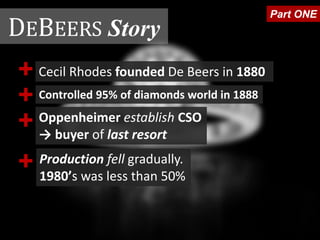

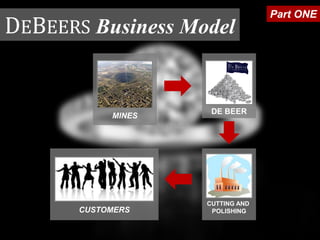

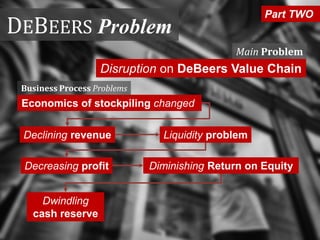

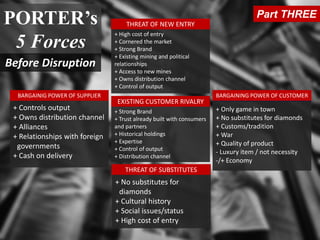

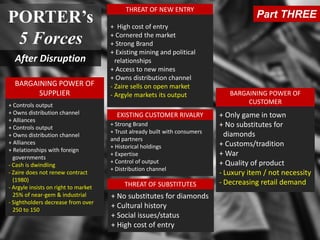

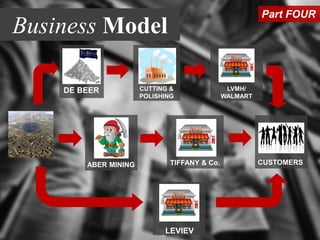

The document analyzes De Beers' history, market position, and strategic challenges in the diamond industry, highlighting its monopoly and the issues posed by new competitors. It emphasizes the importance of adapting to market changes through reverse innovations, such as establishing cost-effective cutting workshops and developing synthetic diamonds. The conclusion recommends a shift in strategy towards improved customer relationships, retail marketing, and corporate social responsibility initiatives.