Embed presentation

Download to read offline

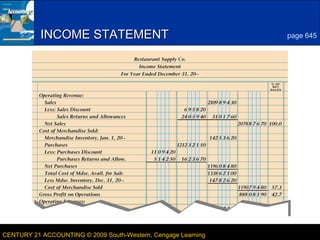

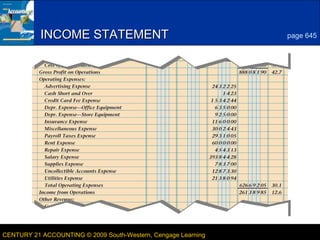

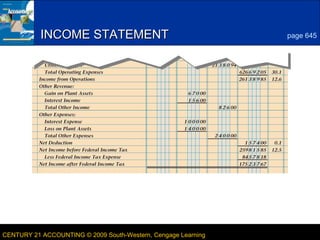

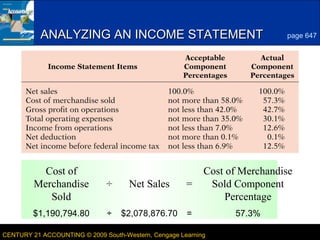

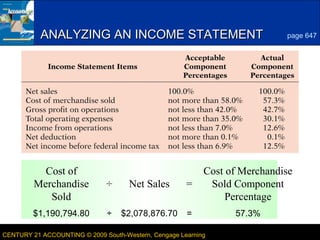

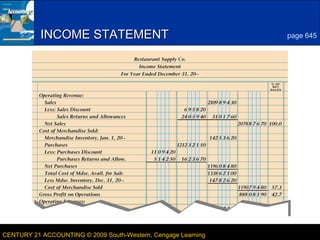

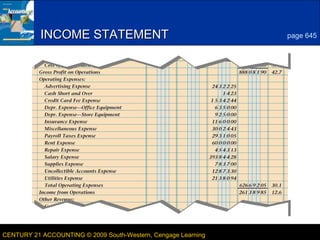

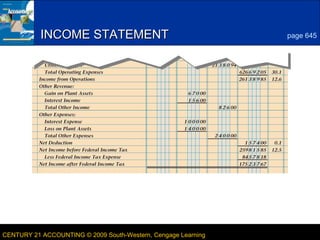

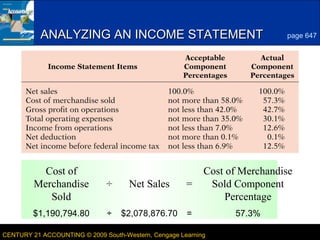

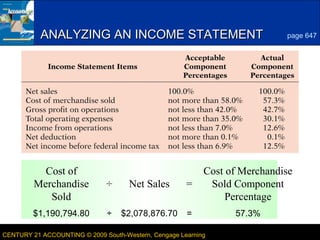

The document discusses how to prepare an income statement and analyze its components. It provides an example of calculating the cost of merchandise sold percentage by dividing the cost of merchandise sold by net sales. Preparing and analyzing income statements is important for understanding a company's profitability.