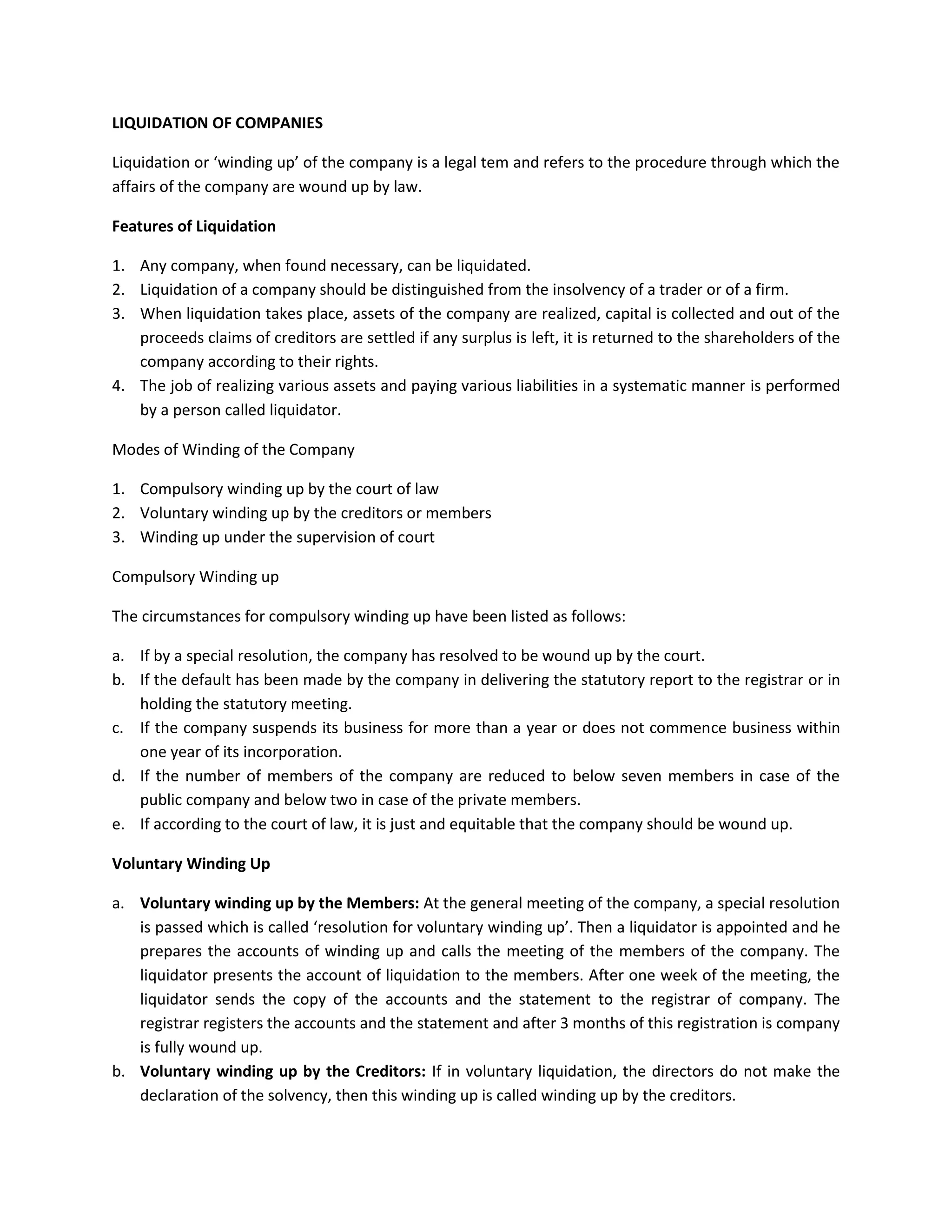

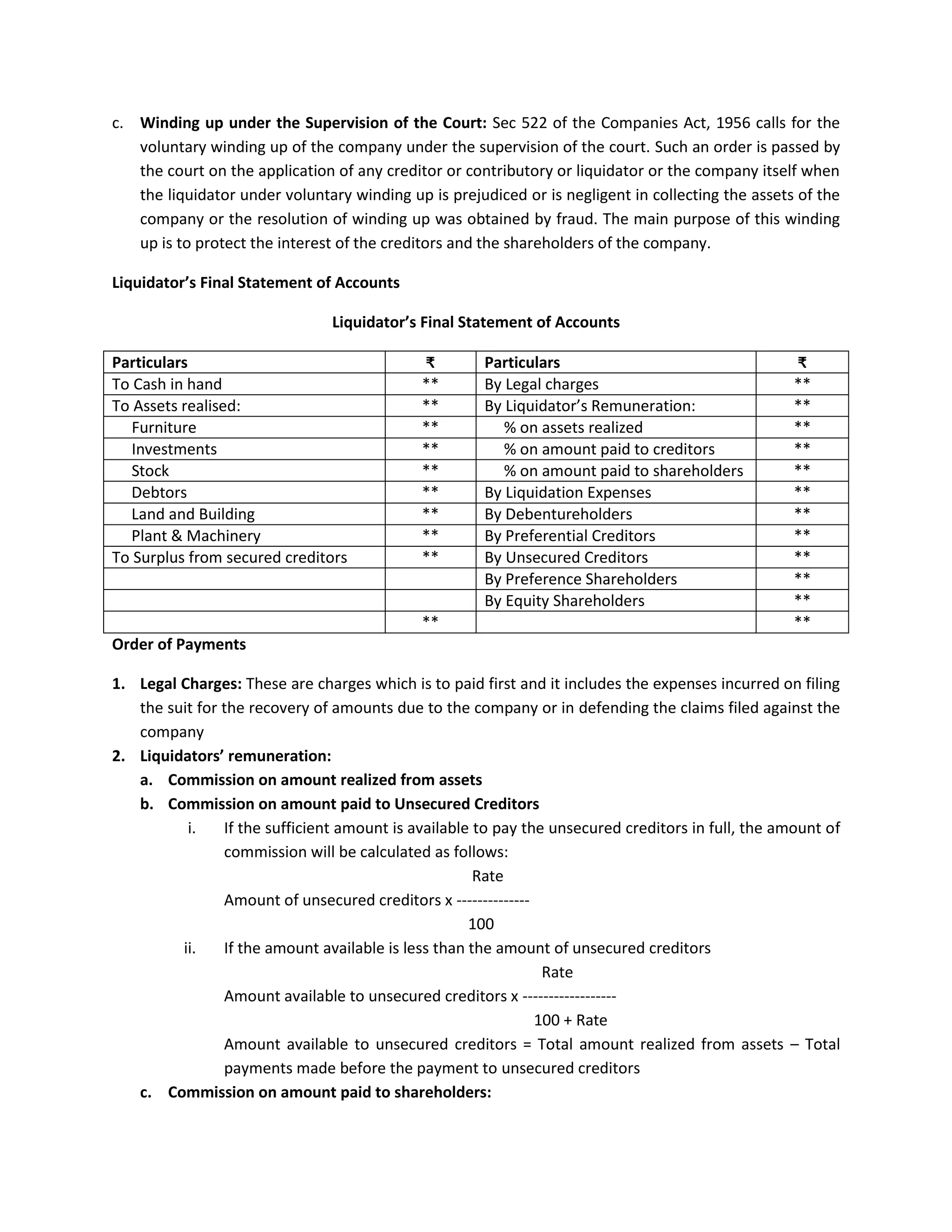

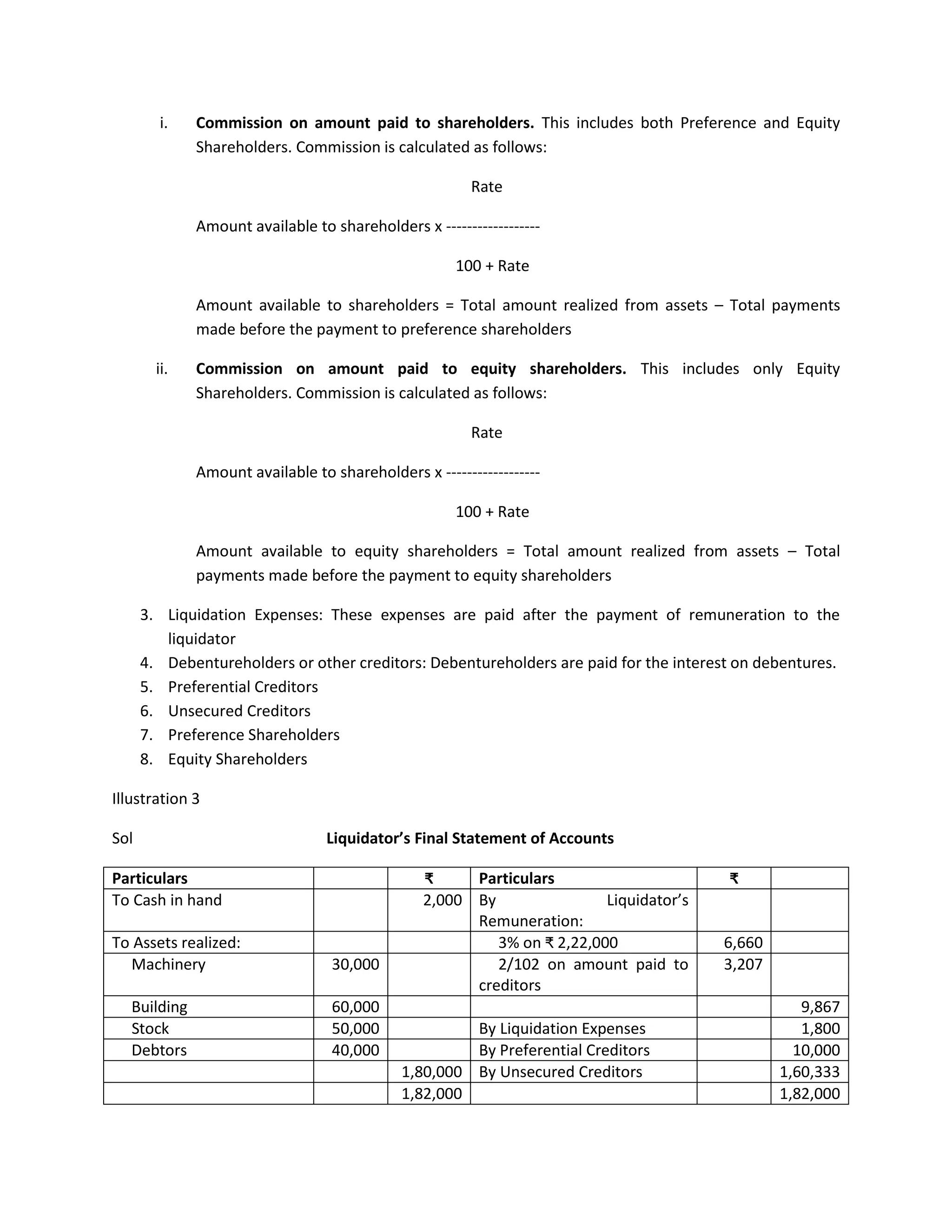

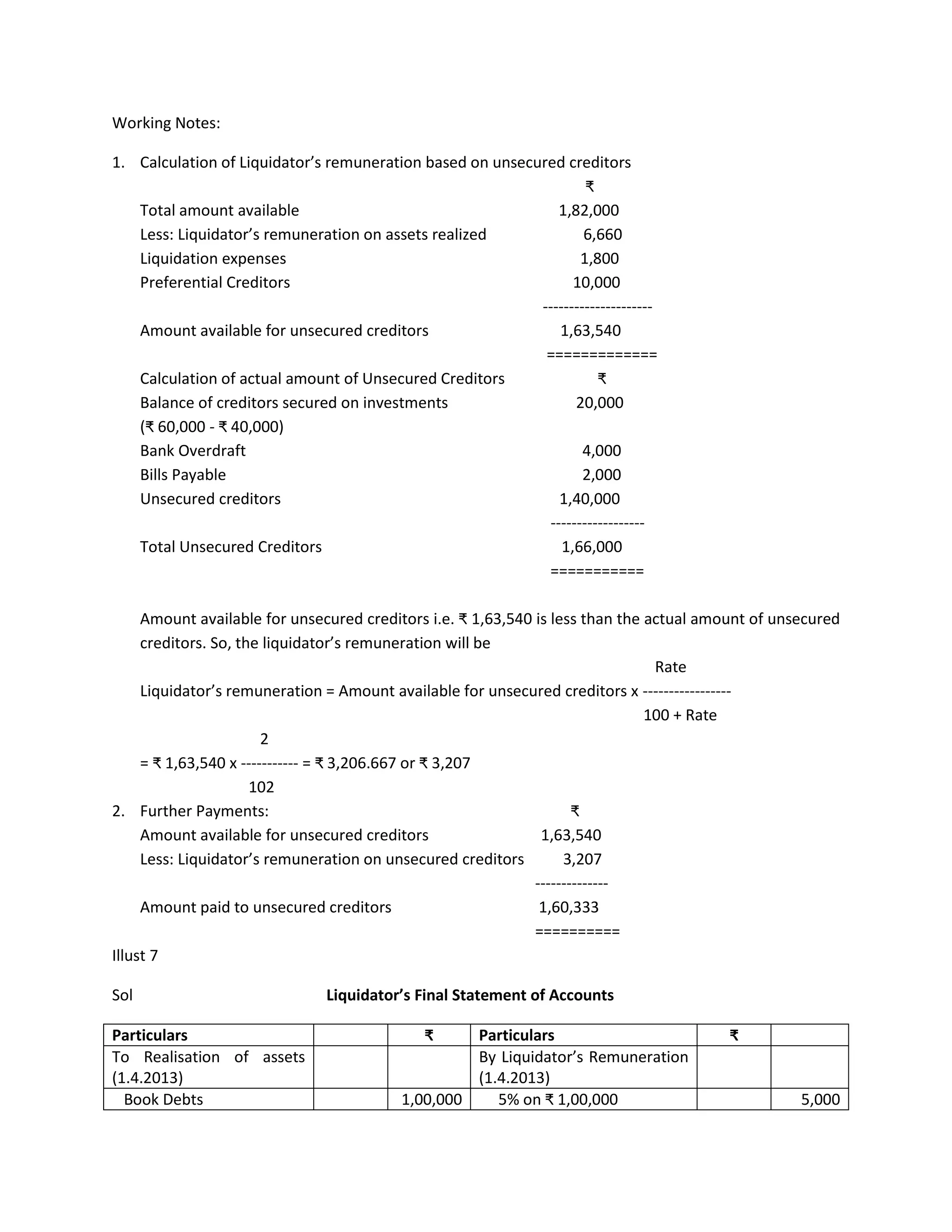

The document discusses the liquidation process for companies. It defines liquidation as the legal procedure for winding up a company's affairs. When a company undergoes liquidation, its assets are realized and proceeds are used to pay off creditors, with any surplus returned to shareholders. A liquidator oversees the process of settling liabilities and distributing assets in an orderly manner. Liquidation can be compulsory, initiated by the court, or voluntary, initiated by creditors or members. The document provides details on the types of liquidation and the order of payments made through the process.