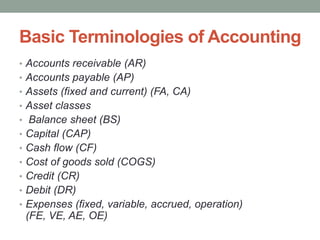

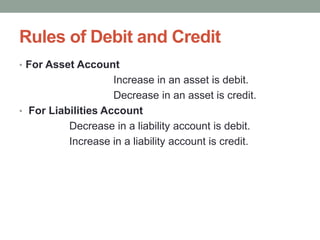

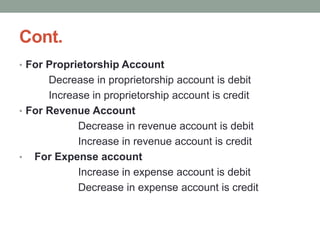

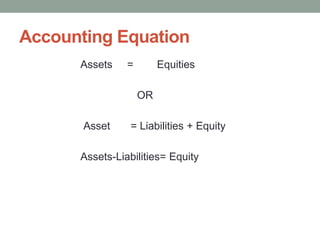

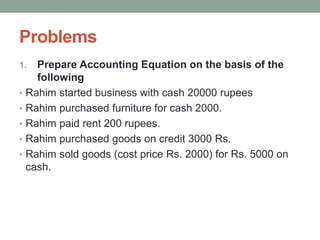

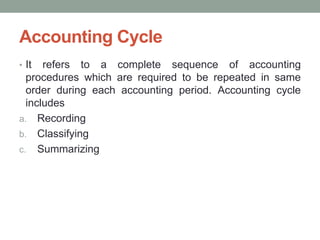

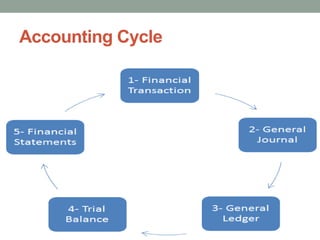

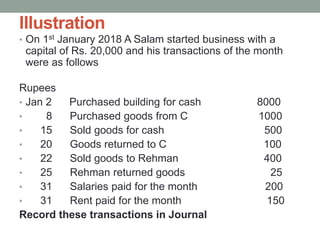

The document provides an overview of key accounting concepts, including terminology, the accounting cycle, and types of accounting such as financial, cost, and management accounting. It explains essential terms like proprietor, capital, assets, liabilities, and distinguishes between expenses and expenditures, as well as outlining the process of recording and summarizing transactions. It also discusses the importance of journals in accounting, highlighting the advantages of detailed record-keeping.