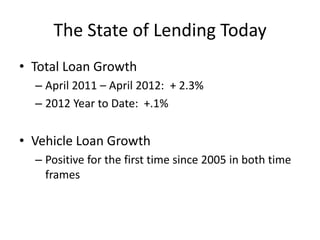

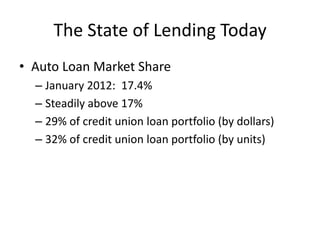

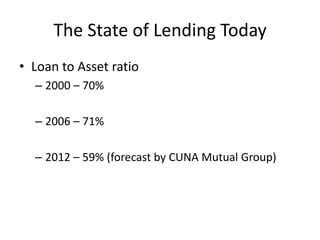

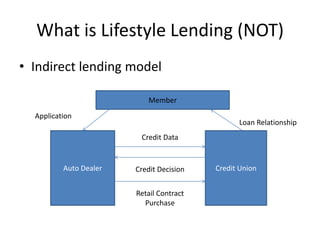

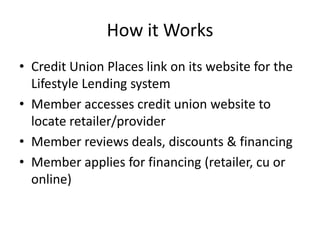

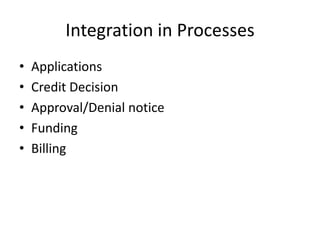

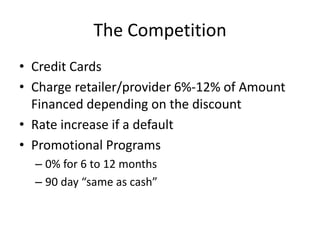

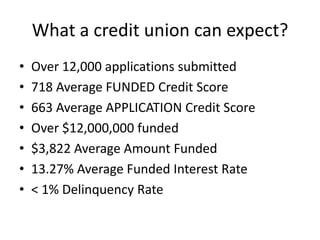

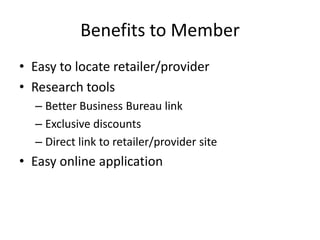

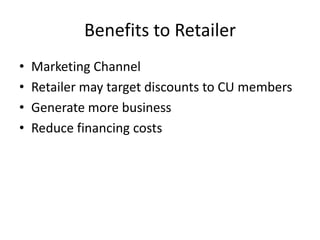

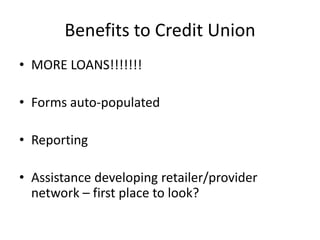

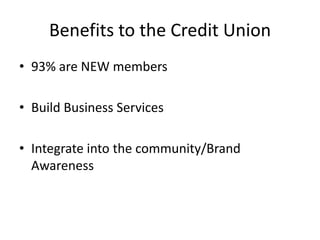

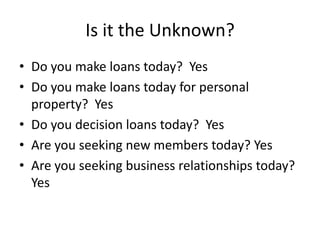

This document discusses lifestyle lending, which is a direct lending model where credit unions provide financing for various lifestyle purchases like medical procedures, home improvements, and retail goods. It outlines the benefits of lifestyle lending for credit unions, including generating new loans and members. Lifestyle lending can integrate easily into credit unions' existing lending processes and offers members convenient financing options. It also benefits retailers by providing a new marketing channel and reducing their financing costs. Overall, lifestyle lending allows credit unions to expand their loan portfolios and build new business relationships in their communities.