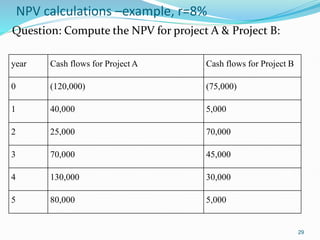

Okay, here are the NPV calculations for Projects A and B with a discount rate of 8%:

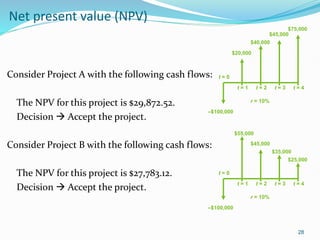

Project A:

CF0 = -120,000

CF1 = 40,000 / (1.08) = 37,037

CF2 = 25,000 / (1.08)2 = 22,222

CF3 = 70,000 / (1.08)3 = 58,333

CF4 = 130,000 / (1.08)4 = 108,333

CF5 = 80,000 / (1.08)5 = 66,667

NPV = -120,000 + 37,037 + 22,222 + 58,333 + 108,333 + 66

![NPV-cont’d

where regular cash flows are expected [these are

termed as annuities], the above expression can be

reduced to:

Take-home Exercise: Compute the NPV for the

following three project alternatives at 3%, 5% & 8%

discount rates.

31

Projects X Y Z

Costs ($)-Initial investment 10,380 10,380 10,380

Project life span (years) 5 15 25

Annual Benefits ($) 2,397 1,000 736](https://image.slidesharecdn.com/fmch6capitalbudgeting-231117182846-2fa18c4a/85/FM-Ch6-Capital-Budgeting-pptx-31-320.jpg)

![Disadvantages of NPV

• If the investments are different, deciding the desirability of the project

based on the NPV will be misleading.

We have learnt that NPV tells us ‘how much birr is the net result of the project’ but

it does not tell us if this amount is the outcome of a big effort or a small one.

Example:

For Project A:

NPV= 10; {B-C=110-100=10]

Big differences in investment amount

For Project B:

NPV=15; [10,015-10,000=15]

• The cost of capital is assumed to remain constant throughout the life of

the project.

35](https://image.slidesharecdn.com/fmch6capitalbudgeting-231117182846-2fa18c4a/85/FM-Ch6-Capital-Budgeting-pptx-35-320.jpg)