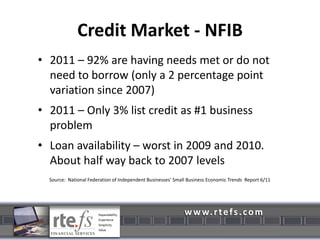

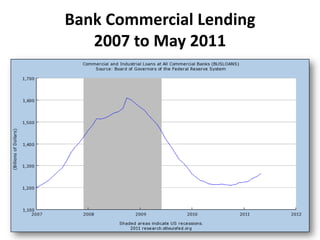

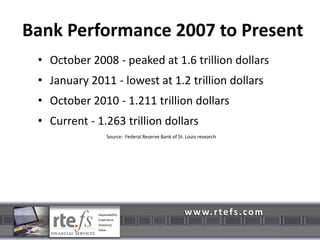

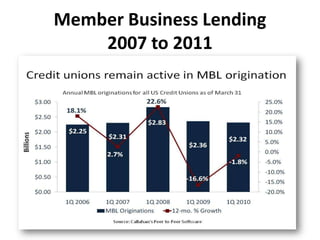

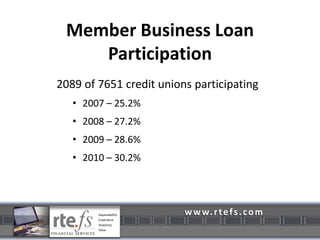

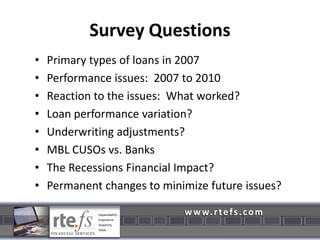

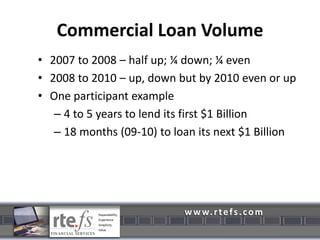

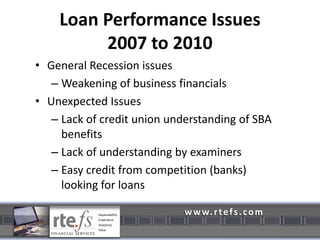

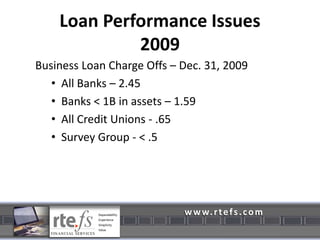

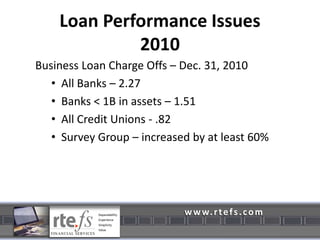

This document summarizes the findings of a survey of MBL (member business lending) CUSOs on their experiences from 2007 to 2011 during the economic recession. The survey found that MBL CUSOs generally performed better than banks during this period, with lower business loan charge-offs. While some CUSOs saw issues like weakening business finances and unexpected lack of understanding from regulators, most addressed these issues by increasing portfolio management, adjusting underwriting standards, and diversifying their loan portfolios. Overall, the survey concluded that MBL CUSOs were well-positioned to weather the recession and continue providing value to credit union owners and members.