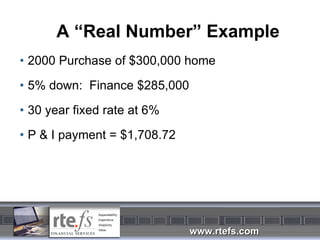

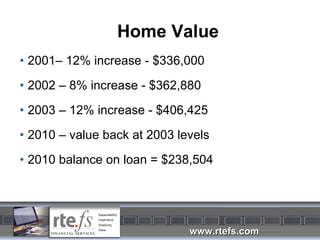

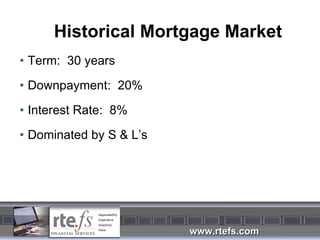

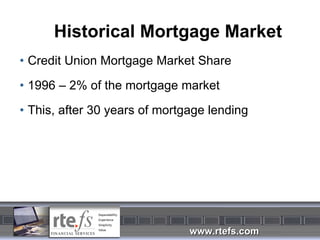

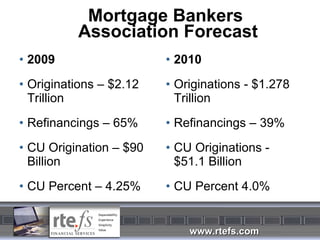

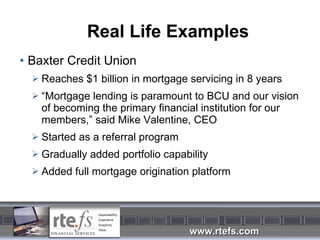

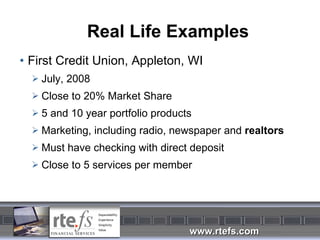

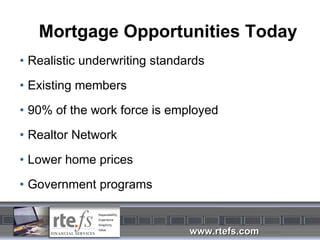

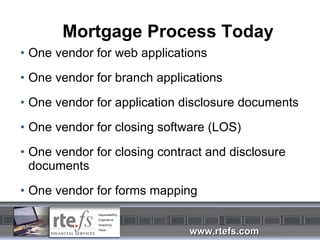

The document discusses the current state of the mortgage lending market, highlighting a significant increase in refinancing and mortgage originations among credit unions despite economic challenges. Key statistics and real-life examples illustrate how various credit unions have successfully leveraged technology and marketing to increase their mortgage services, resulting in substantial savings for members. The content emphasizes the need for strategic responses to market changes, including targeting younger members and adapting mortgage products.

![Thank You Questions and Answers? Gary Hess, President RTE Financial Services, LLC 320-281-9765 [email_address]](https://image.slidesharecdn.com/mortlendcuconf3-11-110317203730-phpapp02/85/Mortgage-Lending-43-320.jpg)