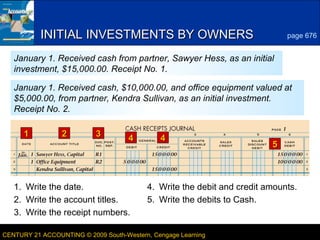

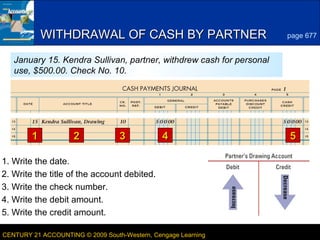

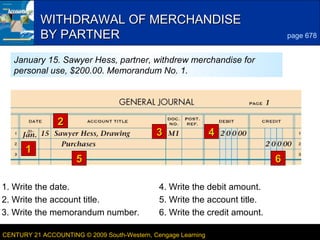

The document provides examples of accounting entries for initial investments, withdrawals of cash, and withdrawals of merchandise from a partnership. It gives the steps to record an initial investment of cash and office equipment from one partner, and cash from another partner. It also shows how to record a partner's withdrawal of cash for personal use with a check, and the withdrawal of merchandise for personal use with a memorandum. Finally, it defines some key terms related to partnerships.