Embed presentation

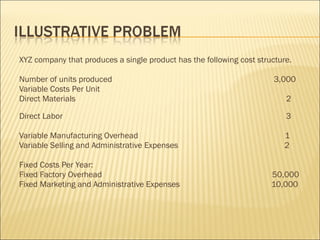

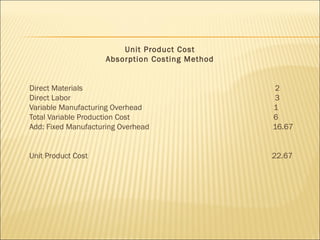

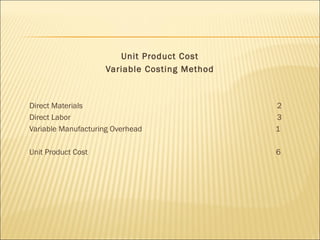

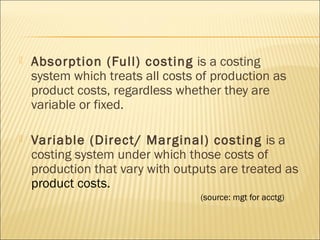

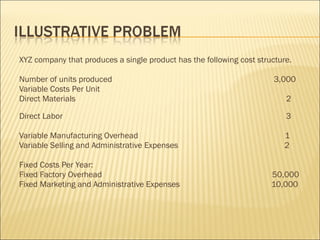

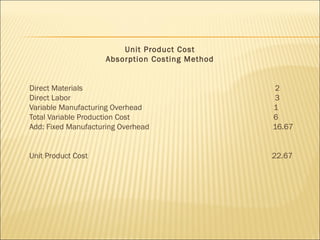

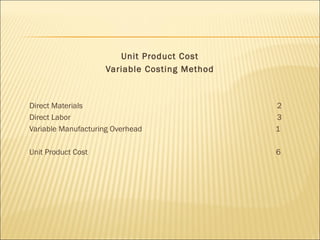

This document discusses different costing methods and provides an example to calculate unit product costs using absorption and variable costing. Absorption costing treats all costs as product costs, while variable costing only treats variable costs as product costs. For a company producing 3,000 units with given variable and fixed costs, the unit product cost under absorption costing is $22.67 and under variable costing is $6.