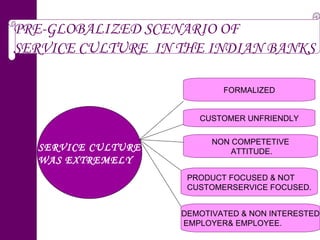

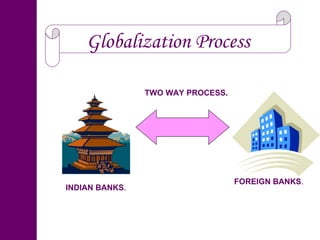

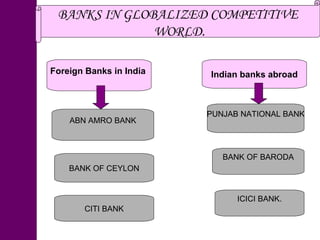

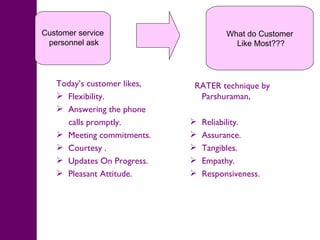

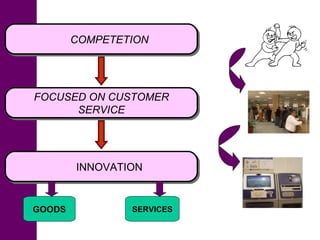

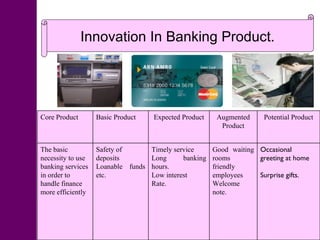

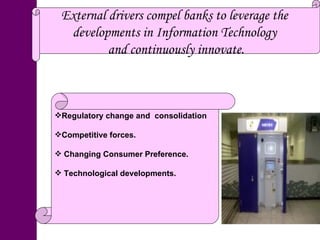

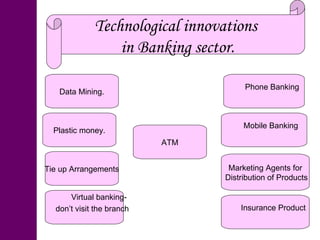

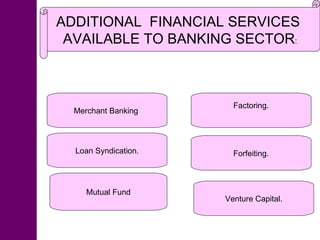

Globalization has significantly impacted the banking sector in India. Prior to liberalization in 1991, Indian banks lacked competitiveness and customer focus. The opening of the Indian economy introduced foreign and private banks that emphasized customer service, technology innovations, and new banking products. While increased competition has benefited customers, globalization has also introduced risks like increased cybercrime and volatility from global financial markets that impact the entire banking sector. Overall, globalization has transformed retail banking in India and increased competitiveness, technology usage, and customer satisfaction across both private and public sector banks.