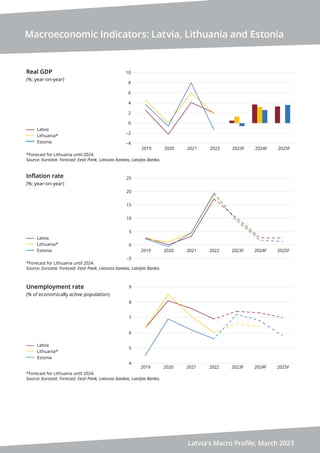

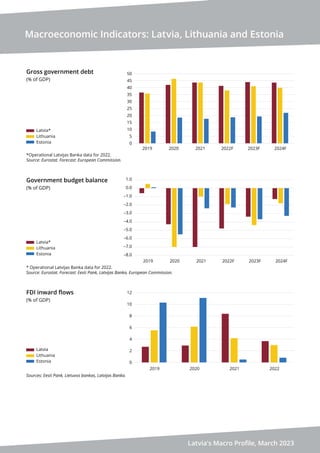

Latvijas Banka has revised Latvia's macroeconomic forecasts for 2023-2025. Inflation is projected to decline to 10% in 2023 and further to 2.7% in 2024 and 2.6% in 2025. GDP growth is forecast to be 0.5% in 2023, then increase to 3.7% in 2024 and 3.3% in 2025. Unemployment is projected to remain stable around 7.3-7.4% through 2025. The general government deficit is expected to decline from 4% of GDP in 2023 to around 2.7-1.5% of GDP in 2024-2025.