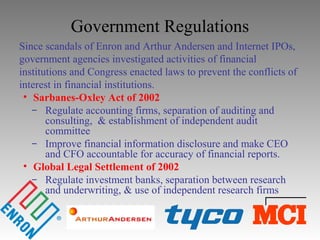

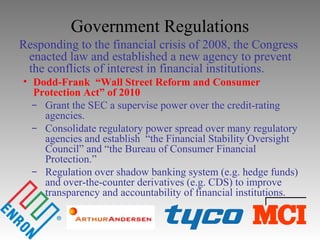

This document discusses conflicts of interest in the financial system. It begins by explaining how asymmetric information between lenders/savers and borrowers/spenders can lead to adverse selection and moral hazard problems. Financial institutions are meant to address these issues by providing information services. However, recent scandals have revealed that financial institutions sometimes act against the interests of lenders/savers due to conflicts of interest. The document then examines examples like Enron, Arthur Andersen, and investment banks. It analyzes the principal-agent problem and conflicts of interest, and how they can arise for different types of financial institutions like brokerage firms and accounting firms serving multiple roles and clients.