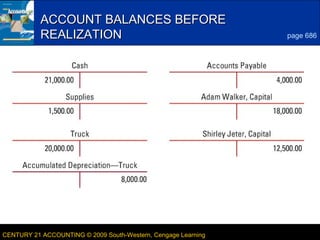

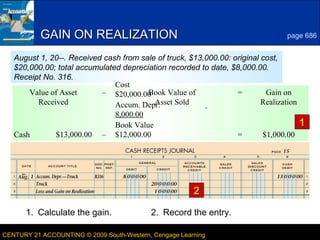

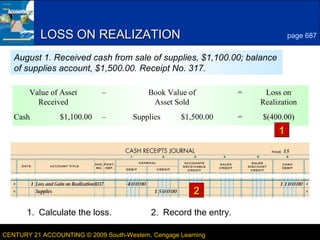

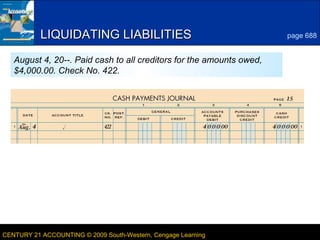

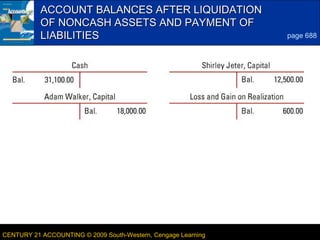

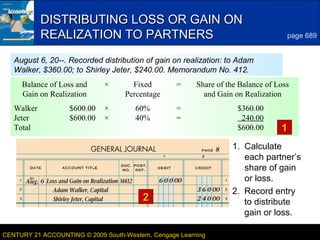

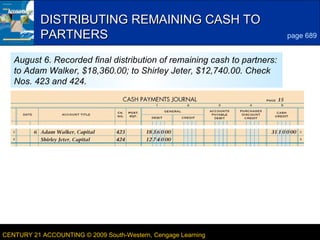

This document discusses the process of dissolving a partnership. It explains how to calculate and record gains or losses on the realization of assets when they are sold. It also covers liquidating partnership liabilities by paying off creditors and distributing any remaining cash balances to partners based on their fixed ownership percentages. Key terms reviewed include liquidation of a partnership, realization, and limited liability partnership.