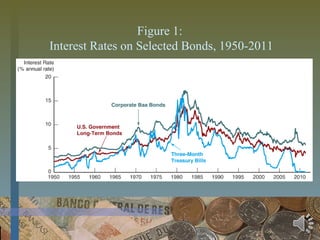

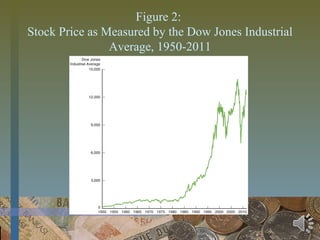

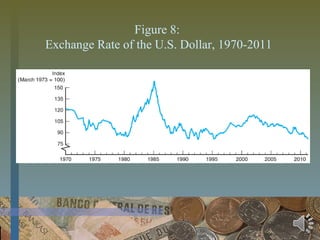

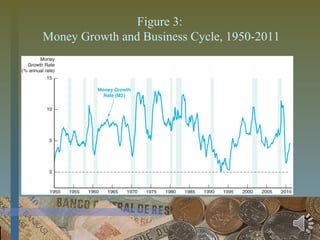

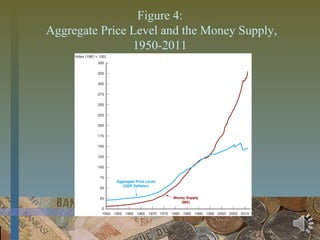

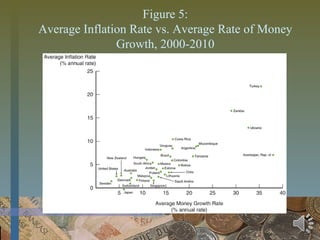

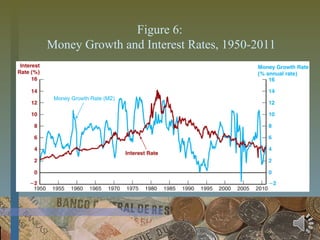

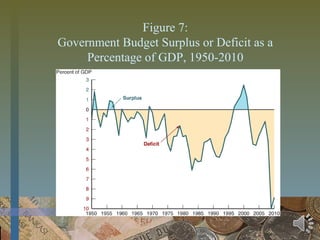

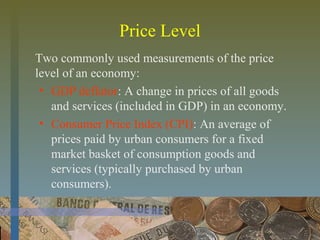

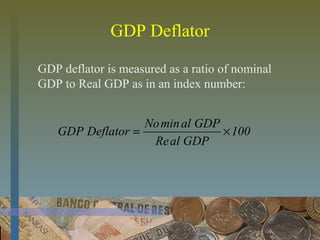

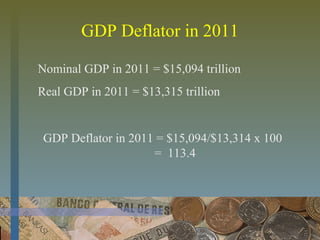

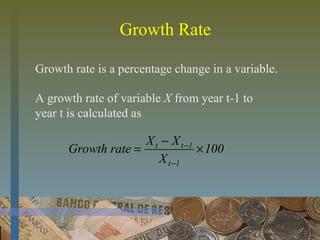

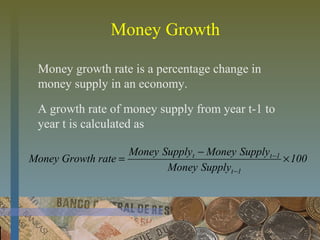

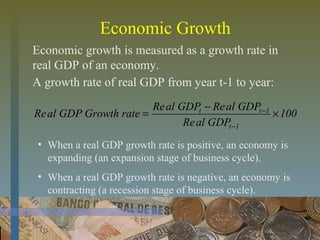

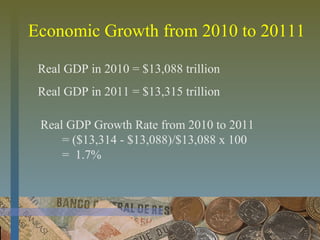

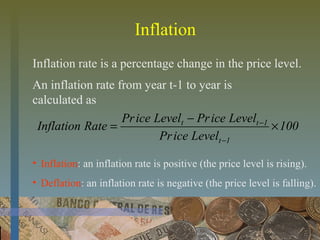

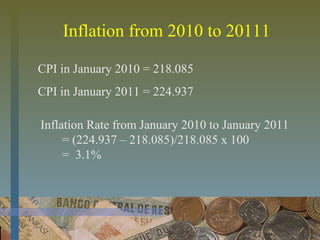

This document provides an overview of money and banking. It discusses the objectives of the learning unit which are to understand the importance of the financial system, the three main financial markets (bond, stock, and foreign exchange), financial institutions, money in the economy, and macroeconomic data. It then defines key concepts like financial instruments, interest rates, how the three financial markets work, and the role of monetary and fiscal policy. It includes graphs to illustrate historical trends in interest rates, stock prices, exchange rates, money supply, inflation, and the government budget.