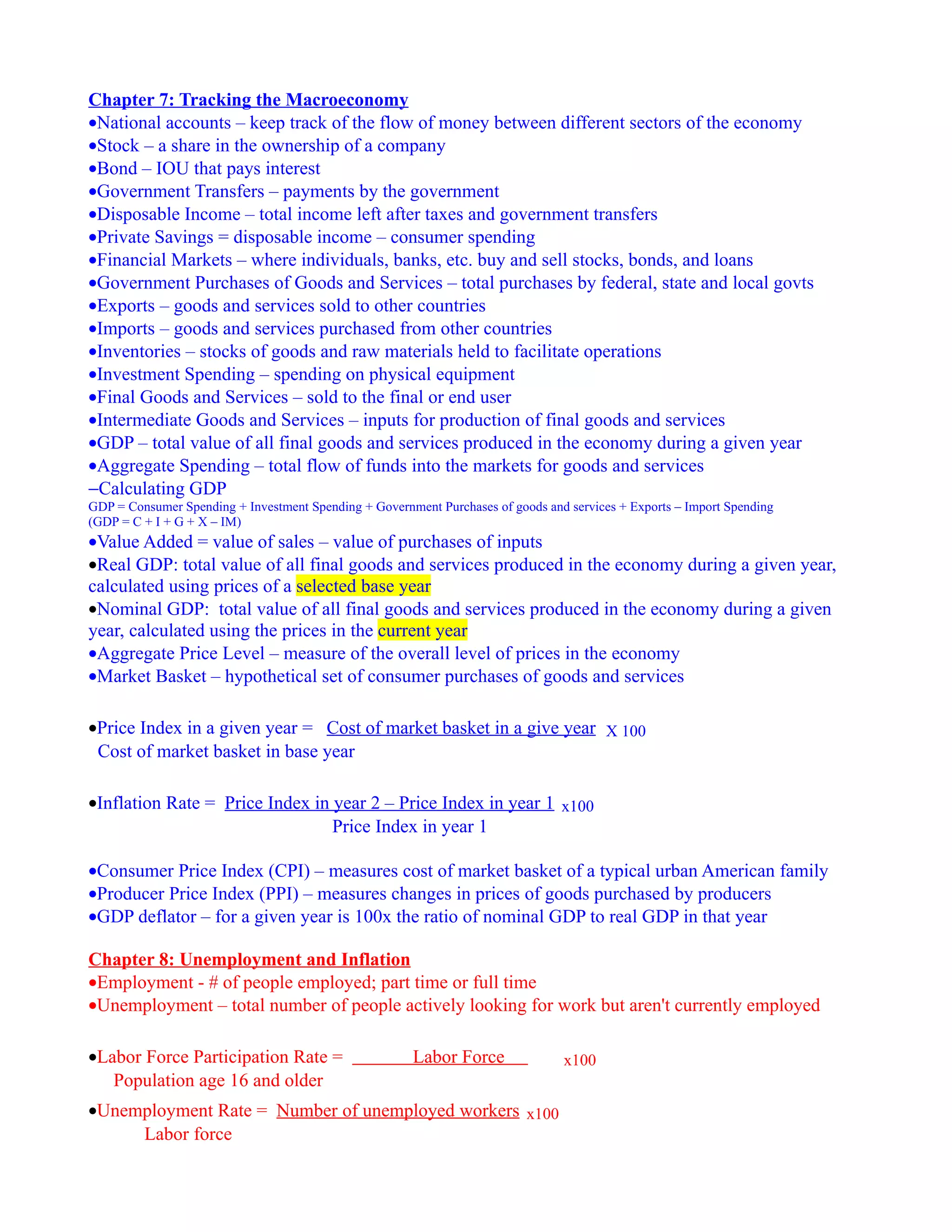

This document provides definitions and explanations of key macroeconomic concepts related to tracking the macroeconomy, unemployment and inflation, economic growth, and the financial system. It defines measures like GDP, inflation rates, productivity, interest rates, and discusses factors that influence economic growth and the role of the financial system in facilitating savings and investment. The chapter outlines how macroeconomists analyze and measure overall economic activity and performance.