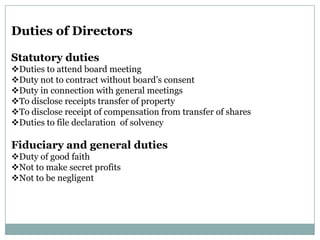

The document discusses the roles and responsibilities of company directors under Indian law. It defines a director and outlines their legal position as agents of the company. There are different types of directors such as executive, outside, and independent directors. All directors must obtain a Director Identification Number. Directors can be appointed through various means and removed by shareholders, government, or courts. Their duties include attending meetings, not contracting without board consent, disclosing property transfers, and acting with good faith and without negligence.