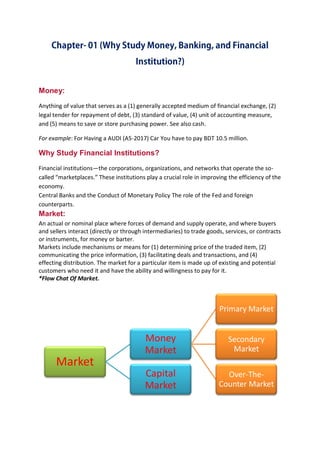

This document contains information about various financial concepts such as money, markets, banking, and monetary policy. It defines money and describes its functions. It also defines different types of markets including money markets, capital markets, primary markets, secondary markets, and over-the-counter markets. Additionally, it discusses financial institutions and their role in the economy, central banks and monetary policy, and the functions and balance sheet of banks.

![B B A - 5 4 , F I N - A Page 7

Evolution of Payment System:

A payment system is any system used to settle financial transactions through the transfer of

monetary value, and includes the institutions, instruments, people, rules, procedures,

standards, and technologies that make such an exchange possible.[1][2] A common type of

payment system is the operational network that links bank accounts and provides for

monetary exchange using bank deposits.

Commodity Money:

Commodity money is money whose value comes from a commodity of which it is made.

Commodity money consists of objects that have value in them as well as value in their use

as money.

Example of commodities that have been used as mediums of exchange include gold, silver,

copper, salt, peppercorns, tea, large stones (such as Rai stones), decorated belts, shells,

alcohol, cigarettes, cannabis, candy, cocoa beans, cowries and barley. These items were

sometimes used in a metric of perceived value in conjunction to one another, in various

commodity valuation or price system economies.

Fiat Money

Fiat money is a currency established as money by government regulation or law. The term

derives from the Latin fiat ("let it become", "it will become") used in the sense of an order or

decree. It differs from commodity money and representative money. Commodity money is

created from a good, often a precious metal such as gold or silver, which has uses other

than as a medium of exchange (such a good is called a commodity), while representative

money simply represents a claim on such a good.

Checks

A check is a written, dated and signed instrument that contains an unconditional order from

the drawer that directs a bank to pay a definite sum of money to a payee. The money is

drawn from a banking account, also known as a checking account.](https://image.slidesharecdn.com/moneyandbanking-170328164553/85/Money-and-banking-7-320.jpg)