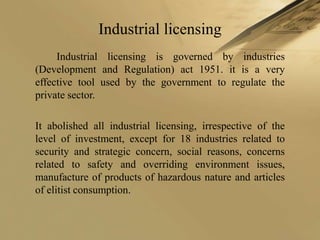

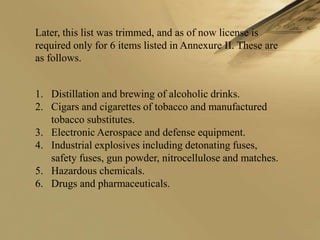

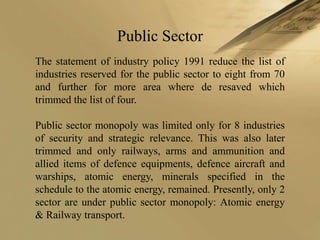

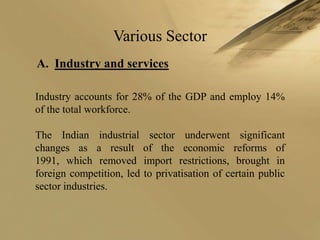

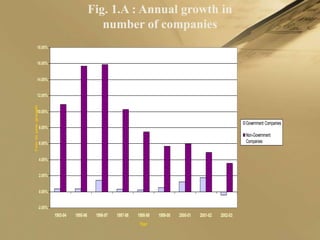

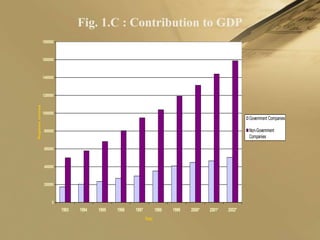

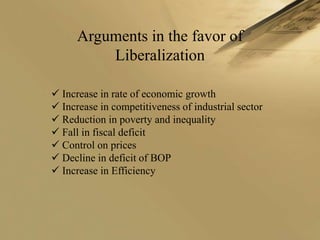

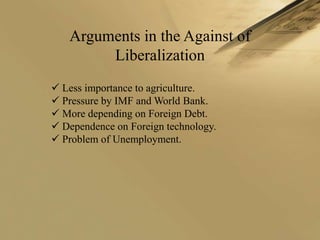

The document discusses India's economic liberalization that began in 1991. It overviews the key reforms like abolishing industrial licensing, liberalizing the MRTP Act, allowing private sector entry into industries previously reserved for public sector, allowing more foreign direct investment and trade. The reforms aimed to transform India from a socialist to a market-based economy and achieve higher growth. Major sectors like industry, services, agriculture and banking saw significant changes and growth due to the liberalization.