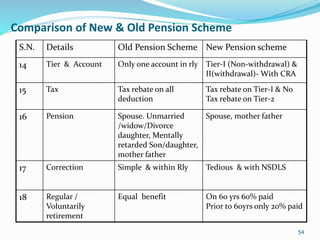

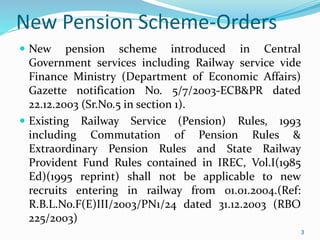

This presentation provides an overview of India's new pension scheme for government employees, including railway employees, who joined service on or after January 1, 2004. Some key points:

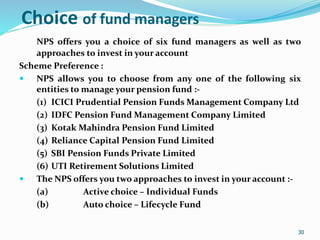

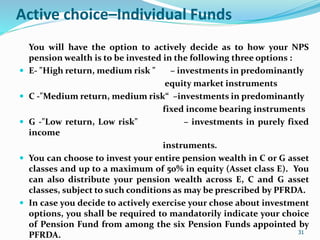

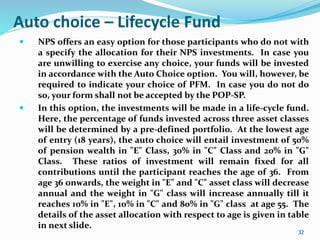

- The new contributory pension system (NPS) requires employees to contribute 10% of their salary each month, which is matched by the government. Contributions are invested in schemes managed by pension fund managers.

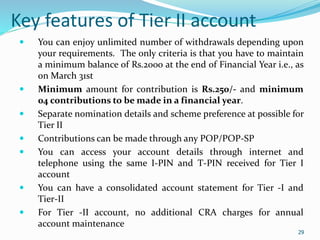

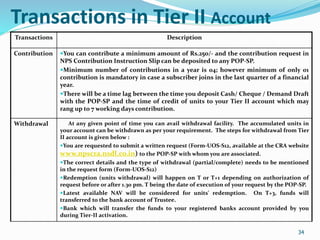

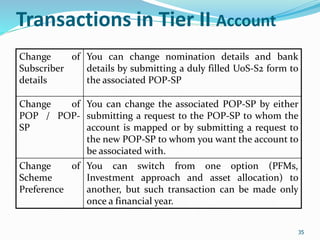

- The NPS has two tiers - Tier 1 is a non-withdrawable pension account and Tier 2 is an optional withdrawal account with no government matching.

- At retirement, at least 40% of the pension wealth in Tier 1 must be used to purchase an annuity to provide a lifetime pension.

![41

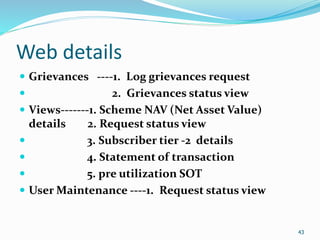

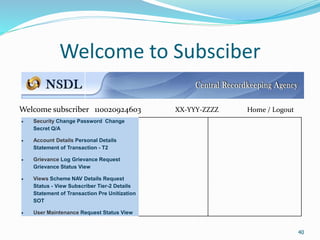

Details of Drop box issues

Security ----.1. Change pass word

2. Change Secret Q/A

Account details (click) 1. Personal details

2. Statement of transaction

Subscriber Details:

PRAN 110020924603 [Status: Active ] PAN ACIPY0936F

Name SHRI RITESH RAJENDRAPRASAD YADAV Father's Name RAJENDRAPRASAD SUKHURAM YADAV

Gender Male Date of Birth 21-Jun-1986

Correspondence Address B-21 , JANPATH NAGAR , Permanent Address B-21 , JANPATH NAGAR ,

(Communication Address) DANTESHWAR DANTESHWAR, PRATAPNAGAR ,

PRATAPNAGAR, VADODARA VADODARA, Gujarat, India - 390004

Gujarat, India - 390004

Phone No. Fax No.

Mobile No. 09825790143 Email Id

SMS Subscription Flag No

Current Status of Subscriber Remarks

Nominee 1

Name SMITHEERAVANTHI DHEVI RAJENDRAPRASAD YADAV Date of Birth

Relationship MOTHER Percentage Share 100%

Major/Minor Major Guardian Name

Nominee Invalid Condition UPON MARRIAGE

Account No. 01960100018328 Bank Name BANK OF BARODA

Bank Branch PRATAPNAGAR BRANCH

Bank Address PRATAPNAGAR BRANCH VADODARA MICR Code 390012010 Pin Code 390004

Bank Account Type SAVINGS

41](https://image.slidesharecdn.com/npspresentation-191228082729/85/Nps-presentation-41-320.jpg)