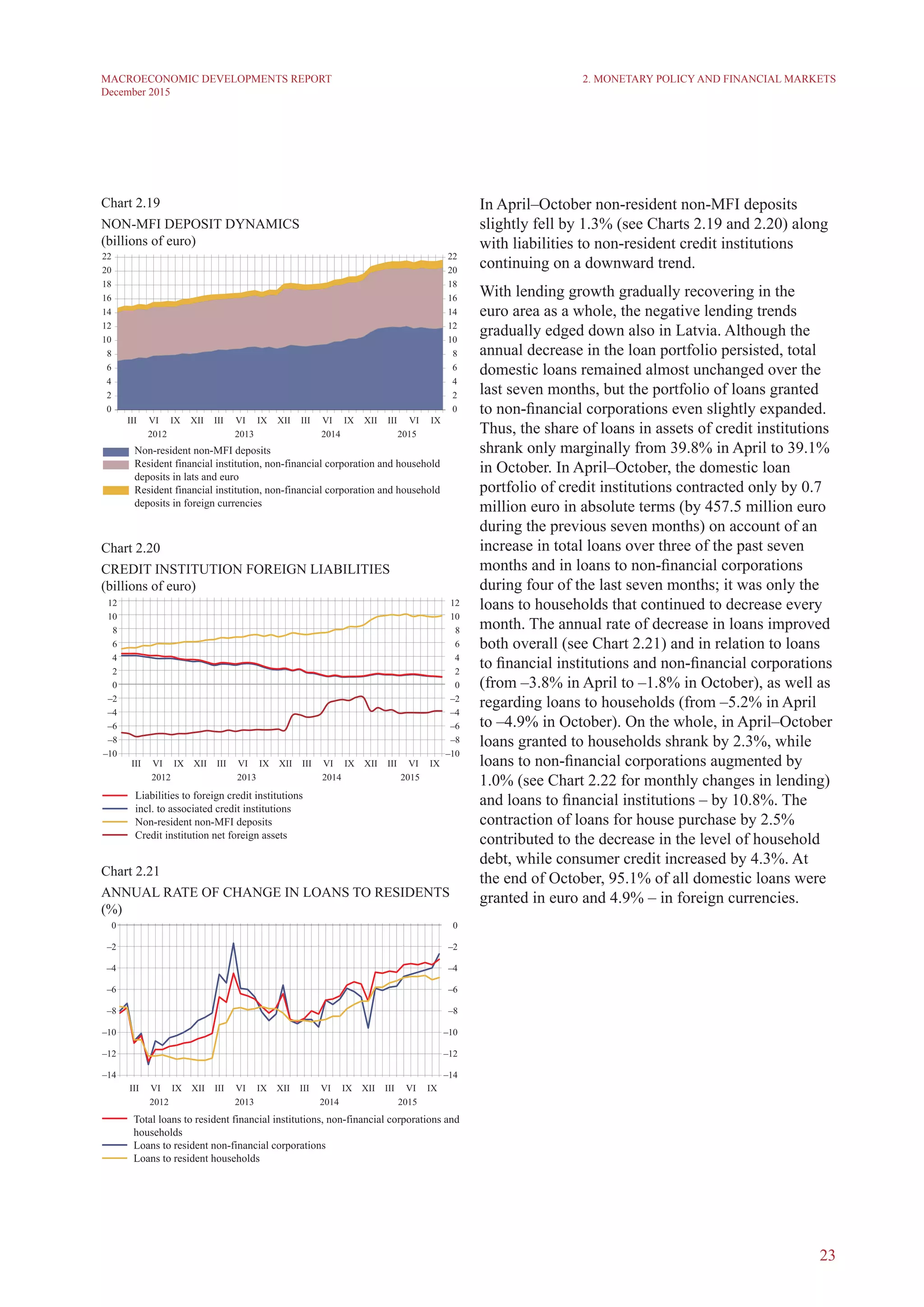

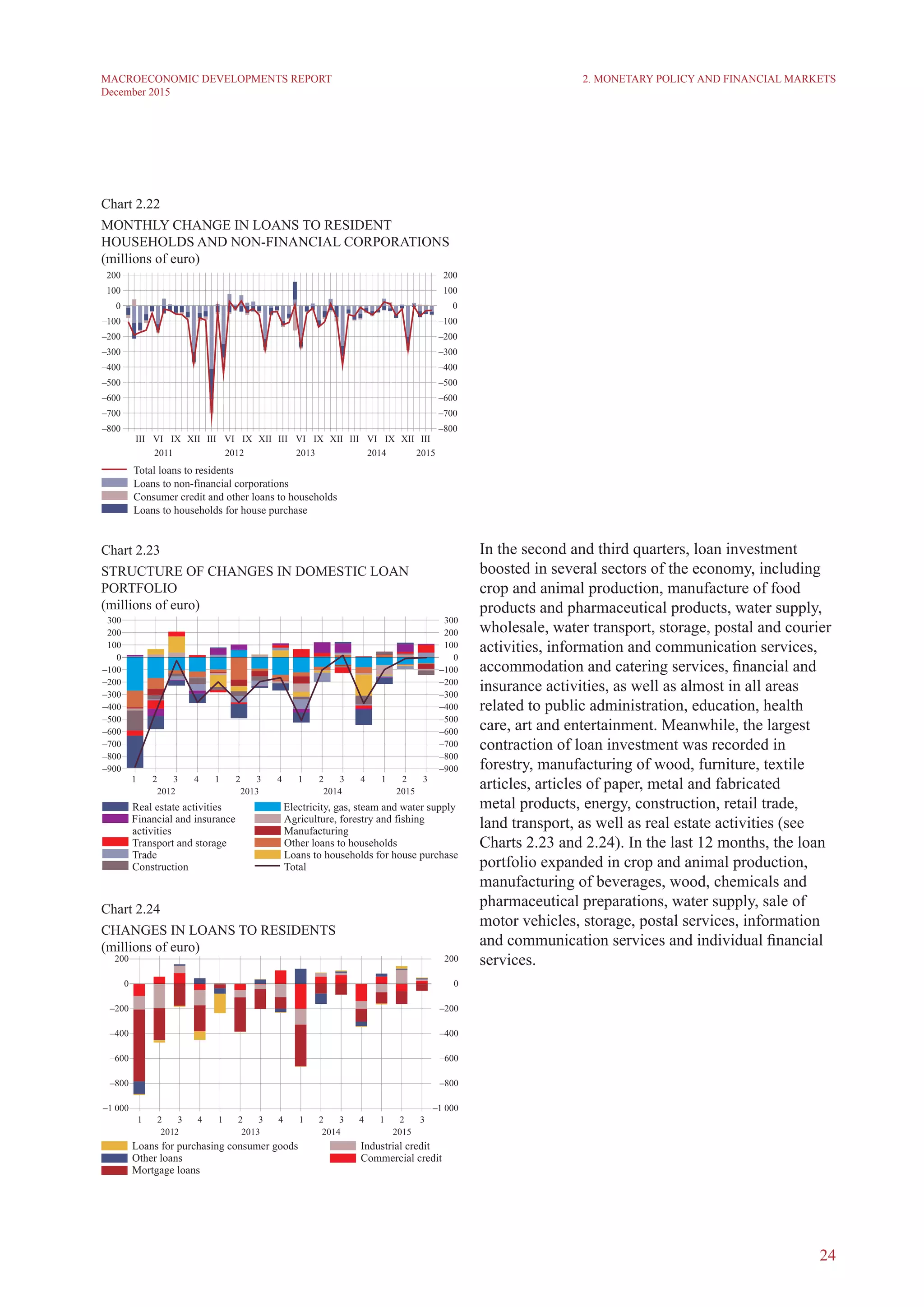

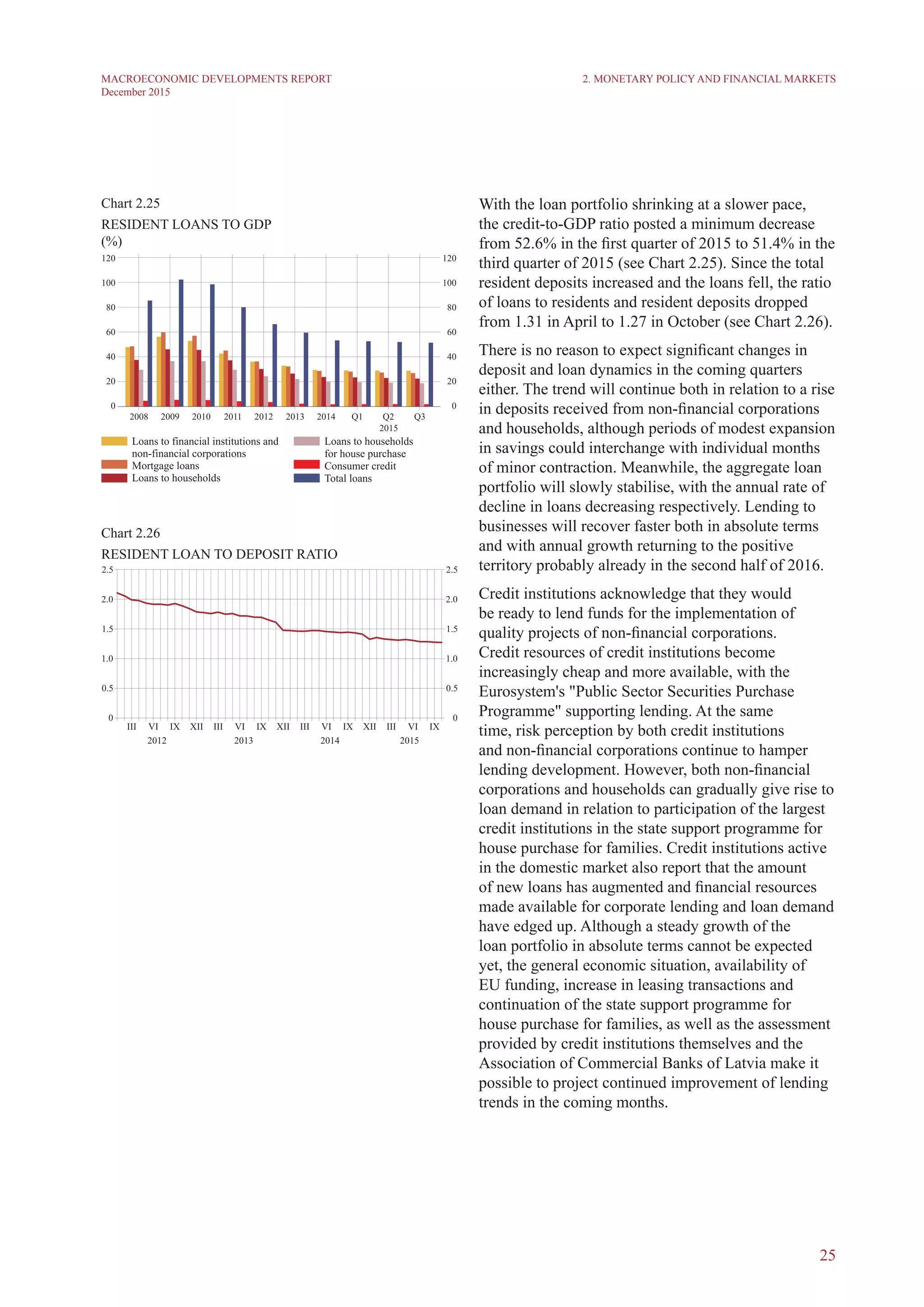

