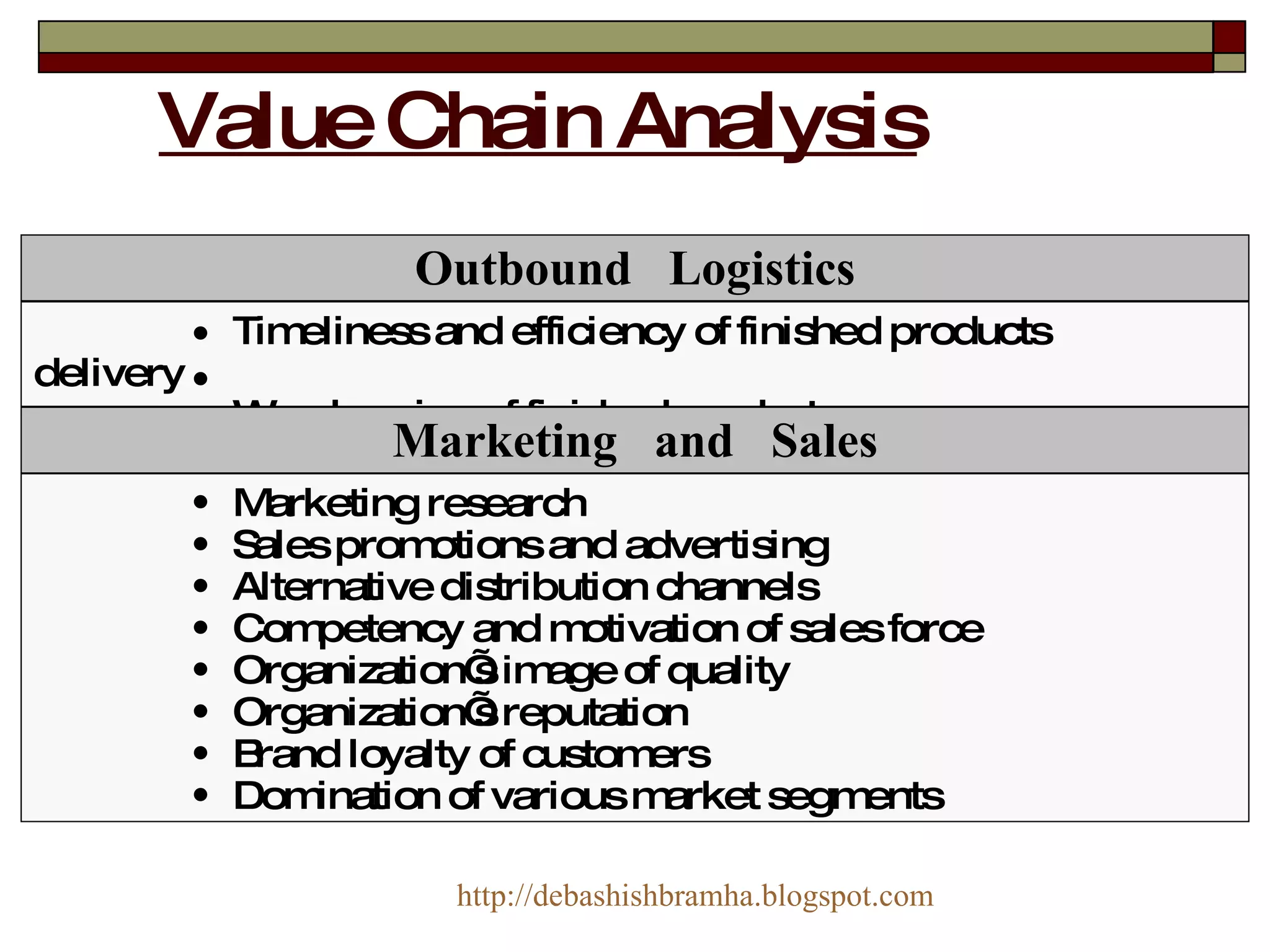

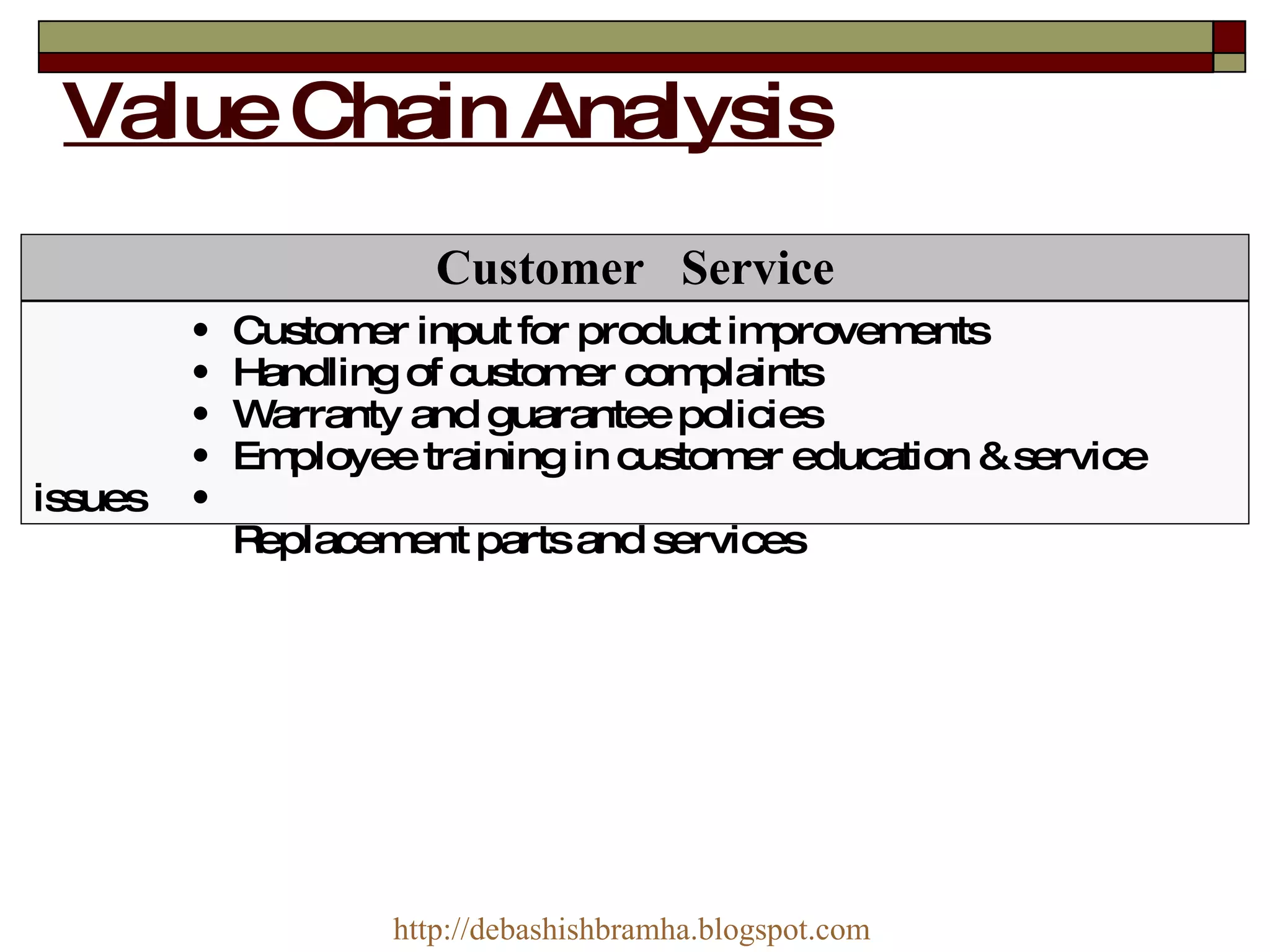

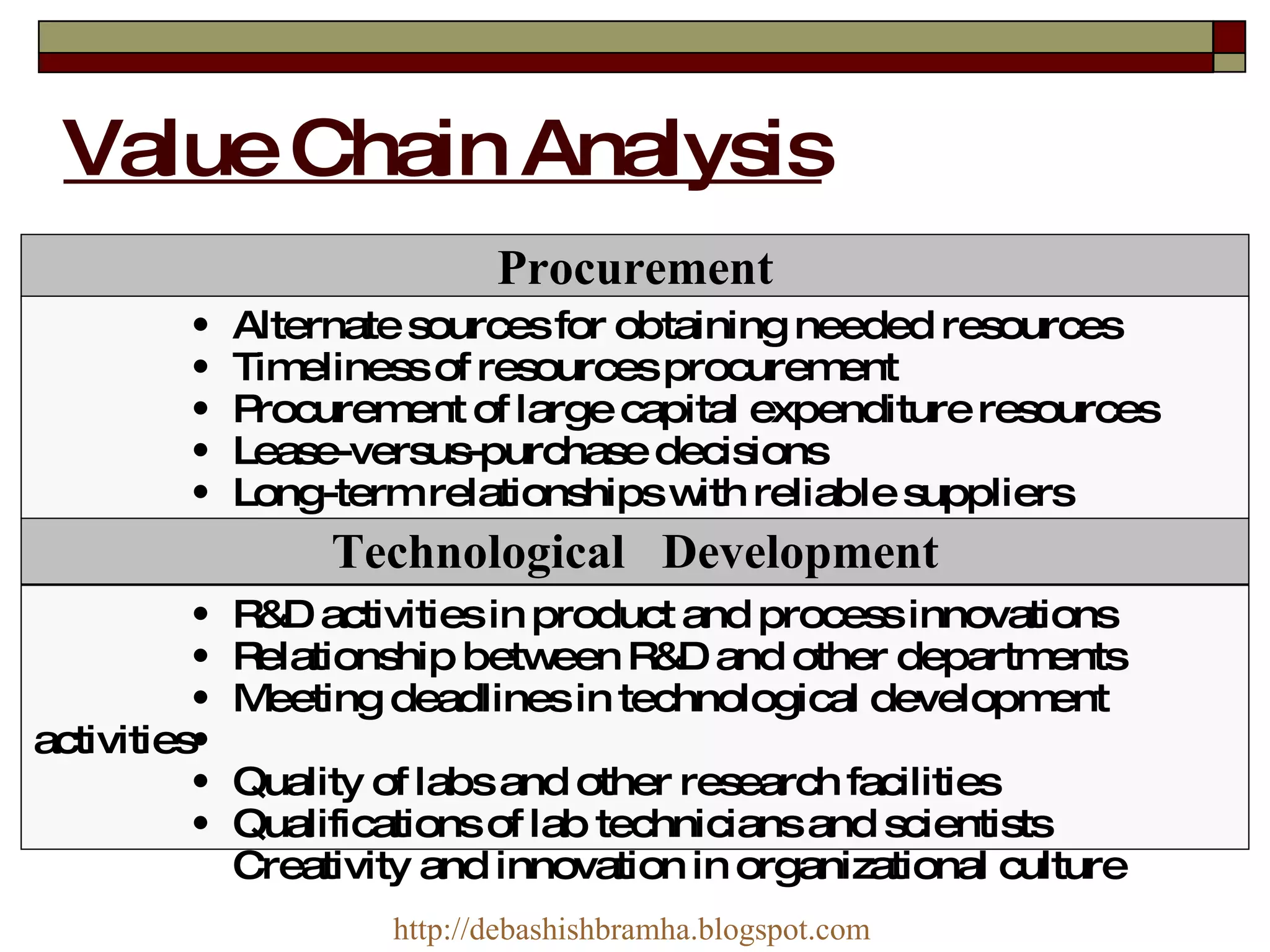

