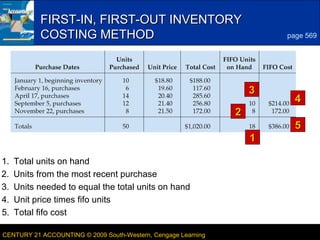

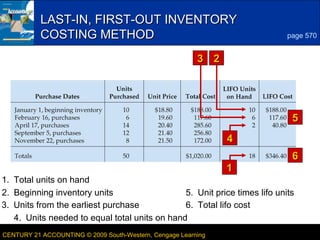

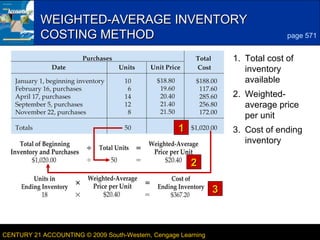

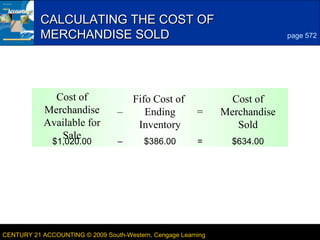

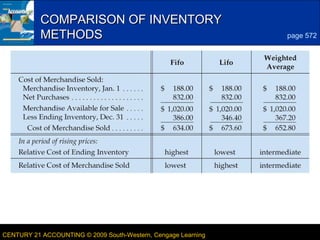

The document discusses different inventory costing methods including first-in, first-out (FIFO), last-in, first-out (LIFO), and weighted average. It provides examples of how to calculate the cost of inventory and cost of goods sold using each method. Specifically, it shows how to determine the cost of ending inventory and cost of goods sold given total units on hand and unit purchase prices over different periods. The document also defines key terms related to inventory costing methods.