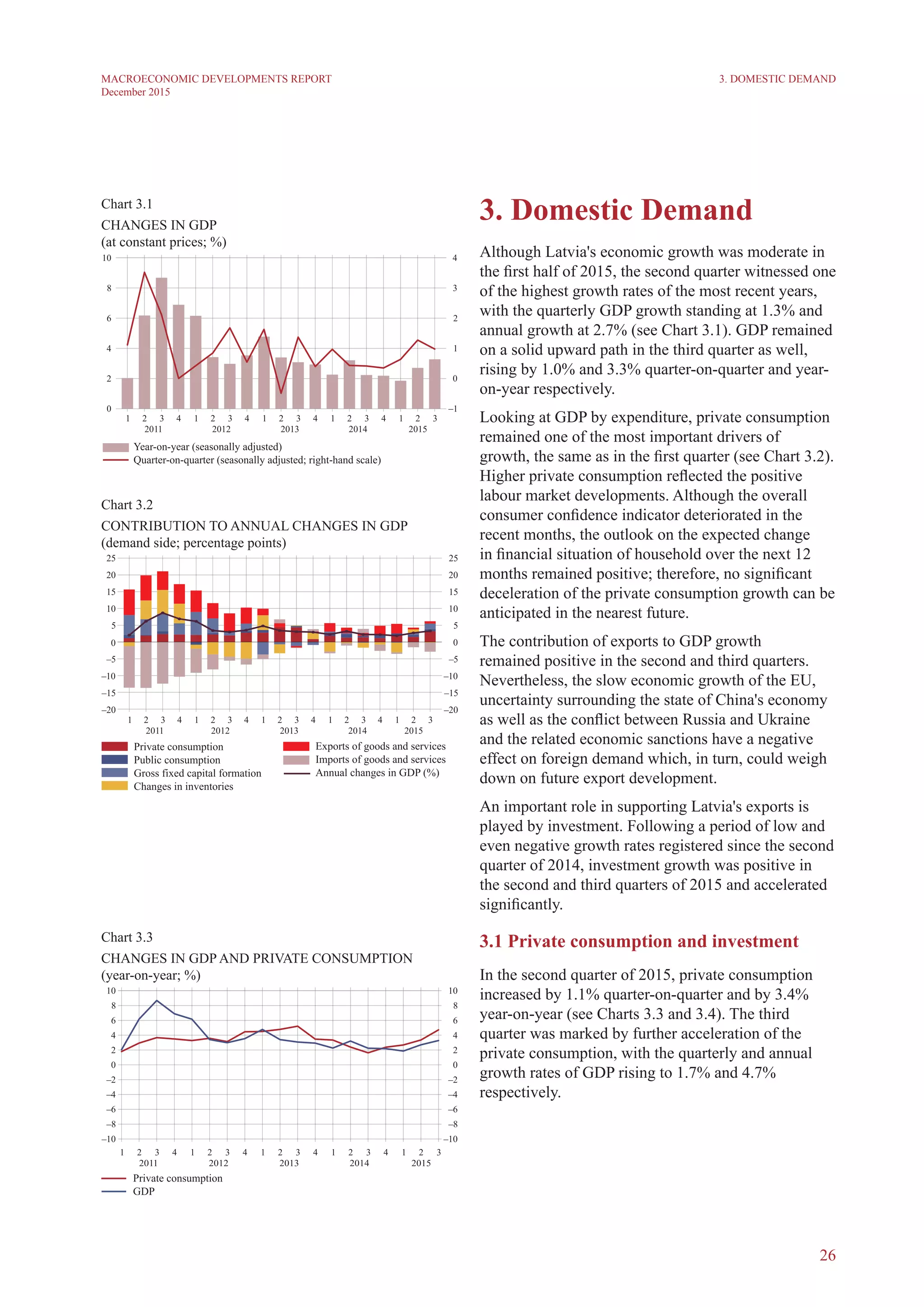

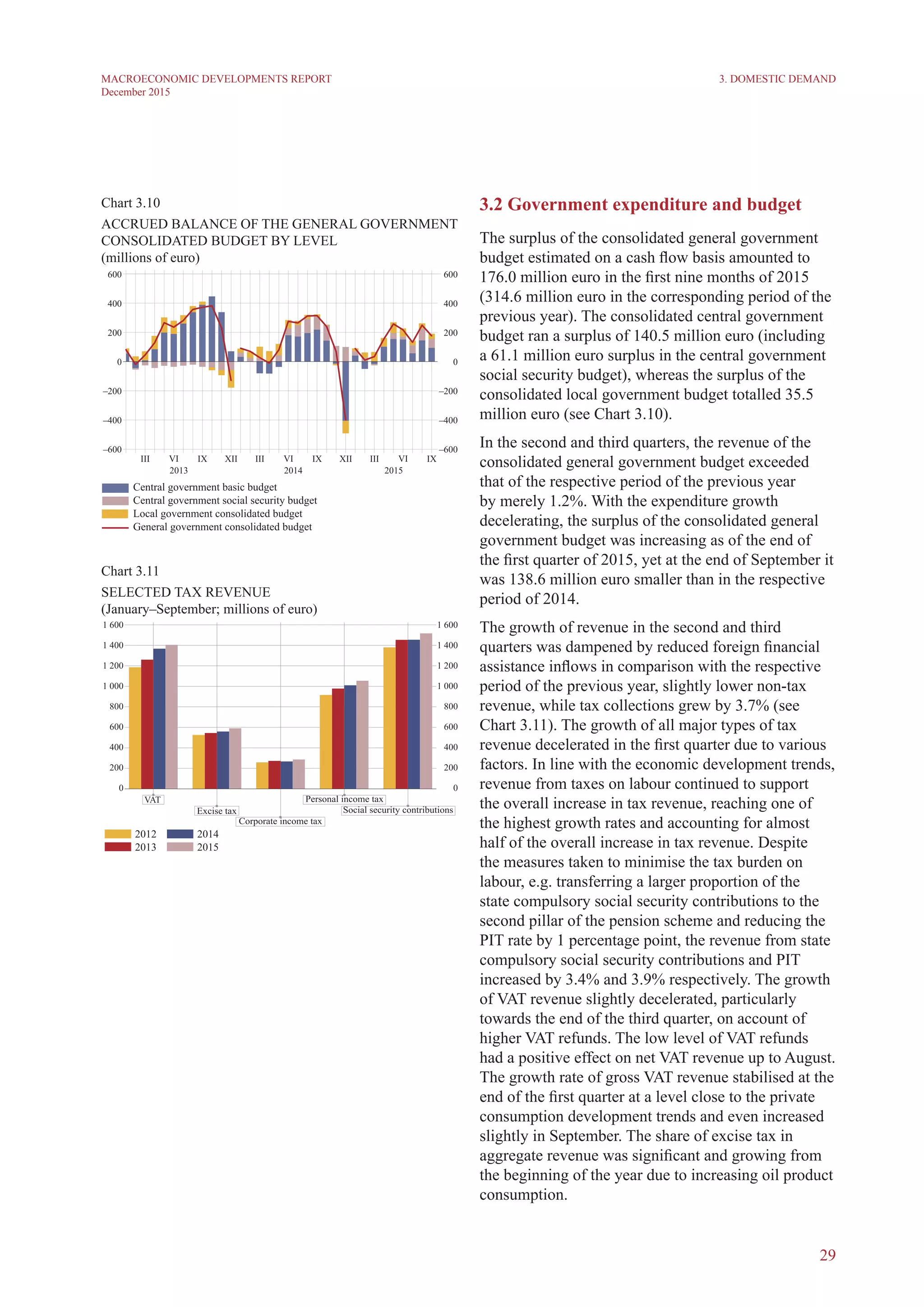

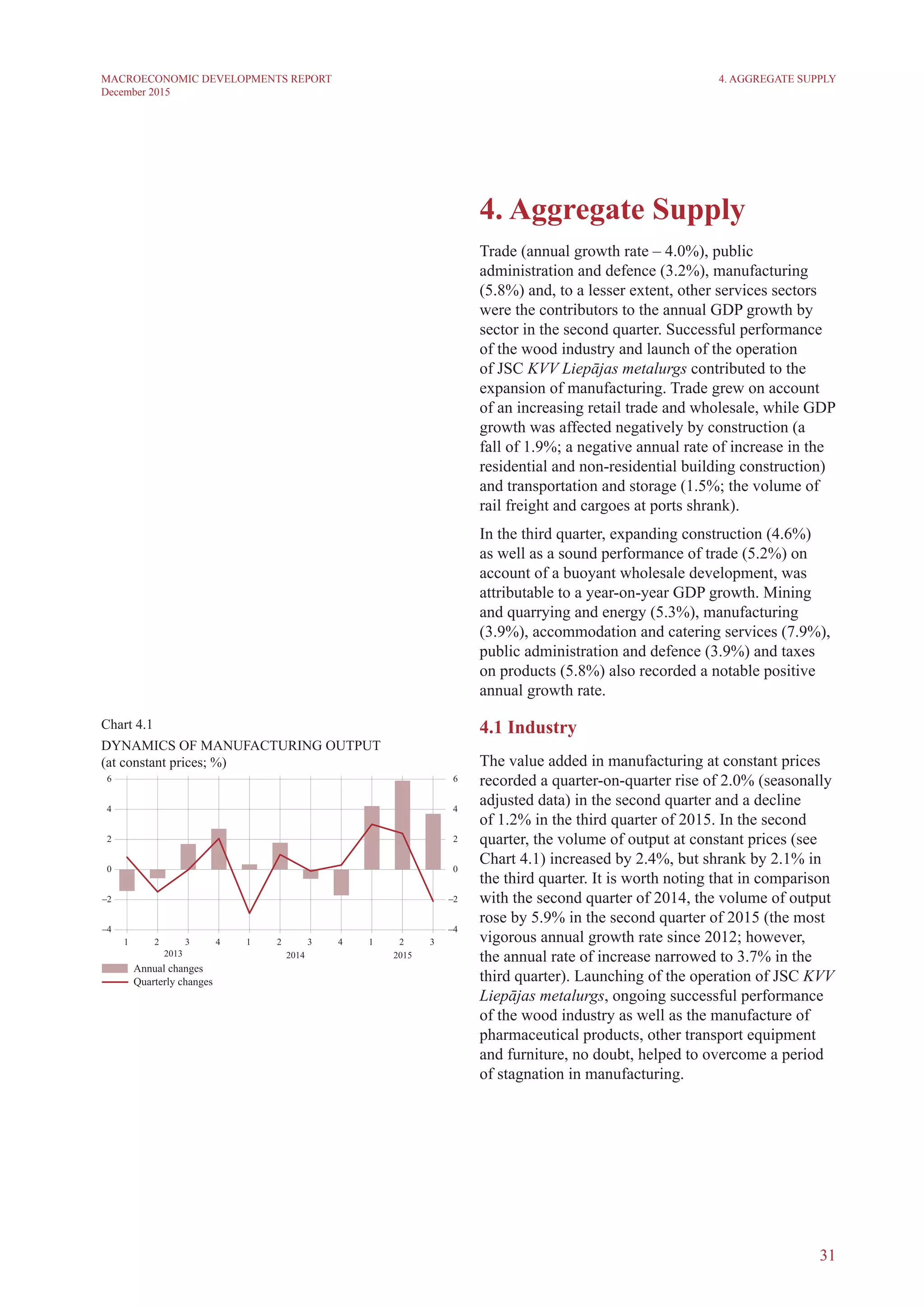

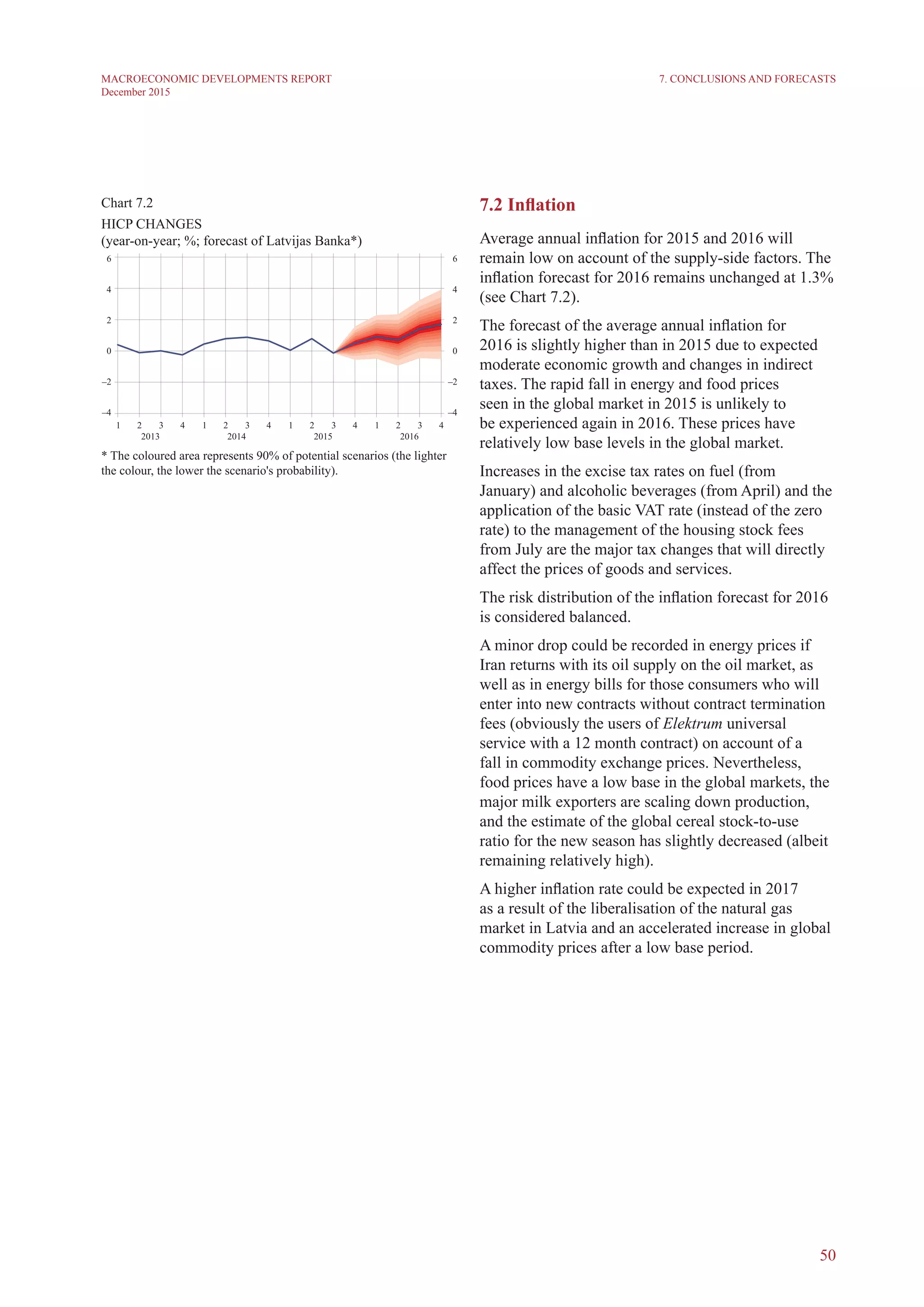

