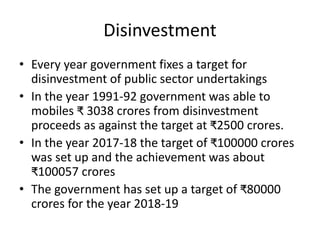

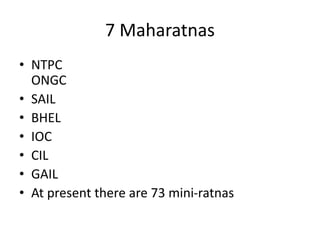

The document summarizes India's economic reforms since 1991 known as the New Economic Policy (NEP). It describes the economic crisis prior to 1991 that necessitated reforms, including high fiscal and trade deficits. The NEP introduced liberalization, privatization, and globalization. Key reforms included reducing licensing, opening sectors to FDI, trade liberalization, and greater private sector participation. The goals were to stabilize and grow the economy. Impacts have included increased GDP growth across all sectors, higher FDI inflows, and larger foreign exchange reserves.