The document discusses several topics related to money and economics:

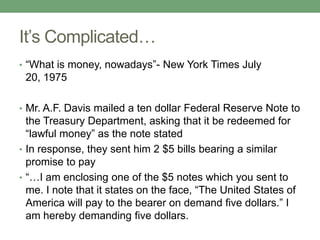

1. It defines money and describes its main functions as a medium of exchange, store of value, and standard of value. Throughout history, various commodities have served as money.

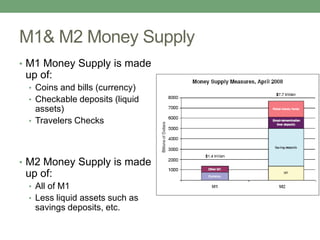

2. Modern fiat money is no longer backed by gold or silver but is accepted due to trust in governments. The money supply includes currency as well as checkable deposits and other liquid assets.

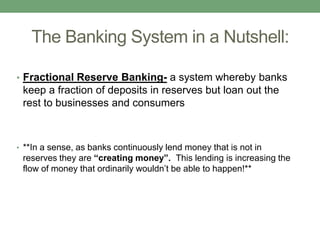

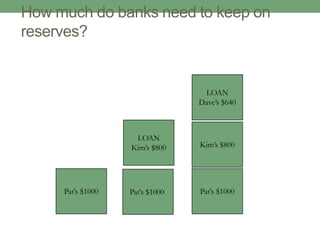

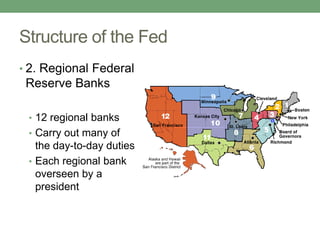

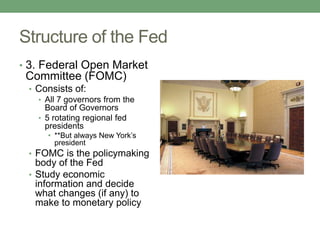

3. Banks play a key role in money creation through fractional reserve banking by lending out deposits. The Federal Reserve influences monetary policy through tools like open market operations and interest rates.