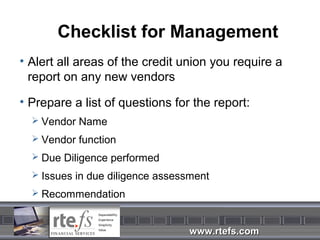

This document discusses vendor due diligence requirements for credit unions. It covers the NCUA's expectations for supervisory committees and directors to establish practices to safeguard member assets when working with vendors. The document outlines key areas of due diligence including assessing risks and benefits, financial reviews, background checks, contracts, and ongoing monitoring. It identifies the top five vendor categories of IT, indirect lending, mortgages, cloud computing, and loan participations. Guidance documents are referenced and checklists are provided to help management evaluate current vendors and processes.