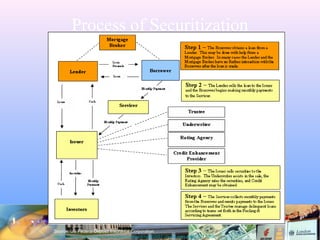

This document provides an overview of financial innovation, globalization, and regulation. It discusses key innovations like securitization, collateralized debt obligations, and adjustable-rate mortgages. It describes how securitization transforms illiquid assets into marketable securities. The document also examines financial globalization through international financial markets and banking, and the benefits this provides to both savers and borrowers globally by allowing funds to flow across borders. Finally, it touches on the role of regulation in the financial system.