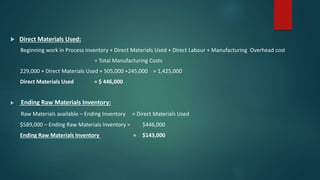

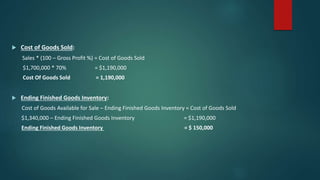

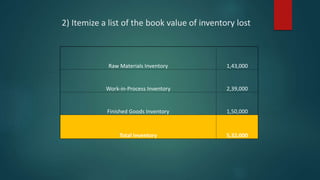

PowerSwitch, Inc. designs and manufactures switches for telecommunications. Its facilities in North Carolina were flooded, destroying inventory and accounting records. The document provides financial information for PowerSwitch and calculates ending inventory balances after the flood by working through the accounting equations. It determines that the total book value of inventory lost was $532,000, consisting of $143,000 in raw materials, $239,000 in work-in-process inventory, and $150,000 in finished goods.