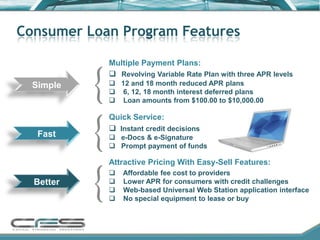

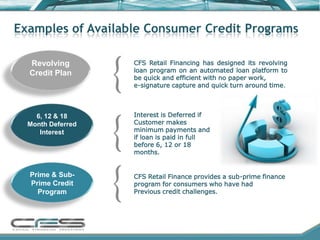

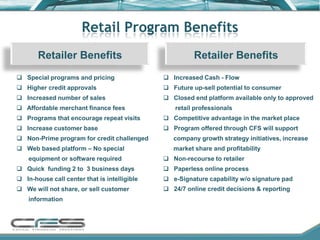

Capital Financial Solutions provides revolving credit and consumer loan programs to retailers through a web-based platform in order to increase sales and cash flow for retailers while offering affordable financing options for credit-challenged consumers, including revolving credit plans, deferred interest plans, and sub-prime programs. Capital Financial Solutions works with retailers to customize programs and provides marketing materials, quick funding, and a paperless online application process at affordable merchant fees.