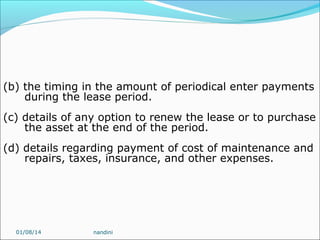

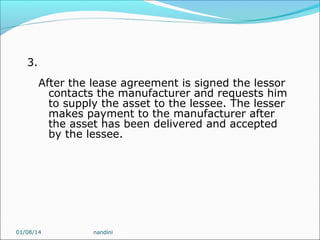

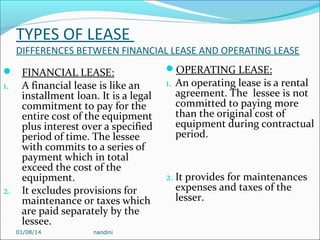

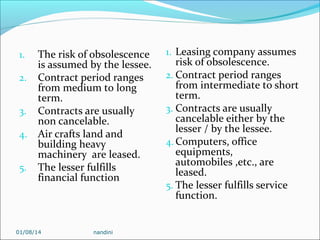

This document provides an overview of various asset and fund-based financial services. It discusses topics like lease finance, consumer credit, factoring, bills discounting, and housing finance. For lease finance, it defines different types of leases and outlines the steps involved in a leasing transaction. It also covers hire purchase agreements and compares leasing to hire purchase. The document then discusses factoring, defining it and outlining the key functions performed by factoring companies. It concludes with a brief discussion of bills discounting.