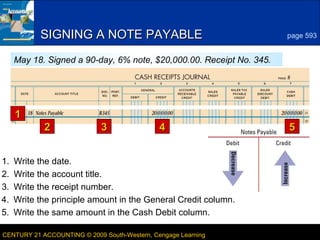

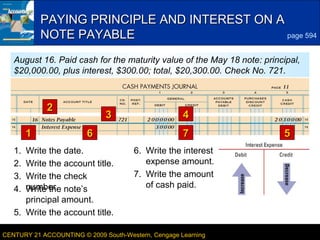

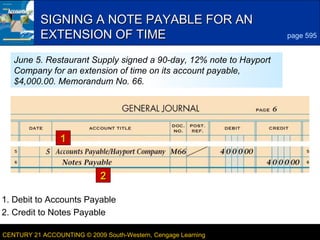

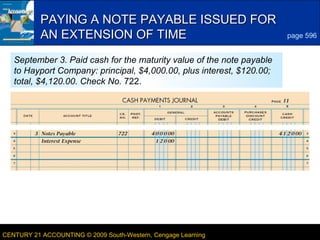

The document provides examples of accounting entries for notes payable. It describes signing a 90-day, 6% note for $20,000 and the journal entries to record it. It then discusses paying the principal and interest of $20,300 for the note at maturity. Another example shows signing a 90-day, 12% note for $4,000 to extend an accounts payable and the entries to record it. Finally, it discusses paying $4,120 for the principal and interest of that note at maturity.