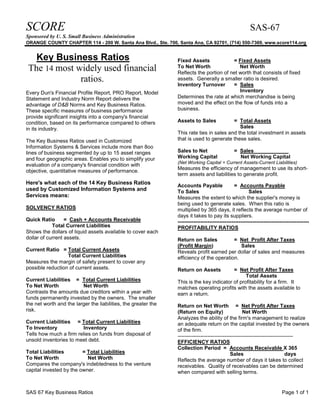

This document provides definitions and explanations of 14 key business ratios that are used to analyze a company's financial health and performance. The ratios are divided into categories of solvency ratios, profitability ratios, and efficiency ratios. Some of the ratios discussed include the quick ratio, current ratio, return on assets, return on net worth, inventory turnover, and collection period. These ratios measure factors such as a company's liquidity, profit margins, ability to generate sales, and efficiency in areas like collecting receivables.