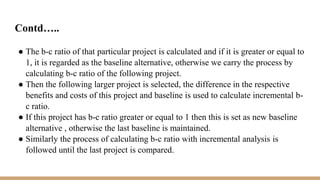

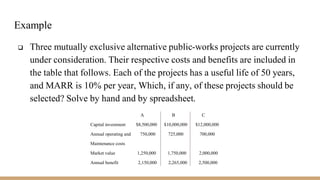

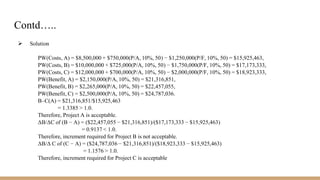

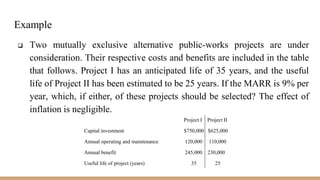

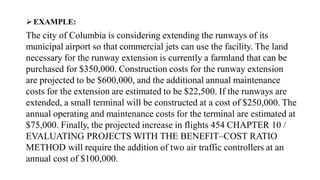

The document discusses the benefit-cost ratio method for evaluating public projects. It provides definitions for different types of public projects like self-liquidating and multiple-purpose projects. It then outlines the difficulties in evaluating public projects and introduces the benefit-cost ratio method. The key steps to calculate the conventional and modified benefit-cost ratio are presented. The document also discusses how to use the benefit-cost ratio method to evaluate mutually exclusive projects and provides an example of incremental benefit-cost analysis for projects with unequal lives.

![Solution

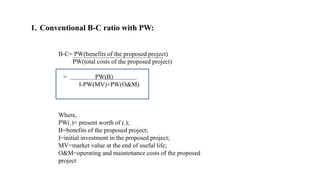

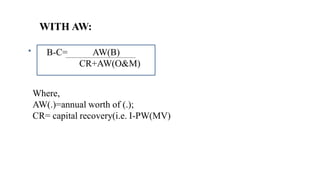

Conventional B–C:

B–C = PW(B)/[I − PW(MV) + PW(O&M

B–C = $490,000 (P/A, 10%, 20)/[$1,200,000 + $197,500

(P/A, 10%, 20)] B–C = 1.448 > 1; extend runways.

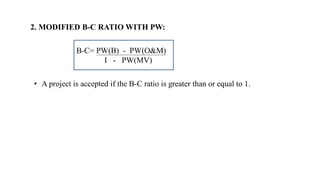

Modified B–C:

B–C = [PW(B) − PW(O&M)]/[I − PW(MV)]

B–C = [$490,000 (P/A, 10%, 20) − $197,500 (P/A, 10%,

20)]/$1,200,000 B–C = 2.075 > 1; extend runways.

.](https://image.slidesharecdn.com/unit-7-221221152930-53d13980/85/Unit-7-pdf-15-320.jpg)

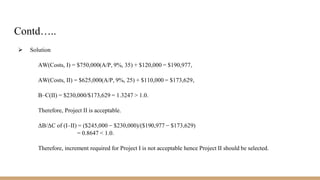

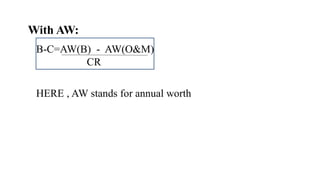

![Conventional B–C:

B–C = AW(B)/[CR + AW(O&M)]

B–C = $490,000/[$1,200,000 (A/P, 10%, 20) + $197,500]

B–C = 1.448 > 1; extend runways.

Modified B–C:

B–C = [AW(B) − AW(O&M)]/CR B–C

= [$490,000 − $197,500]/[$1,200,000 (A/P, 10%, 20)]

B–C = 2.075 > 1; extend runways](https://image.slidesharecdn.com/unit-7-221221152930-53d13980/85/Unit-7-pdf-16-320.jpg)