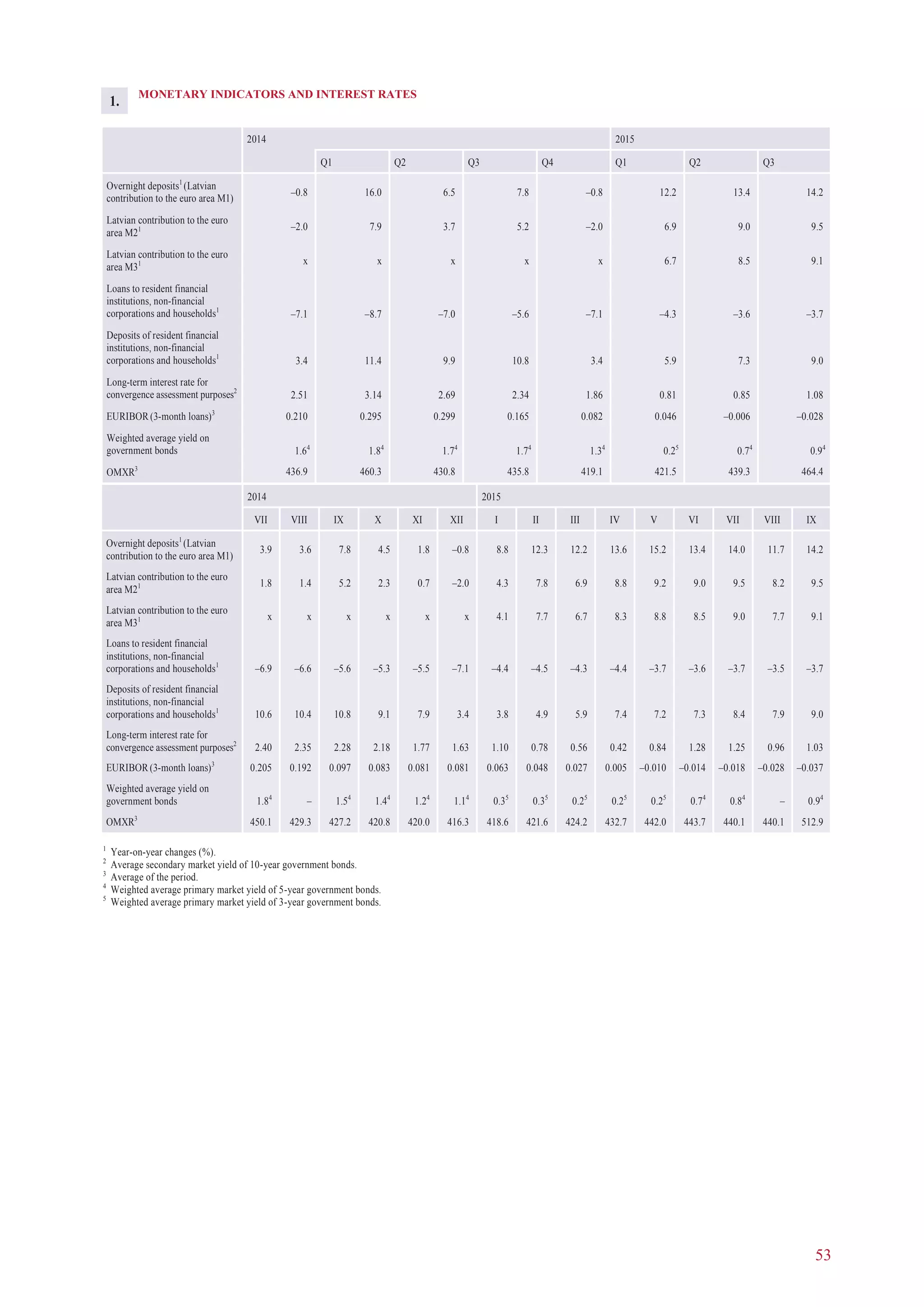

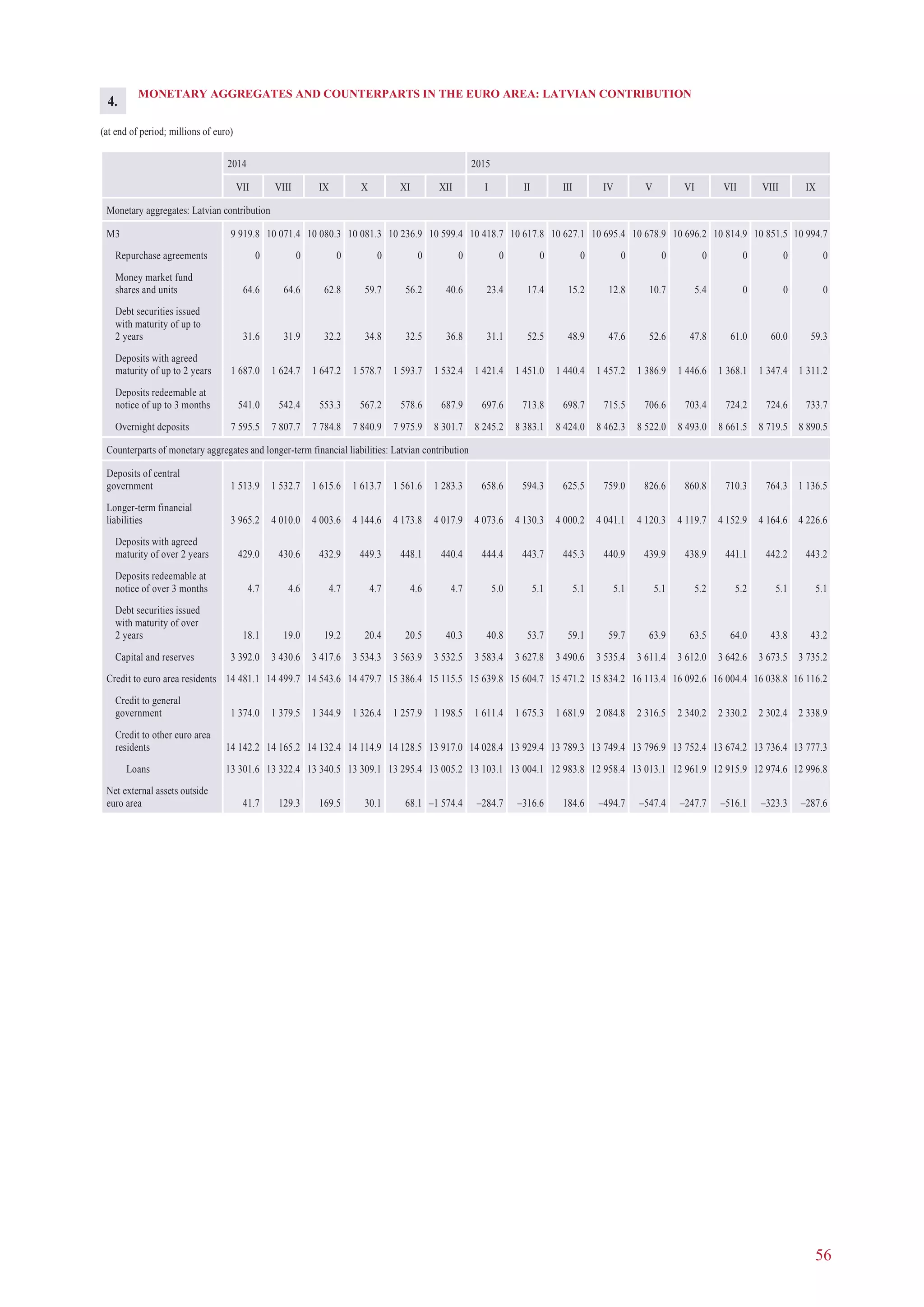

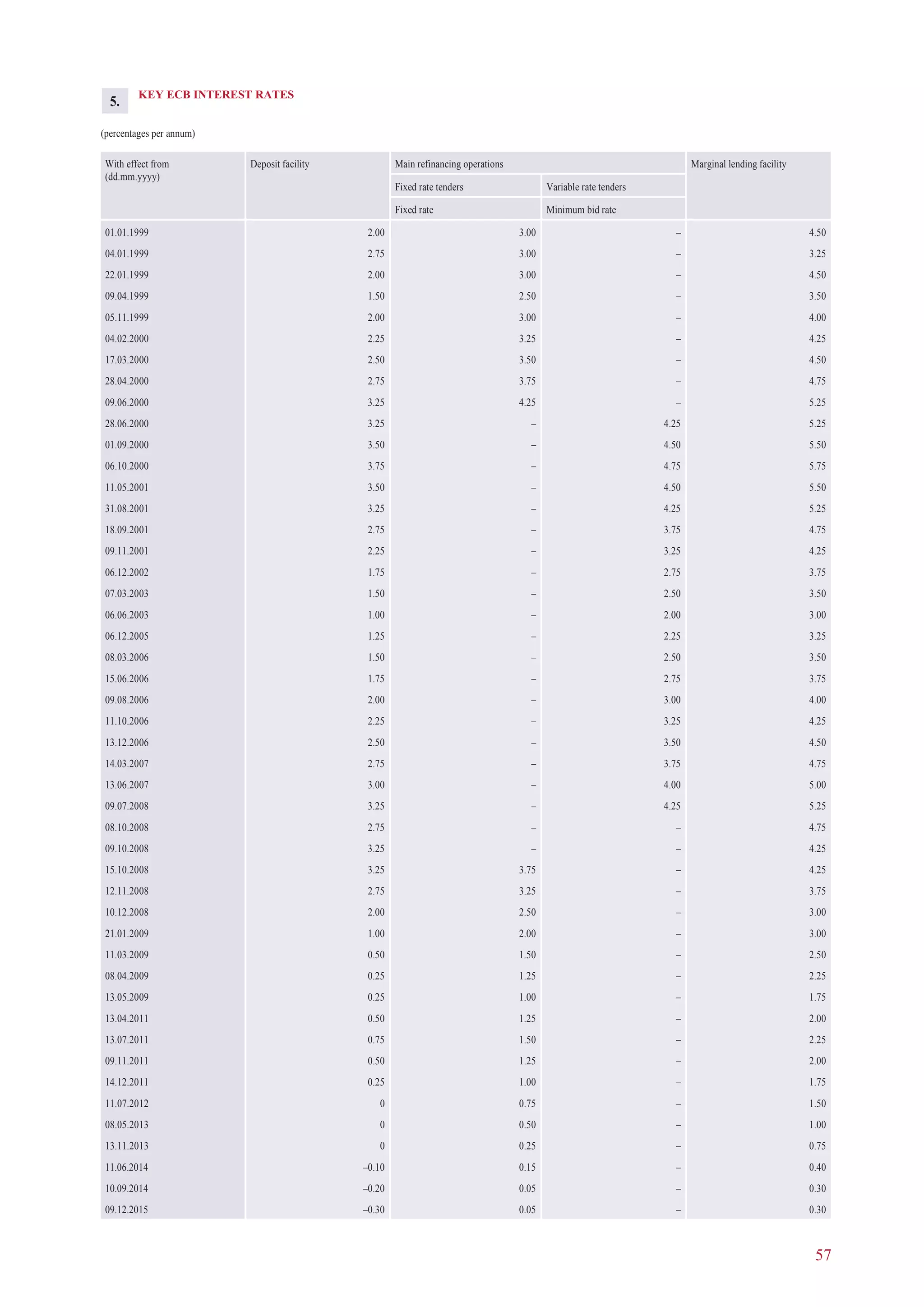

