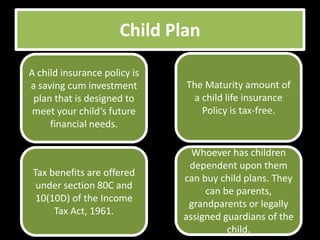

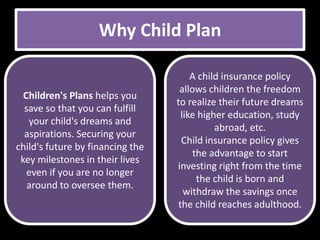

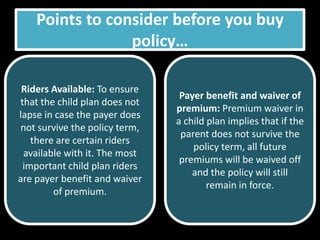

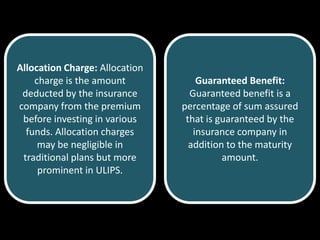

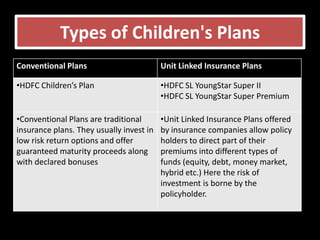

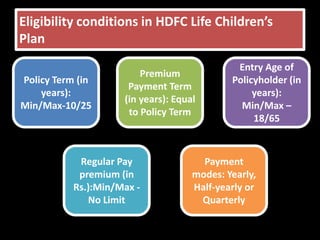

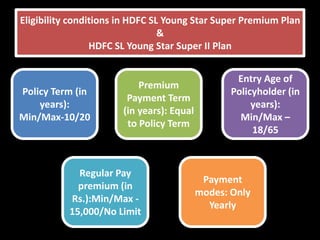

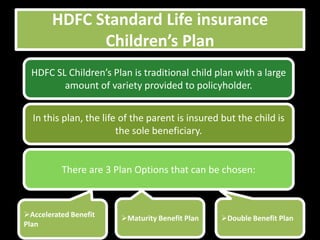

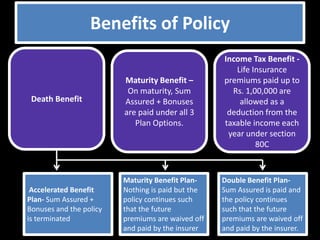

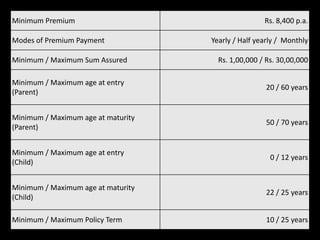

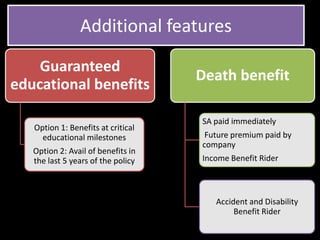

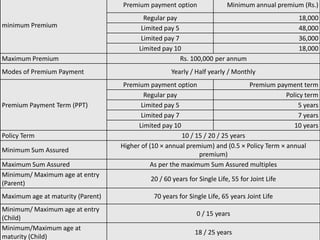

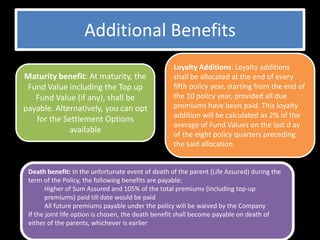

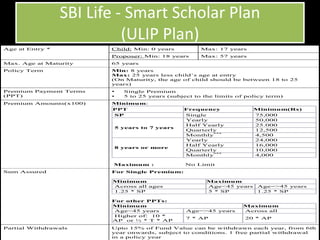

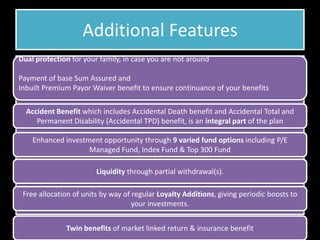

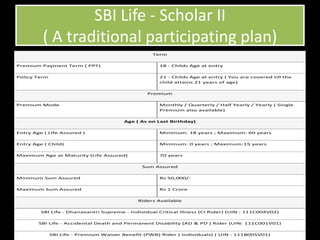

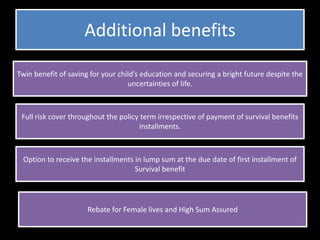

The document provides information on various child insurance plans offered by different insurance companies, including eligibility requirements, benefits, premium amounts, and additional features of traditional and unit-linked plans. Key details covered include plan types, riders, minimum and maximum entry ages, premium and sum assured ranges, maturity proceeds, and tax benefits. The plans aim to help parents save and secure their child's future financial needs and education.