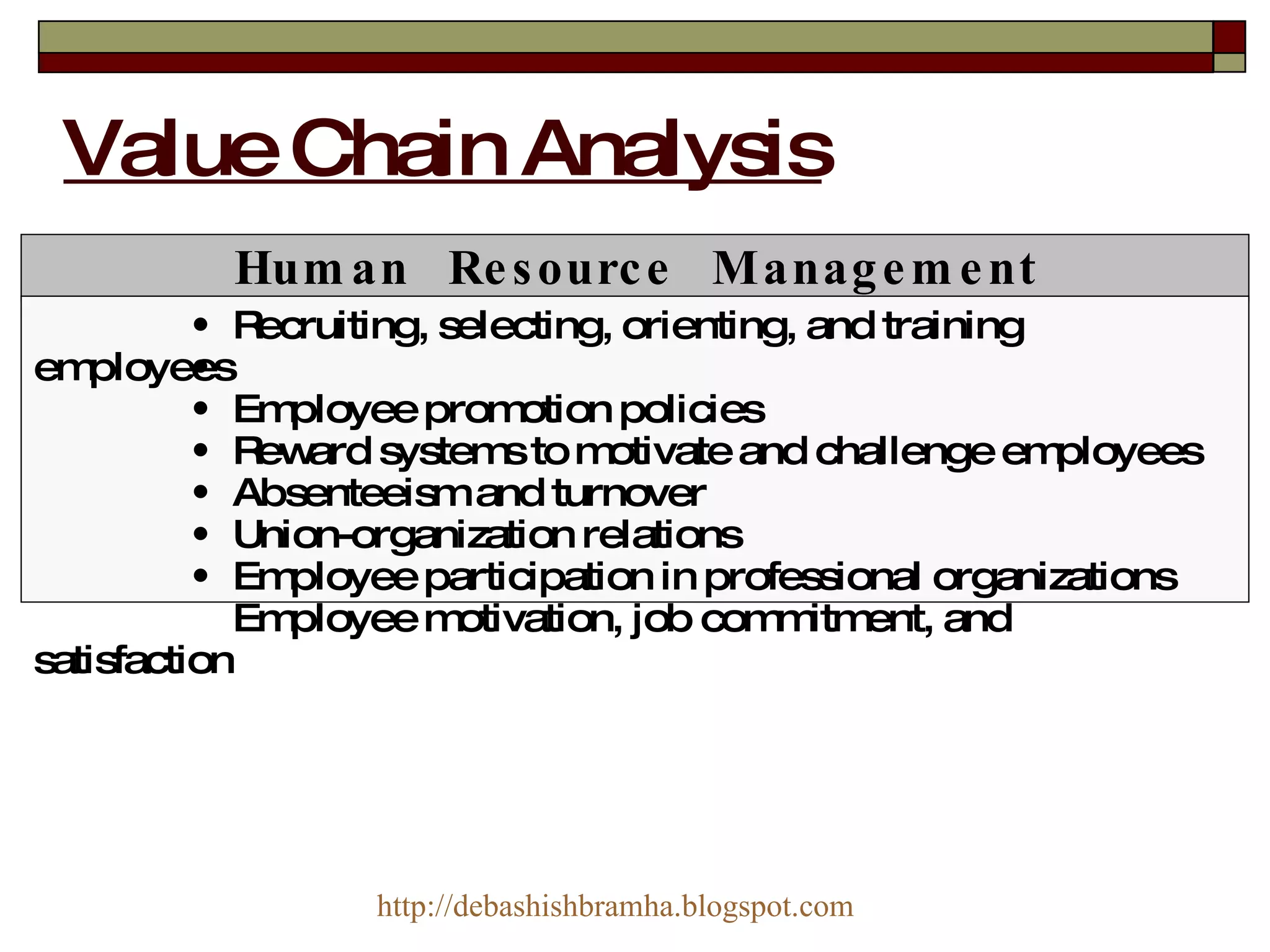

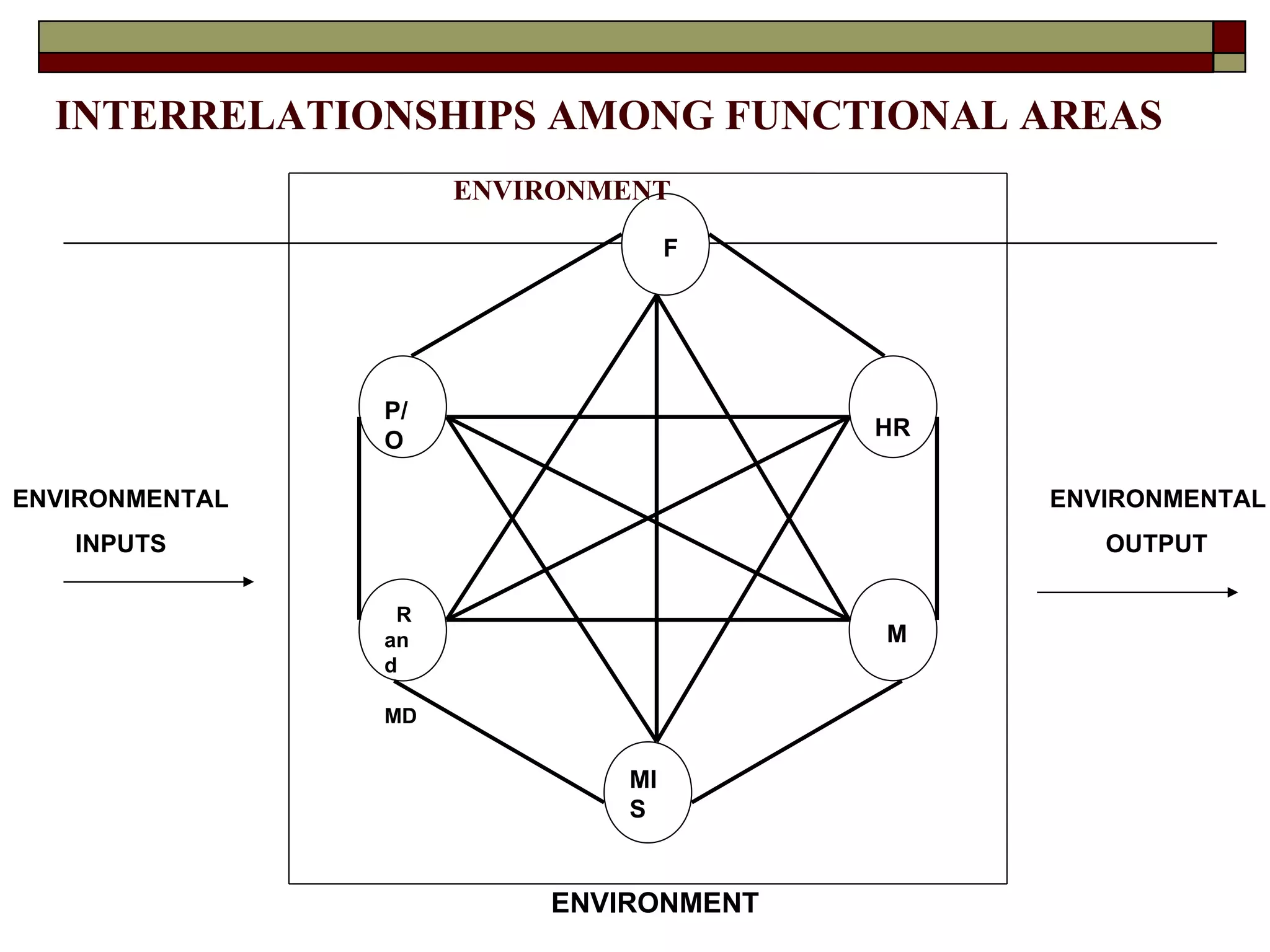

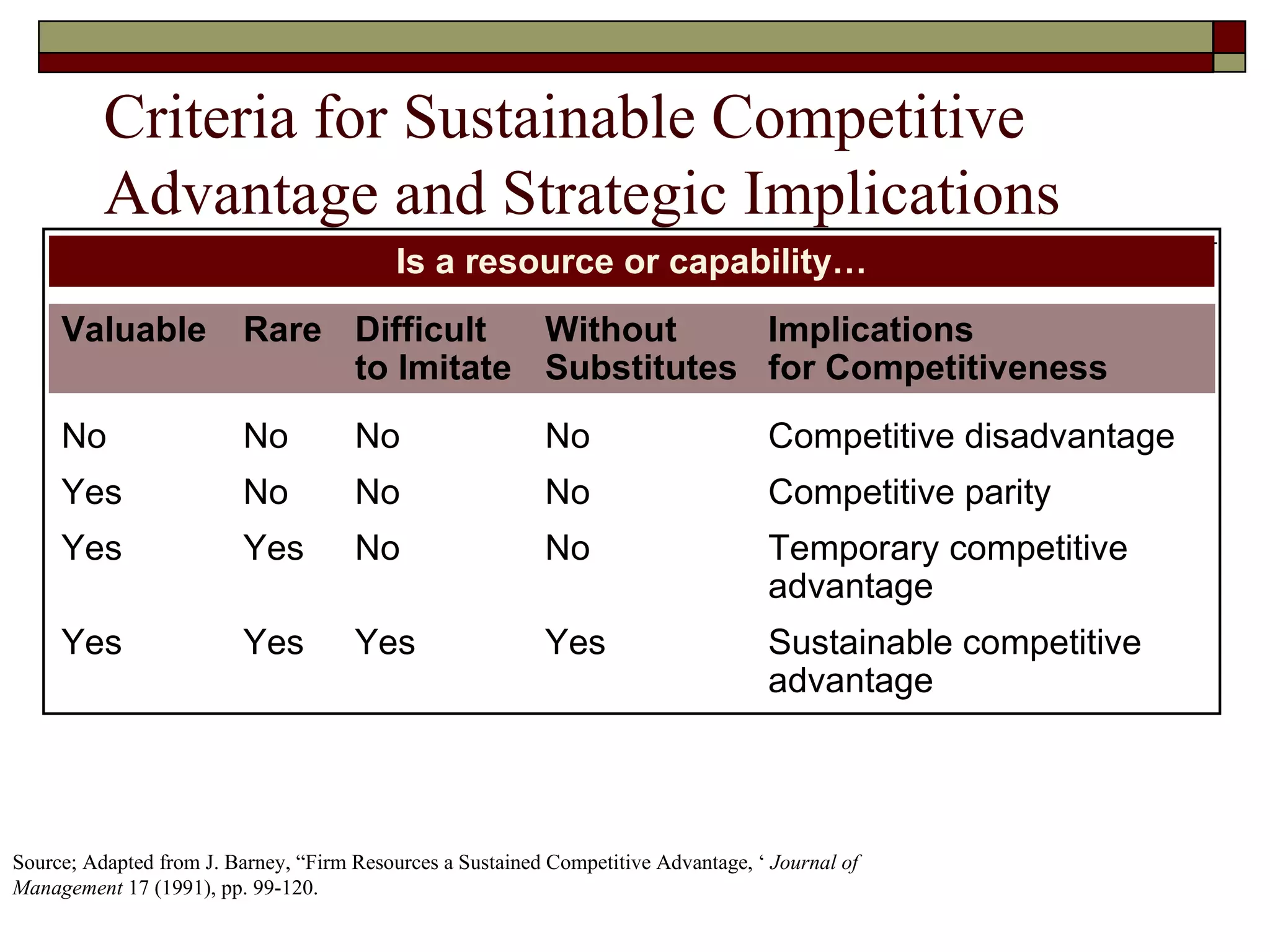

The document discusses business strategy, highlighting the importance of strategic management for achieving competitive advantage and performance targets. It elaborates on the internal analysis process, including components like value chain analysis and resource evaluation, to identify strengths and weaknesses of an organization. Additionally, it reviews financial ratios like liquidity and profitability measures to assess a firm's financial health and effectiveness.