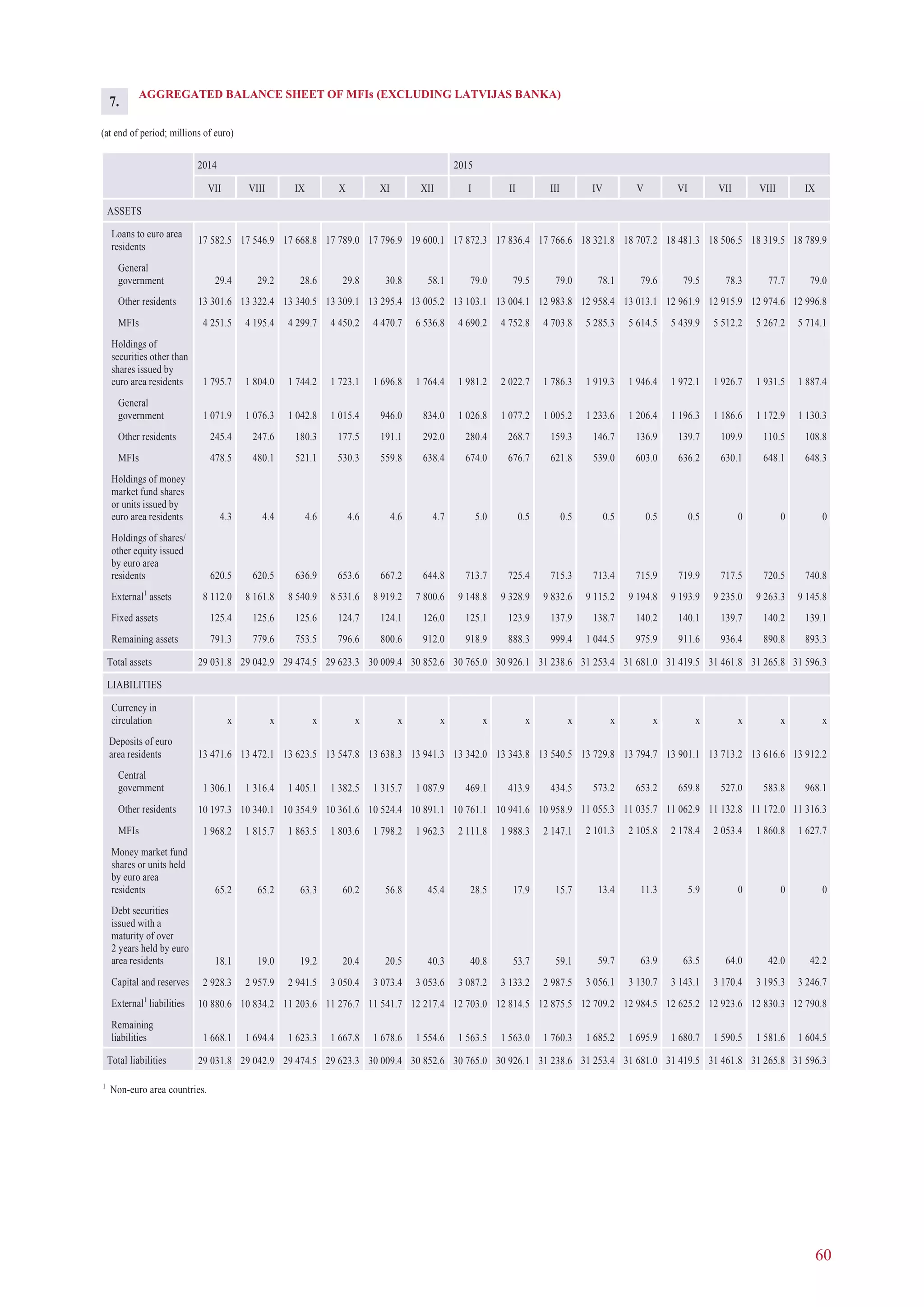

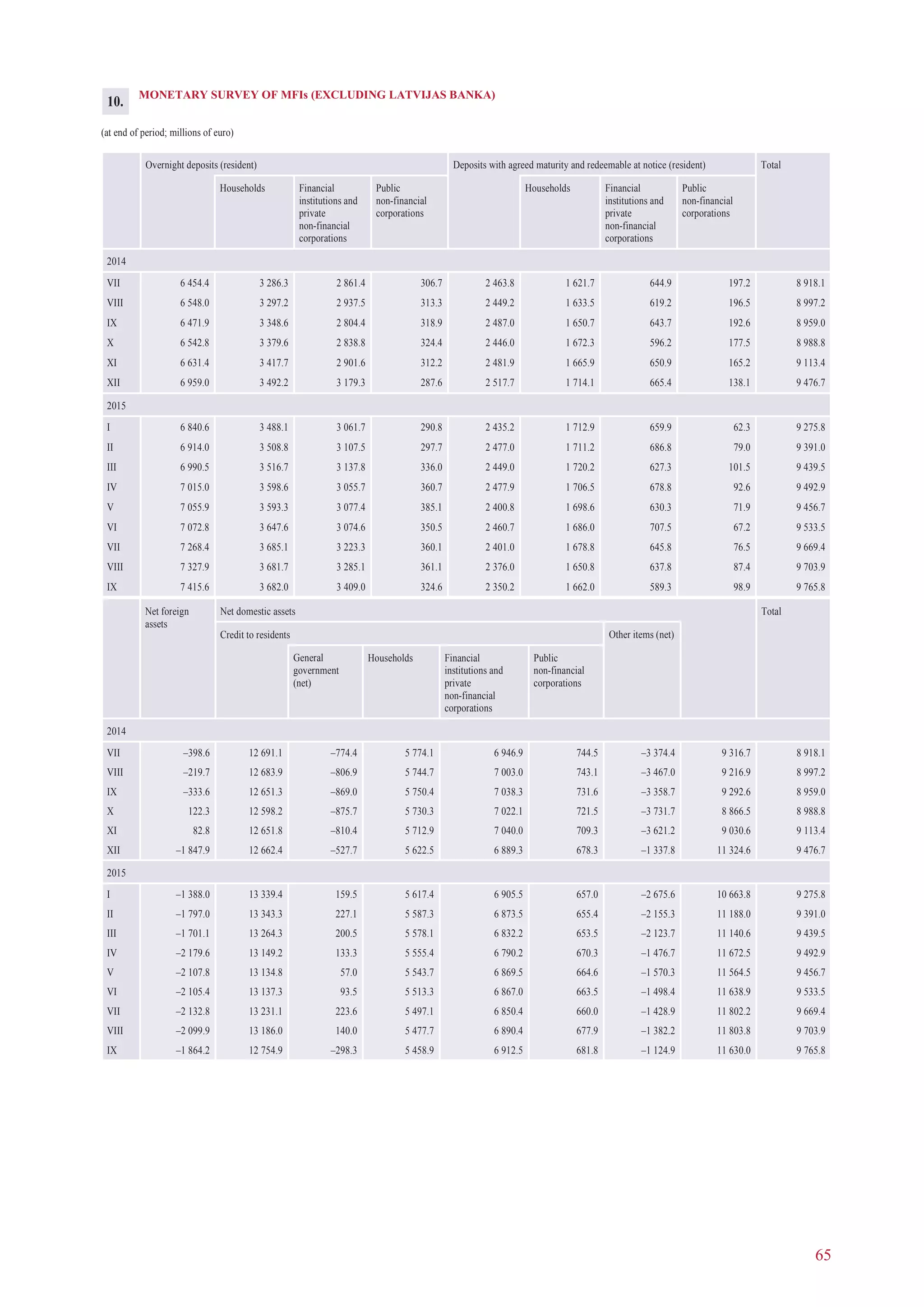

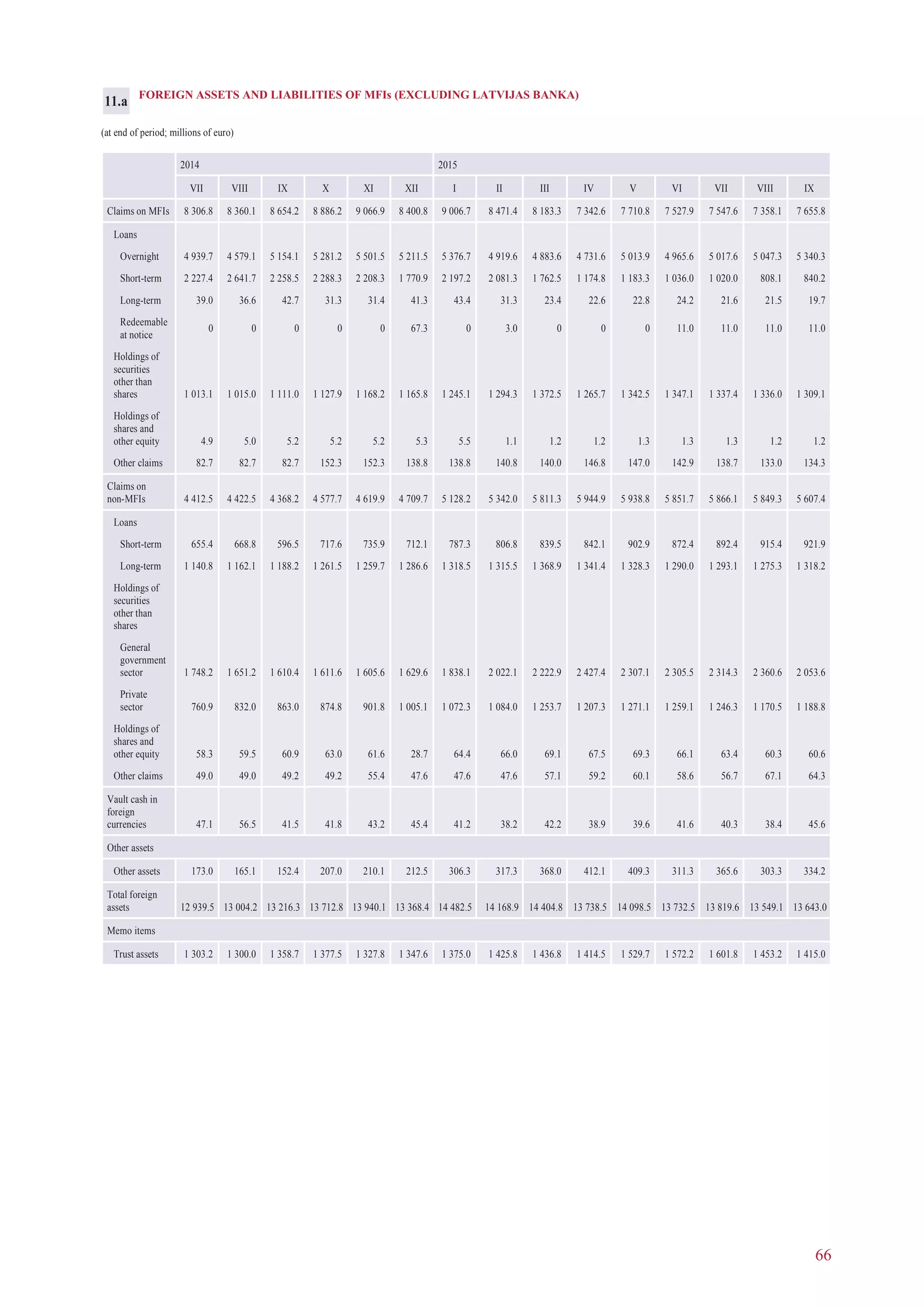

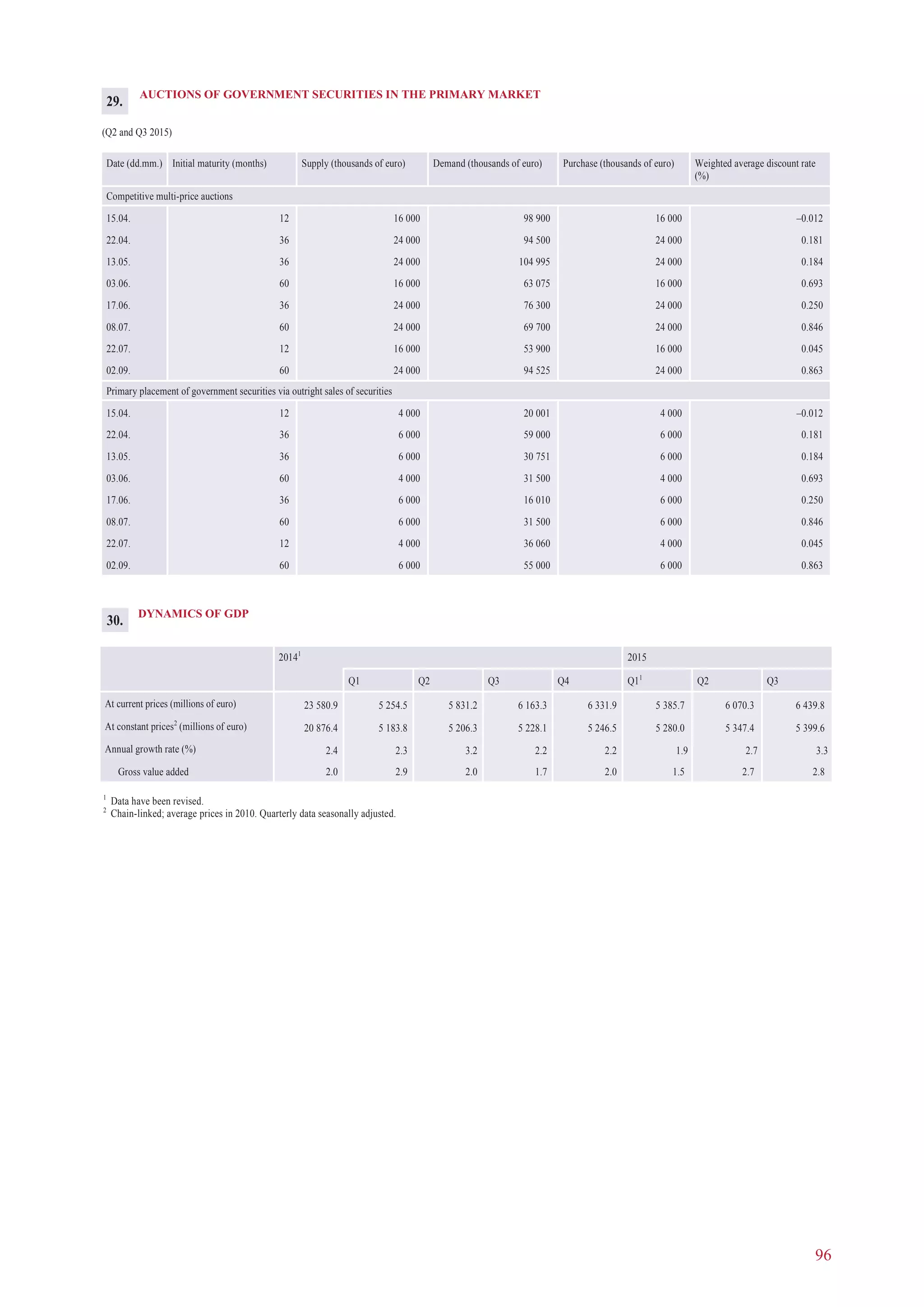

The December 2015 Macroeconomic Developments Report indicates a downward revision in global growth forecasts due to slowing economies in developing nations and underwhelming recovery in developed regions, impacting Latvia's expectations. Despite moderate GDP growth in Latvia driven by private consumption, concerns persist regarding investment activity and potential inflation increases due to domestic and external pressures. The report also highlights monetary policy measures from the ECB aimed at stimulating growth and reducing interest rates amid low inflation expectations.